Three Dividend Stocks Worth Investing In Right Now

Dividend stocks may not shine like high-growth stocks, but they offer a reliable way to pass profits to shareholders, regardless of market performance. Meanwhile, value stocks are typically valued based on their current earnings rather than future growth potential, indicating a market sentiment of limited expectations.

For investors seeking dividend-paying stocks with reasonable valuations, this article highlights three solid options identified by Motley Fool contributors: American Electric Power (NASDAQ: AEP), Owens Corning (NYSE: OC), and ConocoPhillips (NYSE: COP).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

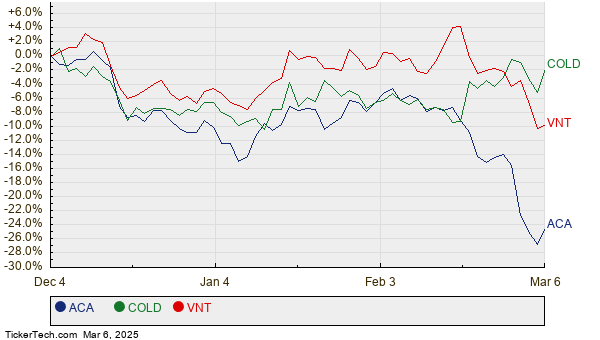

American Electric Power: A Reliable Income Source

Scott Levine (American Electric Power): Even though shares of American Electric Power have risen more than 15% since the beginning of the year, the stock remains appealing for dividend-focused investors. The company offers a forward dividend yield of 3.5% and has continuously paid dividends since 1910. Despite its stock underperforming the S&P 500 in the previous year, it has outperformed thus far in 2025, suggesting it may still be undervalued.

AEP serves approximately 5.6 million customers across 11 states. It boasts a comprehensive network that includes about 40,000 miles of transmission lines and 225,000 miles of distribution lines. The company also has a diversified power generation portfolio, combining coal, natural gas, nuclear, and renewable energy sources to reach 28 gigawatts of total capacity.

Income-conscious investors will find AEP attractive, as it derives around 95% of its earnings from its regulated business model. This structure provides management with clear insights into future cash flows for planning capital expenditures and ensuring consistent dividend payments. From 2025 to 2029, AEP expects to generate $41.5 billion in operating cash and distribute about $11.1 billion in dividends.

For those considering an investment in this leading utility, current shares trade at 8.9 times operating cash flow, below the five-year average of 9.3 times, indicating a favorable entry point.

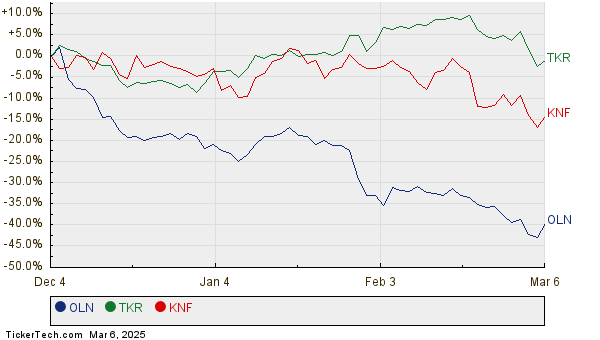

Owens Corning: Value Stock with Recovery Potential

Lee Samaha (Owens Corning): Currently trading at 10 times trailing earnings and 11.3 times trailing free cash flow (FCF), Owens Corning operates firmly in value stock territory. The company returned $638 million to investors through dividends and share buybacks from its $1.25 billion in FCF, with a current yield of 1.7%.

The market’s low rating of Owens Corning stems primarily from its reliance on the North American residential housing market. As noted in the recent earnings call, the company’s performance hinges on residential repair and remodeling activities, housing starts, and commercial construction trends.

Despite the current challenges posed by persistently high market interest rates affecting mortgage rates, historical trends indicate that market conditions must improve in the long term. Owens Corning took advantage of the downturn by acquiring Masonite for $3.9 billion in 2024, expanding its position in the North American market by adding doors to its roofing and insulation offerings. The sale of its non-core glass fiber reinforcement business for $755 million highlights its strategic shift towards building materials.

The combination of favorable valuations and potential earnings upside makes Owens Corning an interesting stock for dividend investors with optimism about the housing market revival.

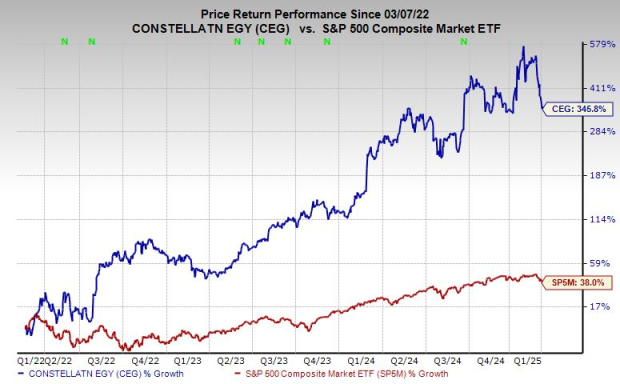

ConocoPhillips: Strong Position in Oil and Gas

Daniel Foelber (ConocoPhillips): As the top U.S.-based exploration and production company, ConocoPhillips boasts a market cap nearly double that of its nearest competitor, EOG Resources. With production projected at 2.34 to 2.38 million barrels of oil equivalent (boe) per day in 2025, it ranks behind only ExxonMobil and Chevron.

Currently, ConocoPhillips has a balanced production mix of approximately 50% oil and 50% natural gas, with 58% of its operations based in the continental U.S. (the Lower 48 states). Canada and Alaska contribute 16% of production, while Europe, the Middle East, Africa, and Asia Pacific account for 14% and 11%, respectively.

In 2025, the company expects a greater proportion of its production to come from the Lower 48, reflecting full-year earnings from its recent acquisition of Marathon Oil. Capital expenditures are also set to rise to their highest level in a decade, aimed at developing existing assets and funding long-term projects likely to enhance FCF. Upcoming initiatives include major investments in Qatar’s North Field expansions, oil production in Alaska, and a liquefied gas project at Port Arthur.

ConocoPhillips Reports Strong Free Cash Flow Amid Oil Price Stability

In 2024, West Texas Intermediate (WTI) crude oil averaged $76.63 per barrel, allowing ConocoPhillips to generate an impressive $8 billion in free cash flow (FCF). This translates to $6.78 in FCF per share, significantly higher than the $3.12 paid in dividends. Even amid mid-cycle conditions, the company’s performance signals operational strength.

Future Projections for Free Cash Flow

ConocoPhillips is positioned to continue generating robust FCF over the next five years, assuming oil prices remain stable. Should prices decline, the company still has a considerable safety margin that allows for profitability. With the acquisition of Marathon Oil, the firm is expected to lower its FCF breakeven point to the low $30 per barrel range. While this may restrict its ability to fully support dividends with cash at that price, it’s important to note that WTI prices currently hover around $70 per barrel, providing a substantial cushion.

Dividends and Investment Appeal

Offering a 3.1% dividend yield, ConocoPhillips is an attractive choice for investors who are taking a neutral stance on the oil and gas sector and seek passive income from a market-leading company.

Is American Electric Power a Good Investment Right Now?

Before considering an investment in American Electric Power, examine the current market offerings:

The Motley Fool Stock Advisor analyst team recently revealed their top picks, which did not include American Electric Power. The ten selected stocks are anticipated to deliver significant returns in the upcoming years.

For reference, Nvidia was featured on this list back on April 15, 2005. An investment of $1,000 at that time would now be valued at a staggering $710,848!*

Stock Advisor provides investors with a clear roadmap for success, offering insights on portfolio development, timely updates from analysts, and two new stock suggestions each month. Since its inception, the Stock Advisor service has outperformed the S&P 500 by more than four times since 2002.* Now is the time to access the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of March 3, 2025

Daniel Foelber, Lee Samaha, and Scott Levine have no positions in any stocks mentioned. The Motley Fool holds positions in and recommends Chevron and EOG Resources, and also recommends Owens Corning. A disclosure policy is in place for the Motley Fool.

The views and opinions expressed herein reflect those of the author and do not necessarily represent the views of Nasdaq, Inc.