Three Warning Signs of a Possible Downturn in Healthcare Stocks

Investors in the healthcare sector should be aware of certain patterns that might indicate a drop in stock values. With the season for ghouls and goblins upon us, here are three cautionary signs to watch for that could spell trouble for your investments.

1. Investing Following a Period of High Profits

Stock market booms can often lead to painful corrections. Investors usually experience trouble when they buy stocks at their peak, particularly when a company has just enjoyed a surge in profits. As the factors driving those high earnings fade, stock prices often drop because growth can’t keep up with past performance.

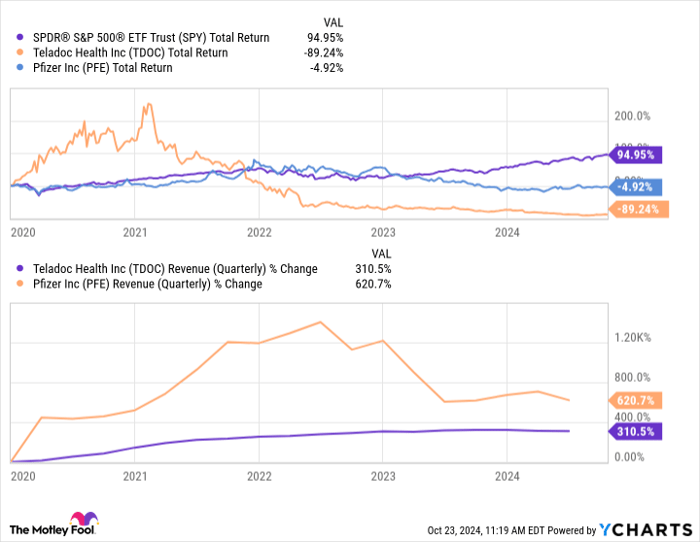

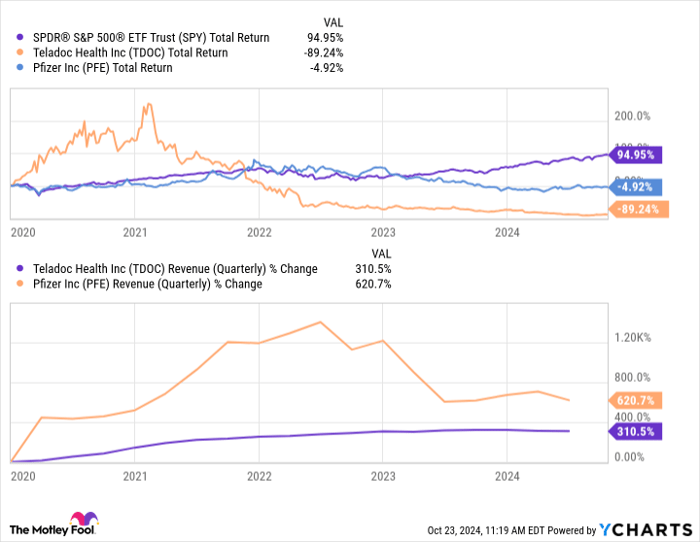

For example, Teladoc (NYSE: TDOC) and Pfizer (NYSE: PFE) faced challenges after initially thriving during the pandemic. Both companies’ shares surged when people sought out telehealth services and vaccinations. Here’s an illustration of their stock trends:

SPY Total Return Level data by YCharts.

As health concerns caused by the pandemic drove increased demand, these companies benefited greatly. However, once the immediate needs were met and vaccine enthusiasm waned, their stock values began to fall as the market adjusted.

Investors should prioritize the long-term prospects of companies rather than relying solely on their recent success. It’s essential to evaluate whether the conditions leading to profit growth can be sustained in the future.

2. Persistent Delays from Management

Shareholders count on company management to deliver reliable timelines for major projects. While delays can occur due to complex interactions with regulatory bodies and logistics, repeated setbacks can signal trouble.

Consider Novavax (NASDAQ: NVAX) and its troubled launch of a COVID-19 vaccine. It experienced multiple setbacks in production and faced a lengthy approval process, leading to significant delays despite management’s reassurances. Ultimately, as competitors moved ahead and gained market share, Novavax lagged behind, causing investor confidence to wane.

Be wary of companies that frequently miss deadlines without valid explanations, as these issues may indicate deeper problems that could impact stock prices.

3. Frequent Shifts to New Trends

It’s not uncommon for companies to chase the latest trends in the biopharmaceutical sector to capture growth. However, frequent changes in focus can be a red flag. Successful drug development typically relies on a company’s expertise in a specific area.

For example, transitioning from therapeutic drug development for dry skin to unrelated conditions like excessive daytime sleepiness raises concerns. Consistently pursuing trendy new initiatives without a clear connection to their core competencies often leads to financial losses.

Such companies may struggle to deliver results, causing investors to question their viability.

Should you invest $1,000 in Teladoc Health right now?

If you’re contemplating investing in Teladoc Health, consider this:

The Motley Fool Stock Advisor analyst team has recently identified what they view as the 10 best stocks for potential growth, and Teladoc Health was not included in this selection. The top choices have a higher likelihood of delivering significant returns in the coming years.

As a reference, when Nvidia was highlighted on April 15, 2005, a $1,000 investment would now be valued at approximately $867,372!*

Stock Advisor offers a straightforward strategy for investing success, with ongoing updates from financial experts and two new stock recommendations each month. The performance has outstripped the S&P 500 by more than four times since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Alex Carchidi has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer and Teladoc Health. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.