The first-quarter earnings season has come to an end for large drug and biotech companies, with Bayer reporting its results earlier this week. Per the Zacks classification, the pharma/biotech industry comes under the broader Medical sector, which comprises pharma/biotech as well as medical device companies.

As of May 15, the Earnings Trends report showed that 87.9% of medical companies beat estimates for earnings and 72.4% beat the same for revenues. While earnings declined 24.3% year over year, revenues rose 6.9%.

Concerns around the economy and inflation, Medicare drug price negotiations, the Federal Trade Commission’s scrutiny of M&A deals, regular pipeline setbacks and generic/biosimilar competition for blockbuster drugs are some of the headwinds faced by drug developers. Amid these headwinds, three drugmakers — Eli Lilly and Company LLY, Novo Nordisk NVO and Merck MRK — caught our eye as they raised their earnings as well as sales guidance for 2024. All three companies beat earnings estimates.

A better-than-expected earnings performance coupled with an increased outlook raises investor optimism about companies. Nonetheless, a single quarter’s results are not so important for long-term investors, and the focus should, rather, be on the companies’ fundamentals. Let’s discuss these companies in detail, each of which carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Eli Lilly and Company

Lilly reported first-quarter 2024 adjusted earnings per share (“EPS”) of $2.58, which beat the Zacks Consensus Estimate of $2.53 per share. Earnings rose 59% year over year.

Revenues of $8.77 billion rose 26% year over year but missed the Zacks Consensus Estimate of $8.81 billion.

Strong demand for its successful GLP-1-based treatments, Mounjaro and Zepbound, and other key drugs, Verzenio and Jardiance, pulled up the top line in the quarter. However, continued supply constraints for incretin-based products like Trulicity, Mounjaro and Zepbound hurt sales. Demand for incretin-based products Mounjaro and Zepbound exceeded supply.

Lilly is investing in new advanced manufacturing plants and lines in the United States and Europe to increase the supply of incretin-based products. Lilly expects the production of these products to increase from the second half of 2024. “Greater visibility” on its production expansion plans and strong demand for Mounjaro and Zepbound pushed Lilly to raise its sales and earnings guidance ranges for 2024 despite a mixed first-quarter performance.

Lilly expects revenues in the range of $42.4 to $43.6 billion, up from the prior expectation of $40.4 to $41.6 billion. The earnings per share guidance was raised from a range of $12.20 to $12.70 to $13.50 to $14.00 per share.

Lilly’s new tirzepatide medicines, diabetes drug Mounjaro and obesity medicine Zepbound are seeing exceptionally strong demand trends. Lilly has also launched some other new products recently like Omvoh and Jaypirca. Mounjaro, Zepbound and other new products are expected to drive Lilly’s top line in 2024, making up for the expected decline in Trulicity sales. Label expansion studies are also going on to allow expansion of the eligible patient population for these drugs in the future. Lilly is also making rapid pipeline progress in areas like obesity, diabetes and Alzheimer’s.

The company is also giving attractive returns to its investors. It hiked its quarterly dividend for 2024 by 15%. Lilly’s stock has surged 578% in the past five years mainly due to its solid pipeline potential, particularly its obesity drugs.

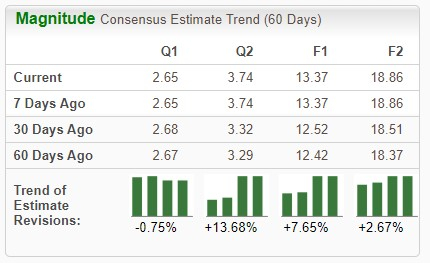

Estimates for Lilly’s 2024 earnings have moved up from $12.42 to $13.37 and from $18.37 to $18.86 for 2025 over the past 60 days.

Image Source: Zacks Investment Research

Its trailing 12-month price-to-sales ratio has more than doubled to 19.80 from around 9 in 2021. Its revenues have jumped from $28.3 billion in 2021 to $34.1 billion in 2023.

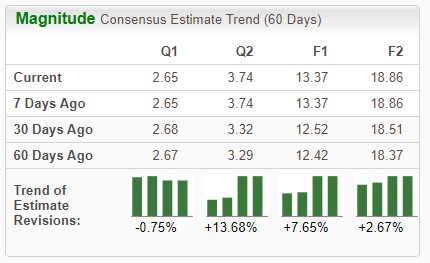

So far this year, the stock has gained 35% compared with the industry’s 14.5% rise.

Image Source: Zacks Investment Research

Novo Nordisk

Novo Nordisk reported first-quarter 2024 earnings of 83 cents per American Depositary Receipt (ADR), which surpassed the Zacks Consensus Estimate of 77 cents. The company had reported earnings of 63 cents per ADR in the year-ago quarter.

Revenues of $9.52 billion increased 22% in Danish kroner (DKK) and were up 24% at constant exchange rate (CER) in the reported quarter. Total revenues also beat the Zacks Consensus Estimate of $9.23 billion. GLP-1 based treatments, Ozempic and Wegovy, drove sales.

Novo Nordisk raised its sales growth guidance to a range of 19-27% from 18-26%. The company also expects operating profit to grow in the band of 22-30%, up from the previous guidance of 21-29%. The guidance increase indicates steady sales growth primarily driven by volume growth of GLP-1-based products.

Novo Nordisk returned DKK 31.4 billion to shareholders via share buybacks (DKK 2.8 billion) and dividends (DKK 28.6 billion) in the first quarter of 2024

The stock of this Danish drugmaker has risen 475% in the past five years, mainly on the success of its drug semaglutide. Semaglutide remains the growth engine for the company. It is approved as Ozempic pre-filled pen and Rybelsus oral tablet for type II diabetes and as Wegovy injection for obesity.

Despite supply challenges, Wegovy is seeing strong prescription trends and is generating impressive revenues and profits for Novo Nordisk. Label expansions of these drugs in cardiovascular and other indications will likely boost sales. NVO’s focused efforts to increase the supply capacity for Wegovy in the United States, as well as other international markets, are highly commendable.

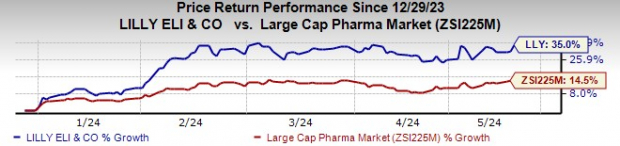

Estimates for Novo Nordisk’s 2024 earnings have moved up from $3.36 to $3.39 and from $4.15 to $4.28 for 2025 over the past 60 days.

Image Source: Zacks Investment Research

Year to date, the stock has gained 30.2% compared with the industry’s 14.5% rise.

Image Source: Zacks Investment Research

Merck

Merck reported adjusted earnings of $2.07 per share, beating the Zacks Consensus Estimate of $1.94. Earnings rose 54% excluding foreign exchange (Fx) impact. Revenues rose 12% excluding Fx to $15.78 billion, driven by key brands, Keytruda and Gardasil. Sales beat the Zacks Consensus Estimate of $15.38 billion.

Merck slightly raised the upper end of its sales guidance for the year while increasing its EPS range.

In 2024, Merck expects to record revenues in the range of $63.1 to $64.3 billion compared with its previous expectation of $62.7-$64.2 billion. The revenue range implies year-over-year growth in the range of 5% to 7%, including Fx, which is expected to be driven by the strong performance of its key products led by Keytruda.

The growth of Keytruda is expected to be driven by additional indications and patient demand. Adjusted earnings per share are expected to be between $8.53 and $8.65 versus the prior expectation of $8.44 and $8.59.

Its key cancer drug Keytruda and HPV vaccine Gardasil have been driving sales. Keytruda alone accounts for around 45% of the company’s pharmaceutical sales. Keytruda has played an instrumental role in driving Merck’s steady revenue growth in the past few years. With continued label expansion into new indications, particularly earlier-stage launches, Keytruda is expected to see continued growth.

Merck also has some key new products lined up for launch. We believe that among these, V116 and Winrevair have the potential to generate significant revenues for Merck over the long term. Winrevair was approved for treating pulmonary arterial hypertension in March 2024. V116 is Merck’s 21-valent pneumococcal conjugate vaccine, which is under priority review in the United States, with an FDA decision scheduled for Jun 17, 2024.

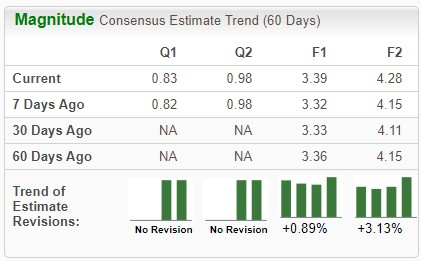

Estimates for Merck’s 2024 earnings have moved up from $8.58 to $8.66 and from $9.81 to $9.91 for 2025 over the past 60 days.

Image Source: Zacks Investment Research

Year to date, the stock has gained 20.8% compared with the industry’s 14.5% rise.

Image Source: Zacks Investment Research

Also, the drug giant is attractively valued. It is trading at a forward sales multiple of 5.05, below the industry’s 7.11, over the last five years.

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators,and more, that closed 228 positions with double- and triple-digit gains in 2023 alone.

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.