In the ever-evolving realm of the Zacks Electronics – Testing Equipment industry, hope is on the horizon. The industry has been thriving amidst 5G-related expansions, a robust push towards automation, and the unstoppable momentum of Industry 4.0. As the automotive sector stages a strong comeback and self-driving vehicles take center stage, players like AMETEK AME, Fortive FTV, and Itron ITRI are poised to reap the rewards.

Despite these favorable winds, challenges loom large on the horizon. A turbulent global macroeconomic landscape, market volatility, recession fears, unfavorable forex rates, and geopolitical tensions are all shadows that hang over this otherwise bright industry.

The Landscape in Detail

The Zacks Electronics – Testing Equipment industry is a melting pot of companies that offer cutting-edge instruments, electronic testing solutions, thermal management systems, electrical connectors, and motors. Serving a multitude of sectors including automotive, consumer, aerospace, healthcare, and more, these companies are at the forefront of technological advancement. With manufacturers spending more on electronic components each day, the industry is on an upward trajectory fueled by innovation and demand.

Forces Shaping Tomorrow’s Market

5G Revolution: The influx of 5G technology is a game-changer, with demand surging for 5G test solutions to support its deployment. The shift towards cloud-based infrastructure and the rise of high-speed data centers are adding fuel to the fire, propelling companies associated with 5G to new heights. In a world hungry for speed and connectivity, the 5G wave is a tide that lifts all boats.

Embracing Motion Control & Test Systems: The adoption of precision motion-control solutions and test systems is on the rise, especially in sectors like aerospace, automation, and military markets. Industries like healthcare are leveraging this technology for everything from motors to autonomous vehicles. With the world moving towards a more automated future, these solutions are at the heart of industry offerings.

Thriving in the Pharmaceuticals Sector: The uptick in using electrical instruments and software for medical research has opened new doors for the industry. As pharmaceutical players increasingly rely on electronic testing equipment, companies like Agilent are finding their niche in life science research. The demand for RF test equipment in the medical device sector further underscores the sector’s utility and potential.

Challenges in the Macro Environment: Global recession fears and economic turbulence have slowed down deal-making worldwide. With enterprises hesitant to engage in long-term commitments, the industry is facing headwinds that could dampen its growth prospects.

Rankings and Potential

Nestled within the broader Zacks Computer and Technology sector, the Zacks Electronics – Testing Equipment industry boasts a Zacks Industry Rank #57, placing it in the top echelons of Zacks industries. With strong near-term projections, this industry is poised for success, with historically better performance than its peers.

The industry’s Zacks Industry Rank, an average of all member stock ranks, signals promising times ahead. Statistics show that top-ranked Zacks industries outperform their peers by a margin of more than 2 to 1.

Before diving into potential stock picks, let’s review the industry’s recent market performance and valuation outlook.

Market Performance Analysis

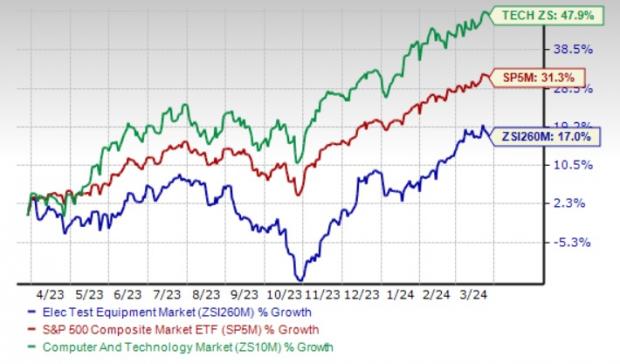

Over the past year, the Zacks Electronics – Testing Equipment Industry has lagged behind the Zacks S&P 500 composite and the wider Zacks Computer and Technology sector.

In this timeframe, companies in the industry collectively gained 17%, falling short of the S&P 500 and Computer and Technology sector which saw gains of 31.3% and 47.9% respectively.

One-Year Price Performance

Valuation Snapshot

The industry’s forward 12-month price-to-earnings ratio (P/E) stands at 26.18X, higher than the S&P 500’s 21.28X but lower than the sector’s 26.68X.

Over the past five years, valuations have ranged from 18.63X to 31.40X, with a median of 24.72X. This trend is illustrated below.

Price/Earnings Ratio (F12M)

3 Promising Stocks in the Testing Equipment Sector

AMETEK: Operating out of Berwyn, PA, AMETEK is reaping the rewards of strategic acquisitions, notably Navitar, Alphasense, Magnetrol International, and Crank Software. These purchases have fueled growth in its Electronic Instruments segment, while the recent acquisitions of Bison Gear & Engineering Corp. and others are expected to bolster AMETEK’s top-line growth in the coming days.

Specializing in electronic appliances and electromechanical devices, AME is optimistic about its AMETEK Growth Model. With comprehensive strategies in place, namely operational excellence, global market expansion, product development investments, and successful acquisitions, this Zacks #2 Ranked (Buy) entity is primed for a prosperous future.

Unearthed Gems in the Stock Market – Unveiling the Success Stories of AMETEK, Fortive, and Itron

The Phenomenon of AMETEK Stock

AMETEK has harnessed a remarkable ascent in the past year, marking a 31.1% surge. The Zacks Consensus Estimate for the company’s 2024 earnings has seen an upward revision of 1.2% over the last two months, now standing at $6.82 per share.

Price and Consensus: AME

The trajectory of AMETEK stock is not just a numerical figure but a testament to resilience and strategic prowess in the financial landscape.

Fortive – A Beacon of Success

The Fortive group from Everett, WA, is basking in the glow of strong demand trends for software and services, alongside growing orders. The company’s use of the Fortive Business System tools has proven to be a key driver of its success. Notably, the acquisition of Solmetric has played a pivotal role in expanding its presence in the electrification market.

Fortive, holding a Zacks Rank #2, is witnessing a 30.4% upsurge in its stock value over the previous year. An optimistic aura hovers around the company as the Zacks Consensus Estimate for Fortive’s 2024 earnings has been uplifting, revised upward by 3.6% in the past 60 days and now forecasted at $3.78 per share.

Price and Consensus: FTV

The story of Fortive echoes resilience and innovation, painting a canvas of progress and profitability for investors.

Itron – Riding High on Innovation

Based in Liberty Lake, WA, Itron is riding the wave of electrification, energy transition, and grid edge digitalization trends. The company’s focus on smart water meters and communication modules has been instrumental in its success. With a 73.1% surge in its stock value in the past year, Itron is demonstrating its prowess in the industry. The Zacks Consensus Estimate for Itron’s 2024 earnings has been revised significantly, up by 15% in the past 60 days, now standing at $3.61 per share.

Price and Consensus: ITRI

Itron’s journey reflects a saga of innovation and adaptability, painting a vivid picture of growth and sustainability in the market.

The stock market landscape is akin to a dynamic ecosystem, where companies like AMETEK, Fortive, and Itron shine as bright stars in the constellation of success. As these entities maneuver through economic tides and market volatilities, their steadfast growth and profitability stand as beacons of hope and opportunity for investors seeking sustainable returns.

In this labyrinth of financial intricacies and market fluctuations, the stories of these companies serve as guiding lights for investors, illuminating the path to prudent investments and long-term wealth creation in the ever-evolving stock market arena.