Investment Opportunities in Oversold Consumer Staples Stocks

Investors looking for undervalued companies may find opportunities among the most oversold stocks in the consumer staples sector.

The Relative Strength Index (RSI) serves as a momentum indicator that compares a stock’s strength on days of price increases to days of price declines. It provides traders insight into a stock’s potential short-term performance. An asset is generally regarded as oversold when the RSI falls below 30, according to Benzinga Pro.

Here’s the latest list of significant oversold players within this sector, featuring stocks with an RSI near or below 30.

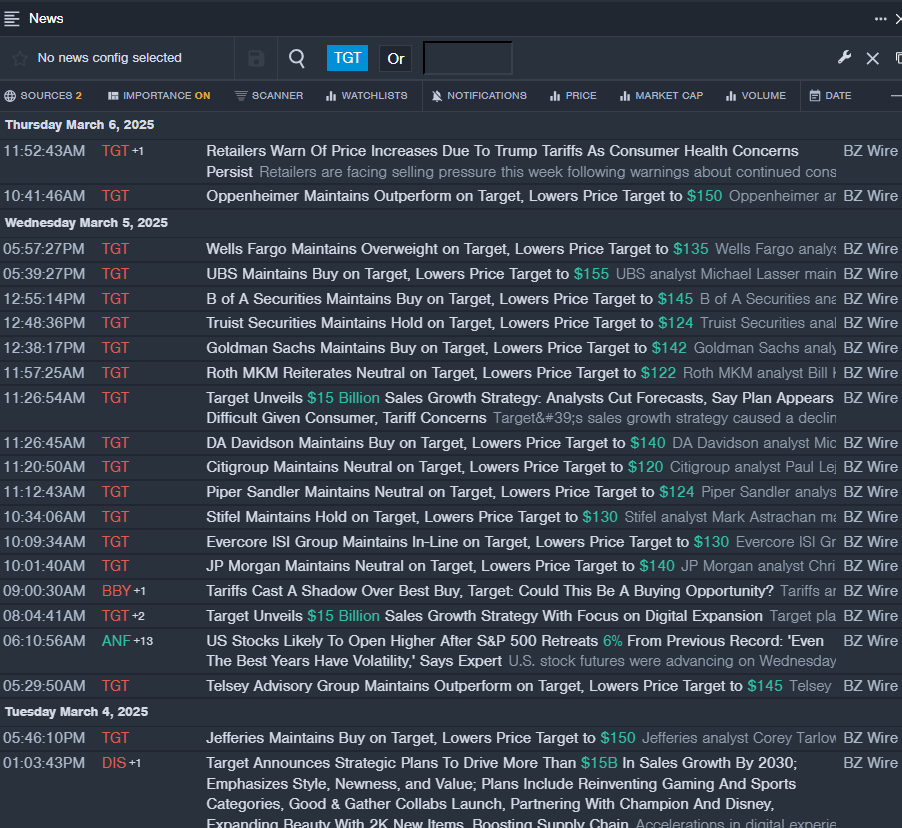

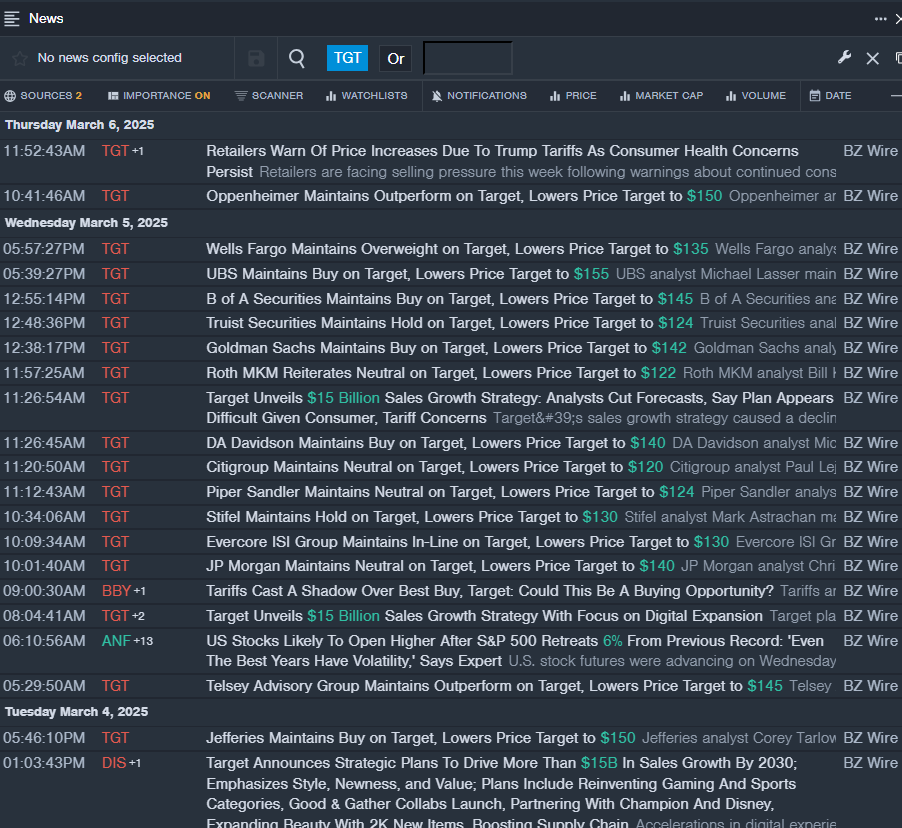

Target Corp TGT

- On March 4, Target Corp reported a fourth-quarter sales decline of 3.1% year-on-year, amounting to $30.91 billion, which exceeded the analyst consensus estimate of $30.84 billion. “Our team grew traffic and delivered better-than-expected sales and profitability in our biggest quarter of the year,” said Brian Cornell, chair and CEO. The stock has fallen approximately 12% in the past month and reached a 52-week low of $112.10.

- RSI Value: 29

- TGT Price Action: Target shares closed up 0.9% at $115.08 on Friday.

- Benzinga Pro’s real-time newsfeed highlighted the latest TGT news.

Eastside Distilling Inc BLNE

- On February 19, Eastside Distilling announced the closing of a $5 million private placement, with over half the capital coming from Nick Liuzza, the CEO of Beeline Financial Holdings, who contributed $2.9 million. The stock saw a slight decline of around 2% in the past five days, marking a 52-week low of $0.41.

- RSI Value: 19.1

- BLNE Price Action: Eastside Distilling shares rose 1.2% and closed at $0.75 on Friday.

- Benzinga Pro’s charting tools identified the trend in BLNE stock.

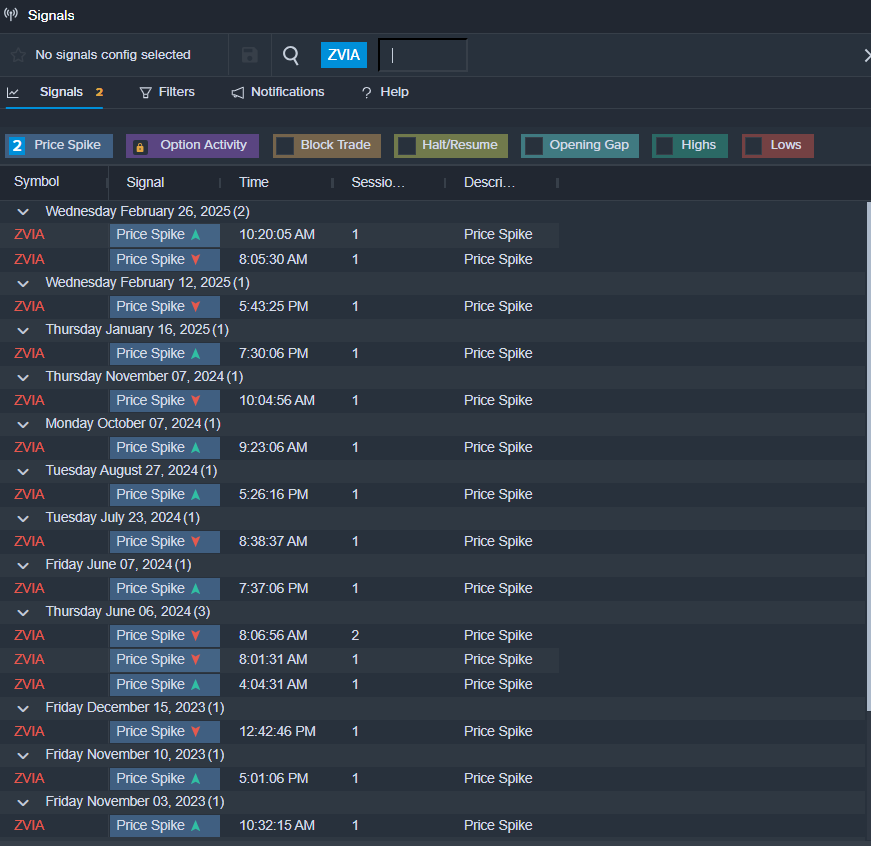

Zevia Pbc ZVIA

- On February 26, Zevia issued FY25 revenue guidance that fell below estimates. Amy Taylor, President and CEO, remarked, “We are pleased to have ended the year on a strong note with a return to top-line growth and significant progress towards achieving profitability. We elevated our brand identity and advanced our three strategic growth pillars.” The stock dropped approximately 37% in the past month, hitting a 52-week low of $0.62.

- RSI Value: 27.5

- ZVIA Price Action: Zevia shares decreased by 2.7% to close at $2.17 on Friday.

- Benzinga Pro’s signal feature indicated a potential breakout for ZVIA shares.

Read This Next:

Momentum–

Growth31.05

Quality–

Value34.77

Market News and Data brought to you by Benzinga APIs