The Rise of Tech Defense: A Closer Look at Promising Stocks

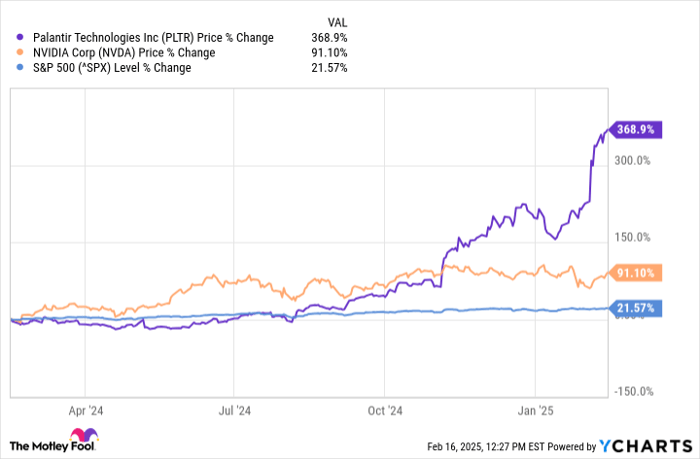

Tech defense giant Palantir Technologies (NASDAQ: PLTR) has experienced remarkable growth over the past year. Its shares have soared by an impressive 368%, outperforming both the S&P 500 and AI leader Nvidia. However, with shares trading at a hefty 208 times forward earnings, Palantir is now one of the most expensive stocks on the market.

PLTR data by YCharts

Meanwhile, several emerging companies in the tech defense sector are gaining traction. Although these stocks may not replicate Palantir’s success, investors should consider these contenders. Here’s a breakdown of what makes each one unique.

Image Source: Getty Images.

BlackSky Technology: Innovating Space Intelligence

BlackSky Technology (NYSE: BKSY) has become a noteworthy player, with its shares rising approximately 40% in the last year. The company focuses on real-time space intelligence, using AI to derive actionable insights from satellite imagery within an average of 90 minutes.

BlackSky’s proprietary Spectra platform offers high-frequency satellite monitoring alongside automated AI analytics, making it a competitor to Palantir in intelligence-gathering. Recently, the company secured multiyear contracts valued at $2.3 billion with various U.S. and international agencies, demonstrating strong validation of its technology.

Trading at 2.86 times trailing sales, BlackSky’s stock has a relatively modest valuation compared to its peers. Analysts predict a hefty 25.8% growth in revenue for 2025, further solidifying its potential as a rising force in the space intelligence field.

Redwire: Leading in Space Infrastructure

Redwire (NYSE: RDW) has emerged as a notable player in the tech defense space, with shares skyrocketing by 690% in the past year—outperforming even Palantir. The company specializes in space infrastructure, utilizing AI and advanced manufacturing to provide essential components for national security and commercial missions.

Redwire’s competitive edge comes from its diverse range of technologies, including power systems and specialized payloads. The firm has formed partnerships with key players like NASA and SpaceX, showcasing the broad applications of its technology.

Though its stock trades at 5.2 times trailing sales, the valuation reflects Redwire’s strong market position and trajectory. With a contract pipeline worth about $6.9 billion, the company is well-positioned for continued growth in the expanding space industry.

Archer Aviation: Pioneering Defense in Urban Air Mobility

Archer Aviation (NYSE: ACHR) has also made significant strides, with shares rising 90% over the last year. Originally focused on commercial electric vertical takeoff and landing (eVTOL) aircraft, Archer has pivoted toward defense through its new Archer Defense division.

The company’s partnership with tech defense leader Anduril Industries presents investors with indirect exposure to autonomous system innovations. Together, they aim to develop hybrid VTOL aircraft for the Department of Defense, combining Archer’s rapid development capabilities with Anduril’s expertise in AI.

Archer secured an additional $300 million from investors, including BlackRock, raising its liquidity to roughly $1 billion. This strong financial standing, along with support from partners like Stellantis and United Airlines, positions Archer to take advantage of expected opportunities in defense.

Evaluating Investment in BlackSky Technology

Before investing in BlackSky Technology, consider the insights from the Motley Fool Stock Advisor analyst team. They identified the 10 best stocks for investors to consider right now; BlackSky Technology is not among them. The selected stocks have shown potential for substantial returns.

For example, if you had invested $1,000 in Nvidia on April 15, 2005, you would have seen it grow to an astonishing $850,946.

The Stock Advisor service assists investors in building successful portfolios with regular updates and new stock picks each month. Since its inception in 2002, it has surpassed the S&P 500’s returns significantly.

Learn more »

*Stock Advisor returns as of February 7, 2025

George Budwell holds shares in Archer Aviation, BlackRock, Nvidia, and Palantir Technologies. The Motley Fool holds positions in and recommends Nvidia and Palantir Technologies and also recommends Stellantis. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.