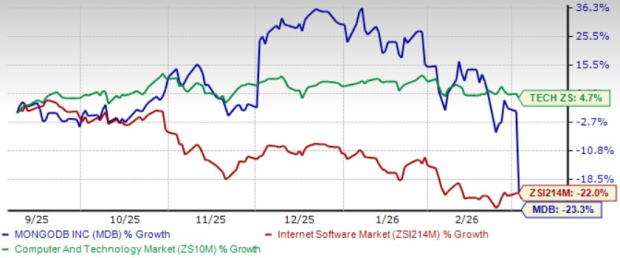

Strength in Zacks’ Computer-Software Industry

Over the last year, the Zacks Computer-Software Industry has been a significant contributor to the Nasdaq’s robust performance. This industry boasts a remarkable 58% one-year return, outshining the S&P 500’s 21% and even surpassing the Nasdaq’s 36%.

Optimistic Outlook for Computer Software Stocks

The outlook for top-rated computer software stocks seems promising in the light of potentially easing inflation and lower interest rates, which may positively impact consumer spending, particularly on non-essential items like technological products.

Blackbaud: A Beacon of Hope

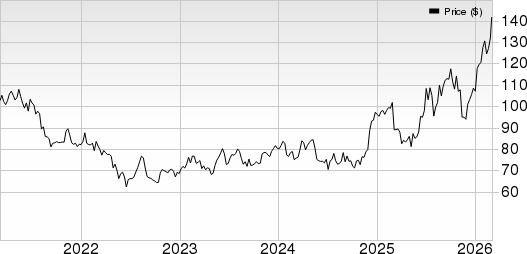

Blackbaud, currently holding a Zacks Rank #1 (Strong Buy), offers a range of cloud-based and on-premise software solutions aimed at supporting social causes. The company’s consistent top-line growth and impressive profitability have propelled its stock up by 35% over the last year. Anticipation of a robust fiscal year, with an expected 43% earnings increase and an 8% surge in total sales, further solidifies Blackbaud’s potential for growth.

Microsoft: A Trailblazer in Tech

It’s challenging to discuss top software companies without mentioning Microsoft, known for its Zacks Rank #2 (Buy) and ‘A’ Zacks Style Scores grade for Growth. With a remarkable 64% stock climb in the last year, Microsoft has consistently outperformed broader indexes and the Zacks Computer-Software Markets, driven by its enterprise-to-consumer software solutions, cloud capabilities, and strategic acquisitions.

Trend Micro: The Rising Star

Although Trend Micro might be playing catch-up in its growth story, the Japan-based software solutions provider has garnered attention with an “A” Zacks Style Scores grade for Momentum and a Zacks Rank #1 (Strong Buy). The company’s increasing relevance in endpoint and web security software and services is reflected in its stock, which has surged 52% over the last three months alone.

The Surging Fortunes of Trend Micro Inc in FY24

In dawn’s early light, Trend Micro appears set to spread its wings and soar in FY24, riding high on a projected 3% surge in fiscal year 2023, and followed by another robust 9% jump in FY24, propelling its revenue to an impressive $1.93 billion. The impending Q4 fiscal 2023 results, to be unveiled on February 15, hold the promise of further fueling this meteoric rise, as the company is expected to deliver positive guidance, thereby cementing its stance and bolstering confidence in its stronger outlook for the fiscal year 2024. Indeed, the celestial alignment surrounding Trend Micro appears to herald a bullish trajectory, with the stars seemingly in perfect harmony with the company’s ascent.

Shining Performance in FY23 and Beyond

With its steadfast climb, Trend Micro is projected to manifest a 3% rise in fiscal year 2023, a harbinger of the stellar performance that lies ahead. The subsequent fiscal year, FY24, seems poised to witness an even more remarkable ascent, with a projected 9% surge elevating the company’s revenue to a lofty $1.93 billion. The company’s ascendant trajectory appears as unyielding as a force of nature, defining its journey as an awe-inspiring spectacle that captivates the onlookers with every twist and turn.

Impending Fiscal Revelation

The imminent unveiling of Trend Micro’s Q4 results for fiscal 2023 on February 15 holds the key to further fortifying the company’s position. The positive guidance accompanying the financial reveal bears the potential to solidify the company’s stance and underpin the steadfast, upward momentum culminating in a strengthened outlook for the fiscal year 2024. It’s as if Trend Micro is on the verge of unlocking the treasure chest, revealing the long-awaited riches that await within, setting the scene for an exuberant celebration of its financial prowess.

Market Standing and Key Players

Amid the stalwarts of the Zacks Computer-Software Industry, Trend Micro continues to command an influential position, firmly ensconced within the top 40 percentile among over 250 Zacks industries. The triumvirate of Blackbaud, Microsoft, and Trend Micro itself have emerged as the latest, notable victors commanding attention. Their combined acumen can be likened to an orchestra, with each entity playing its distinct role, harmonizing to create a symphony that resonates throughout the industry.

Investors, in their pursuit of lucrative opportunities, may find themselves irresistibly drawn to this triumphant trinity, as they navigate the ever-shifting currents of the market, seeking the perfect wave to ride.

Would Trend Micro ride the tide and emerge victorious, or would the ebb and flow of the market impede its soaring ambition? The answer might lie in the upcoming Q4 financial results and the subsequent prophetic guidance that would determine Trend Micro’s trajectory. All eyes are on the horizon, eagerly anticipating the revelation that could solidify Trend Micro’s ascendant path.

Amidst this momentum, one cannot help but wonder if Trend Micro, like a majestic phoenix, is poised for an audacious rise, shedding its previous constraints to embrace the boundless skies ahead.