As the year 2023 drew to a close, the economy began exhibiting signs of steadying, much to the relief of market participants. Alleviating the inflationary pressures, the Federal Reserve made the resolute decision to maintain unaltered interest rates. This turn of events bodes well for generic drug manufacturers such as Amphastar Pharmaceuticals AMPH, Teva Pharmaceutical TEVA, and Dr. Reddy’s Laboratories RDY. These entities stand to gain from enduring cost reductions in the long haul.

Additionally, these drug companies are actively engaged in launching novel products or bolstering existing ones with substantial gross margins, thereby buttressing their revenue and profitability. In a bid to bolster their market share, generic drug firms are also venturing into strategic partnerships with regional and global enterprises.

Review of the Generic Drugs Industry

The Medical – Generic Drugs industry encompasses firms that develop and market chemically or biologically identical versions of brand-name drugs following the expiration of patents that grant exclusivity to the branded drugs. These drugs are categorized as generic or biosimilar based on their composition. The pervasive nature of the generic segment is largely attributable to a handful of prominent drug manufacturers and generic units of major pharmaceutical companies. Smaller entities also partake in crafting generic versions of branded medications at markedly lower costs than the original drugs. Fierce competition in this sector translates to narrow profit margins for manufacturing companies. Notably, a few companies within this industry possess a portfolio of branded drugs, enabling them to tap into a more lucrative market with higher margins.

Factors Influencing the Future of Generic Drug Companies

Erosion of Patent Exclusivity for Branded Drugs: Generic drug manufacturers heavily hinge on the erosion of patent exclusivity for branded drugs. They petition the FDA for approval of their generic or biosimilar versions of branded drugs that have lost patent protection. The loss of patents for blockbuster drugs such as AbbVie’s Humira has presented substantial opportunities for generic drugmakers. Notably, several companies, including Amgen and Sandoz, have successfully launched their versions of Humira’s biosimilars.

Companies might also roll out authorized generic versions of branded products, securing exclusivity over other generic variants of the same drug for several months. While the development of biosimilars is considerably convoluted, generic players have already introduced a few. It’s worth noting that these generic drug manufacturers might encounter legal disputes to market the generic version of these drugs.

Rigorous Competition: The generic drug industry vies with original branded drugs. Upon the loss of patent exclusivity for a branded drug and the subsequent availability of generic versions in the market, it instigates competition as rivals price their generic offerings well below the original price. The rivalry among multiple generic drugmakers launching the same drug exerts downward pressure on prices, much to the benefit of consumers. Consequently, these drugmakers strive to attain the “first-to-file” (FTF) status for medicines. The current generic market scenario is notably saturated, with numerous drugmakers awaiting approval for several generic filings from the FDA. With various biosimilar drugs slated for launch in the coming years, the revenue of these companies is poised to observe a substantial uptick.

Patent Settlements: The successful resolution of patent disputes continues to be a crucial catalyst for the growth of generic drug manufacturers. The resolution of these disputes expedites the availability of low-cost generic products while alleviating the uncertainties linked with legal battles. However, the pursuit of actively settling patent disputes necessitates litigation, inevitably culminating in escalated costs.

Positive Industry Standing According to Zacks

The Zacks Medical – Generic Drugs industry is a niche cluster of 14 stocks nestled within the broader Zacks Medical sector.

At present, the industry’s Zacks Industry Rank is the median of the Zacks Rank for all constituent stocks. The Zacks Medical – Generic Drugs industry is presently placed at Zacks Industry Rank #99, positioning it among the upper 39% of the 251 Zacks industries. Our analysis indicates that the top 50% of Zacks-ranked industries surpass the bottom 50% by a factor exceeding 2 to 1.

Given this backdrop, we are poised to spotlight a few noteworthy stocks. But prior to delving into that, it’s imperative to dissect the stock market performance and prevalent valuation of the industry.

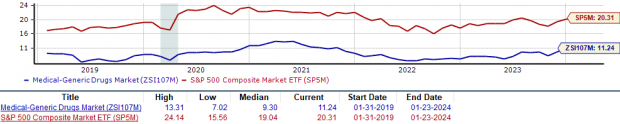

Industry Outperforms Sector and S&P 500

The Zacks Medical – Generic Drugs industry has notably outperformed the broader Zacks Medical sector and the S&P 500 Index over the bygone year.

In this period, the industry has surged by 27.4% in contrast to the marginal uptick of 0.3% in the broader sector. Meanwhile, the S&P 500 has observed a 20.3% upswing during the same timeframe.

One-Year Price Performance

Image Source: Zacks Investment Research

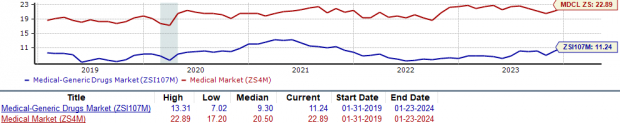

The Industry’s Current Valuation

Based on the forward 12-month price-to-earnings (P/E F12M) ratio, a widely used metric for valuing generic companies, the industry is currently trading at 11.24X, notably lower than the S&P 500’s 20.31X and the Zacks Medical sector’s 22.89X.

Over the past five years, the industry’s P/E ratio has peaked at 13.31X, hit a low of 7.02X, and settled at a median of 9.30X, as illustrated by the charts below.

Price-to-Earnings Forward Twelve Months (P/E F12M) Ratio

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Noteworthy Generic Drug Stocks

Amphastar: This company specializes in the development, production, and marketing of generic as well as proprietary injectable, inhalation, and intranasal products, along with an insulin-active pharmaceutical ingredient. With a primary focus on augmenting its portfolio of generics and biosimilars, the company had three generic drugs under review with the FDA as of the culmination of September 2023. Amphastar is also engrossed in the development of three biosimilar and six generic drugs offering substantial market potential.

Analysis of Top Generic Drug Stocks and Market Trends

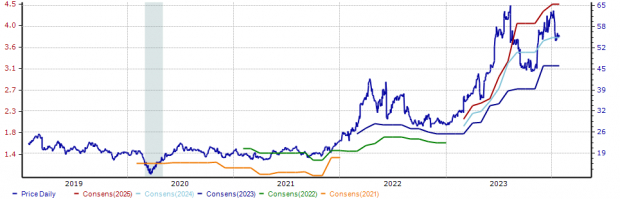

Amphastar Pharmaceuticals: A Strong Contender

Amphastar Pharmaceuticals boasts a robust position in the generic drug market as it continues to thrive. The company’s stock has surged from $3.72 to $3.77 per share in the past 60 days, signaling a positive market sentiment. With a Zacks Rank #1 (Strong Buy), Amphastar Pharmaceuticals presents an exciting investment opportunity. The firm’s stock performance has been steady, reflecting investor confidence and a promising trajectory.

Price & Consensus: AMPH

Image Source: Zacks Investment Research

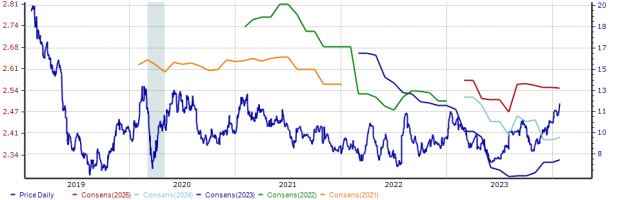

Teva, ranked #2 (Buy), stands as a key player in the generic drug industry. Its global standing as the largest generic drug company is testament to its steadfast growth. The firm has exhibited strong performance, with its stock recording a remarkable 17.4% increase in the past year. Teva’s strategic focus on enhancing operational efficiencies and reducing debt could pave the way for sustained growth in the future. With a consistent consensus estimate of $2.39 per share for 2024, investors are presented with a promising outlook.

Price & Consensus: TEVA

Image Source: Zacks Investment Research

The market presence of Dr. Reddy’s Laboratories cannot be understated as the India-based company continues to make significant strides in the U.S. generics market. Dr. Reddy’s favorable positioning can be attributed to its robust efforts to propel the development of a complex generics portfolio. This commitment is underscored by the company’s ongoing endeavors to ensure timely approvals, reflecting its proactive approach to anticipate potential challenges. Although the consensus estimate for the fiscal 2025 earnings has moderated slightly from $4.09 to $4.07 in the past 60 days, Dr. Reddy’s Labs remains a formidable force with a Zacks Rank #3 (Hold).

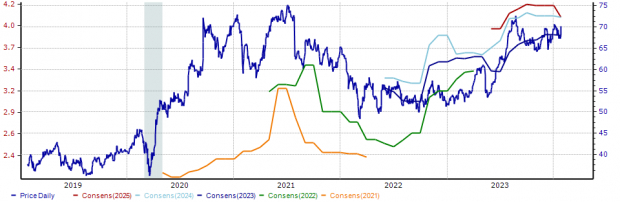

Price & Consensus: RDY

Image Source: Zacks Investment Research

If you’re on the lookout for the latest recommendations from Zacks Investment Research, today is your lucky day! You can download 7 Best Stocks for the Next 30 Days and gain access to invaluable insights. Dive into the detailed analysis of Amphastar Pharmaceuticals, Inc. (AMPH), Dr. Reddy’s Laboratories Ltd (RDY), and Teva Pharmaceutical Industries Ltd. (TEVA) to make well-informed investment decisions.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.