Nvidia (NASDAQ:NVDA) is causing quite a commotion in the market, and it’s not just the stock reaping the benefits. Three ETFs boasting substantial positions in Nvidia, namely the VanEck Semiconductor ETF (NASDAQ:SMH), the iShares U.S. Technology ETF (NYSEARCA:IYW), and the Invesco S&P Momentum ETF (NYSEARCA:SPMO) are riding high on Nvidia’s phenomenal success and seem ready to capitalize further if its shares continue their upward trajectory.

Boasting significant exposure to Nvidia, these ETFs offer different strategies and rationales for owning Nvidia. All three hold sizable positions in the soaring stock, up an impressive 235.5% in the past year, edging closer to a $2 trillion market cap.

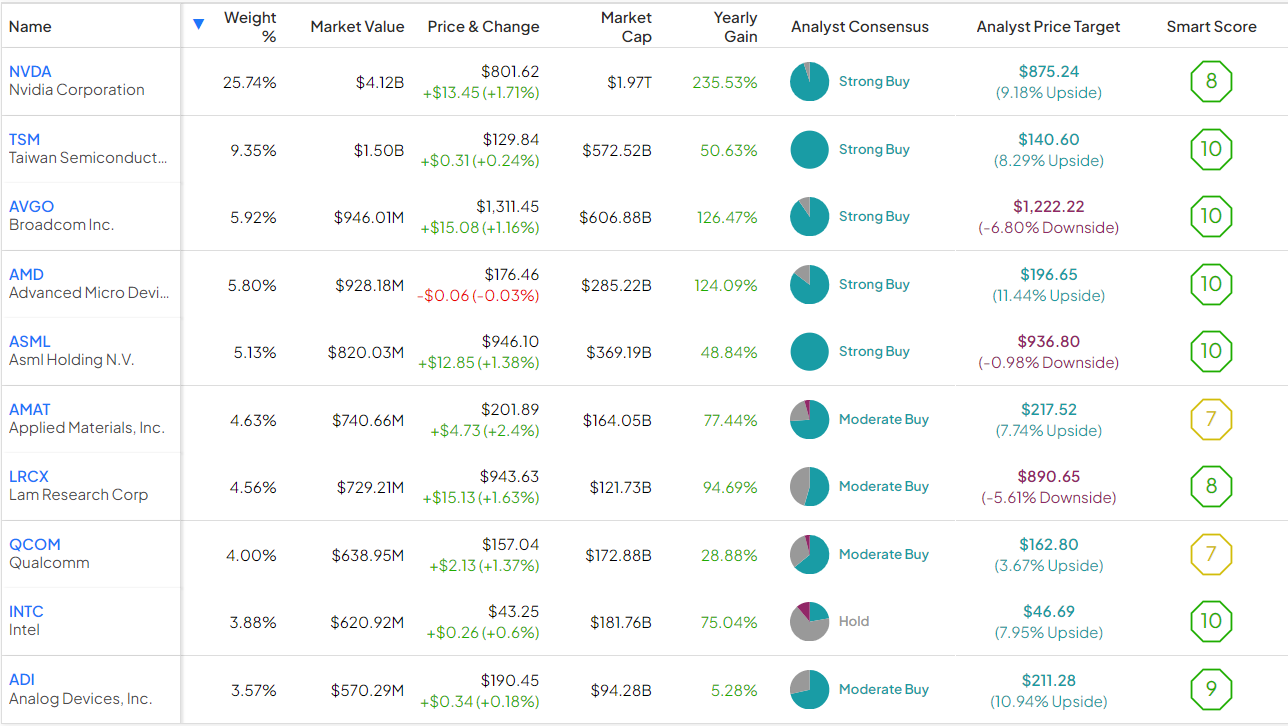

VanEck Semiconductor ETF (NYSEARCA:SMH)

The VanEck Semiconductor ETF (SMH) is a $16 billion fund that aims to provide investors with “exposure to the top 25 most liquid U.S.-listed semiconductor companies, spanning the entire industry value chain from chip design and fabrication to manufacturing machinery.”

SMH boasts a significant position in Nvidia, accounting for over one-quarter of the assets in this semiconductor-focused fund, with a weightage of 25.7%.

Furthermore, SMH’s top holdings include Nvidia’s competitors such as Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC), along with crucial players in the semiconductor manufacturing sector like Taiwan Semiconductor (NYSE:TSM) and equipment manufacturers like Applied Materials (NASDAQ:AMAT), Lam Research (NASDAQ:LRCX), and ASML Holding (NASDAQ:ASML).

Historically, SMH has outperformed the market significantly, driven in part by its substantial Nvidia position. As of January 31, SMH has delivered remarkable returns of 18.8% over three years, an outstanding 32.1% over five years, and an impressive 26.1% over ten years, surpassing both the S&P 500 (SPX) and Nasdaq (NDX) indices across all these periods.

Notably, with an expense ratio of 0.35%, investors would incur $35 in fees annually on a $10,000 investment in the fund.

Considering SMH’s substantial Nvidia exposure, its track record of market-beating performance, and its array of highly-rated stocks, as per Smart Score, the outlook appears promising. For those seeking Nvidia exposure via ETFs, SMH emerges as a compelling option due to its substantial 25.7% Nvidia position and its exposure to complementary stocks in Nvidia’s orbit.

Is SMH Stock a Buy, According to Analysts?

Sell-side analysts portray a positive sentiment towards SMH, giving it a Strong Buy consensus rating based on 21 Buys, five Holds, and no Sell ratings in the past three months. The average target price of $223.22 for SMH suggests a 6.1% potential upside from current levels.

iShares U.S. Technology ETF (IYW)

On the other hand, the iShares U.S. Technology ETF holds Nvidia as part of its objective to “track the investment results of an index composed of U.S. equities in the technology sector.” IYW invests in U.S.-based electronics, computer hardware and software companies, and IT firms.

Nvidia forms 6.8% of IYW’s assets under management, a substantial position albeit dwarfed by SMH’s massive 25.7% allocation. In total, IYW holds 135 stocks, with the top 10 constituting 63.9% of the fund.

Unlike SMH, IYW has a broader investment focus, with holdings spanning beyond semiconductors to include tech giants like Microsoft (NASDAQ:MSFT), Apple (NASDAQ:AAPL), and Meta Platforms (NASDAQ:META).

Similarly to SMH, IYW’s portfolio garners favorable ratings from TipRanks’ Smart Score, with an impressive nine out of the top 10 holdings boasting Outperform-equivalent scores of 8 or above.

Over time, IYW has demonstrated strong performance, achieving annualized returns of 14.2% over three years, 24.5% over five years, and 20.2% over ten years leading up to January 31.

With an expense ratio of 0.40%, investors would pay $40 in fees annually on a $10,000 investment in the fund.

Overall, I am optimistic about IYW, given its robust performance history and well-rated portfolio of leading tech stocks, although it’s worth noting that SMH offers significantly greater exposure to Nvidia.

Insights into Investing in Semiconductor Stocks

Analysts’ View on IYW Stock

Analysts evaluating IYW assign a Moderate Buy consensus rating to the stock with 106 Buys, 27 Holds, and two Sells in the past three months. The average price target of $145.91 suggests a potential 10.2% upside.

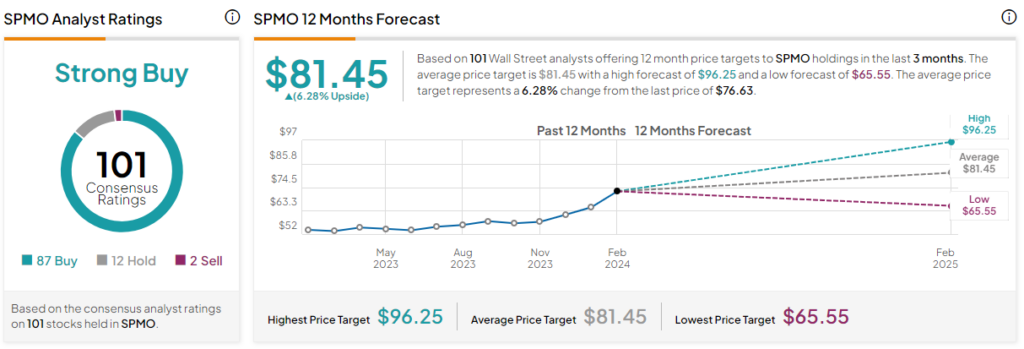

Invesco S&P 500 Momentum ETF (SPMO)

In comparison, the Invesco S&P 500 ETF takes a different approach, tracking high momentum stocks in the S&P 500 Index. Comprising 100 stocks, with Nvidia holding 11.4%, SPMO’s top 10 holdings represent 56.1% of the fund.

Not exclusively focused on technology, SPMO’s robust portfolio includes top performers from various sectors, such as Meta Platforms, Eli Lilly, General Electric, and Walmart. Impressive Smart Scores of 9 or higher characterize nine of the fund’s top 10 holdings.

Since its launch in 2015, SPMO has delivered solid annualized returns, with a rate of 10.9% over three years and 15.1% over five years. With an expense ratio of just 0.13%, it is the most affordable among the three funds discussed.

Considering its performance, diversified holdings, and significant Nvidia stake, SPMO presents a promising investment opportunity.

Analysts’ Perspective on SPMO Stock

Analysts hold a favorable view of SPMO, giving it a Strong Buy consensus rating with 87 Buys, 12 Holds, and two Sells in the last three months. The average price target indicates a 6.3% potential upside from current levels.

Diverse Investment Opportunities In Nvidia

All three featured ETFs, including SMH, IYW, and SPMO, offer attractive investment options with strong portfolios and consistent returns. Of the three, SMH stands out as my preferred choice due to its highest Nvidia exposure and exceptional performance record.

Disclaimer: The opinions expressed are solely those of the author and do not necessarily reflect Nasdaq, Inc.’s views.