Amazon’s AI Strategy: Opportunities Amidst Stock Price Fluctuations

For some time, artificial intelligence (AI) was a dominant theme in the business and investing landscape. Companies rushed to incorporate AI into their offerings, attracting significant investment interest. Despite some initial excitement, the AI-driven stock price growth has recently cooled, with Amazon (NASDAQ: AMZN) exemplifying this shift.

The stock of Amazon saw an impressive rise of more than 160% from the beginning of 2023 to the end of 2024. However, as of April 29, 2024, it has faced a decline of over 15%. Despite this downturn, Amazon remains a key player in the AI ecosystem and is considered a strong buy for many investors. Below are three reasons justifying this outlook.

The Role of Amazon Web Services in AI

Amazon Web Services (AWS) stands as the leading cloud platform globally, holding a market share of 30% as of the end of 2024. For comparison, Microsoft Azure and Google Cloud follow with market shares of 21% and 12%, respectively.

Originally focused on storage and hosting, AWS has evolved into a vital platform for companies training and deploying AI models. Analogously, AWS provides AI infrastructure much like what Home Depot and Lowe’s offer for home improvement projects.

AWS features tools like Amazon SageMaker to facilitate the training and deployment of machine learning models. Additionally, Amazon Bedrock enables businesses to build generative AI applications without starting from scratch, which can be costly and time-consuming.

Unless faced with significant disruption, AWS is likely to maintain its leading position for the foreseeable future.

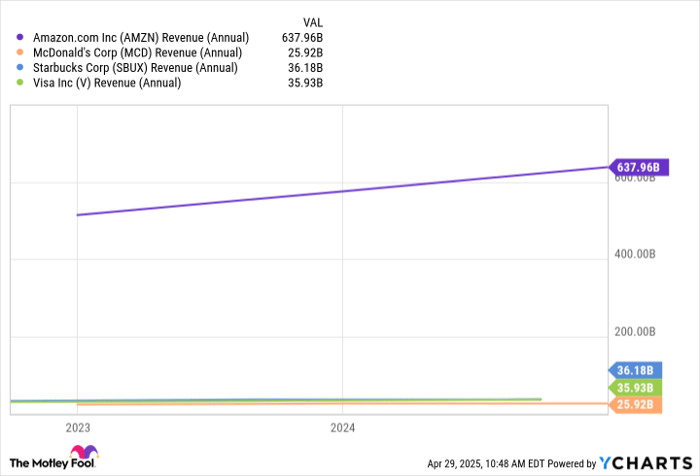

In 2024, AWS generated $107.6 billion in revenue, reflecting a 19% year-over-year increase. This revenue figure surpasses the combined revenues of McDonald’s, Visa, and Starbucks.

AMZN Revenue (Annual) data by YCharts

Integrating AI Across Amazon’s Diverse Businesses

Amazon has grown into a formidable conglomerate with significant interests in e-commerce (Amazon.com), cloud computing (AWS), advertising (Amazon Ads), entertainment (Amazon Prime), and healthcare (Amazon Pharmacy). Each segment stands to gain substantially by leveraging AI.

In e-commerce, AI enhances product recommendations and inventory management. The advertising segment benefits from improved audience targeting, while entertainment sees gains from personalized content suggestions. Lastly, the healthcare division can enhance prescription management and analyze patient data more effectively.

While AI may not be a silver bullet for these businesses, its application enhances their competitive edge in their respective industries.

Strategic Investments in AI

One of Amazon’s strengths lies in its profitable e-commerce operations, which enable substantial investments in higher-margin sectors. The company is proactive in deploying this capital.

In the fourth quarter of 2024, Amazon invested $26.3 billion in capital expenditures, with a significant portion allocated to AWS AI infrastructure. Projections indicate that spending will exceed $100 billion in 2025, according to the CFO.

AMZN Capital Expenditures (Annual) data by YCharts

Amazon’s ability to invest over $100 billion not only underscores its financial robustness but also its commitment to becoming a leader in the AI sector. While Amazon’s Stock remains a viable buy today, its true benefits will emerge in the long term as these investments yield returns.

For investors wary of market volatility, strategies like dollar-cost averaging can help in gradually acquiring shares, whether starting fresh or adding to existing holdings.

A New Chance for Investors

Have you ever felt you missed out on investing in leading stocks? If so, this may be your opportunity.

Occasionally, our team of analysts issues “Double Down” stock recommendations for companies poised for significant growth. If you’re concerned about having missed previous investments, consider acting now while opportunities remain available. The statistics are compelling:

- Nvidia: Invested $1,000 in 2009 would now be worth $282,717.

- Apple: A $1,000 investment in 2008 would yield $40,044.

- Netflix: A $1,000 investment in 2004 would amount to $607,048.

We are currently issuing “Double Down” alerts for three notable companies, available to those who join our investment advisory services.

John Mackey, former CEO of Whole Foods Market, is on the board of directors at The Motley Fool. Stefon Walters holds positions in Lowe’s Companies, McDonald’s, and Microsoft. The Motley Fool maintains positions in and endorses Amazon, Home Depot, Microsoft, Starbucks, and Visa. Full disclosure policies apply.

The views expressed herein are those of the author and may not reflect those of Nasdaq, Inc.