A few days prior, an article was published outlining “My Top 3 Picks for 2024.” These picks were carefully selected to leverage the potential growth opportunities, influenced by several factors including the presidential election, surging AI investments, and declining mortgage rates.

- Alphabet (GOOG) Blended P/E: 24.1x, 10Y EPS growth: 17.5%, Annual Return Potential: 17%

- Nvidia (NVDA) Blended P/E: 41.3x, 15Y EPS growth: 39.5%, Annual Return Potential: 31%

- Lowe’s (LOW) Blended P/E: 16.2x, 15Y EPS growth: 16.5%, Annual Return Potential: 14%

The majority of the previously discussed stocks fit within the growth stock category. However, additional picks with a more aggressive growth profile will be introduced in this article. Though not core holdings, these selections hold substantial potential, ranging from 1% to 3% exposure in the portfolio. This choice reflects the confidence placed in their ability to deliver outstanding performance in 2024.

Although the focus is often on dividend growth stocks in writings, it’s essential to acknowledge the presence of growth stocks without distribution, strategically chosen to invigorate the portfolio.

The advantage of growth stocks without distribution is their ability to maximize the potential of compound interest by reinvesting profits to foster business growth. Despite their higher volatility, these stocks carry the allure of potentially higher returns.

With that said, three growth stock picks will be showcased for heavy investment throughout 2024, aligning with the investment style and portfolio, whilst recognizing the existence of potentially more attractive or riskier opportunities.

Chipotle Mexican Grill, Inc. (CMG)

If you’re not familiar, Chipotle Mexican Grill is a popular fast-casual restaurant chain renowned for its emphasis on using fresh, high-quality ingredients in crafting Mexican-inspired dishes.

Yes, it might sound surprising, but I’ve chosen a restaurant chain as a potential growth stock.

The rationale behind this choice is straightforward – Chipotle transcends the traditional image of a restaurant chain by focusing on the automation of kitchen processes and embracing robotic innovation in gastronomy.

Traditionally, labor costs constitute a significant chunk of expenses for restaurant businesses, often reaching up to 34% of sales. The impact of this became even more apparent post-COVID-19, with many restaurants scaling down operations due to a shortage of available labor. Chipotle stood up to the challenge.

Initially, Chipotle introduced a robot for crafting tortilla chips, followed by another for assisting in guacamole preparation. The latest endeavor involves testing a robotic chef tasked with creating salads and bowls at the Chipotle Cultivate Center innovation hub in Irvine, California.

Automated assistance in preparing bowls and salads becomes particularly crucial since these dishes constitute approximately 65% of all Chipotle digital orders.

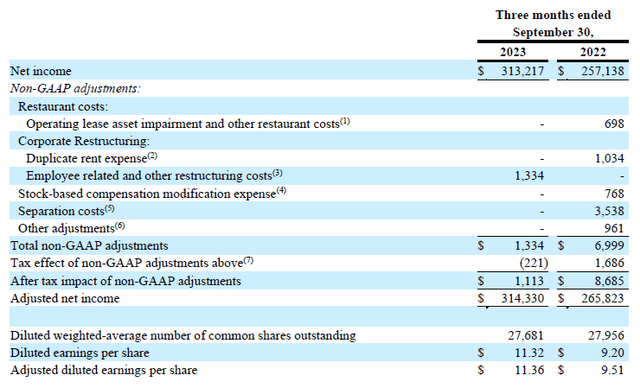

Chipotle’s ability to adapt and innovate is underscored by its Q3 earnings report, revealing an improvement in demand trends and rising profit margins amidst a challenging economic environment for consumer spending.

Drawing more diners doesn’t seem to be an issue for Chipotle, evident in a 5% increase in comparable-store sales during the Q3 period that extended through late September. Management attributes this success to enhanced hiring and training practices, superior food quality, and faster service.

In the face of economic uncertainties, Chipotle’s CEO, Brian Niccol, confidently states that the company’s value proposition is stronger than ever.

The enhanced value proposition has translated into increased customer traffic, a sought-after achievement that has proven challenging for many restaurant peers in recent times. However, McDonald’s (MCD), with its focus on value, is outpacing others, experiencing a faster expansion with an 8% increase in comparable-store sales in the US market this past quarter.

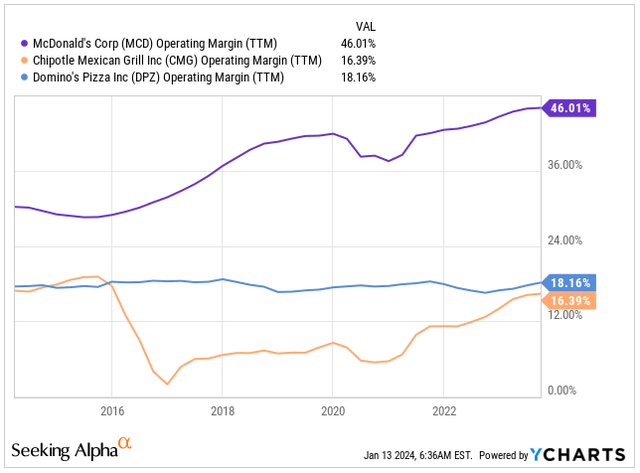

It’s worth noting that Chipotle operates differently from McDonald’s and Domino’s Pizza (DPZ), employing a non-franchised operating model. Consequently, its profit margins don’t reach the same heights.

Chipotle’s restaurant-level operating profit margin saw improvement, climbing from 25% to 26% of sales compared to a year ago. The overall profitability also increased to a robust 16% of sales from 15%. This positive trend is reflected in a noteworthy 20% surge in adjusted earnings for the quarter.

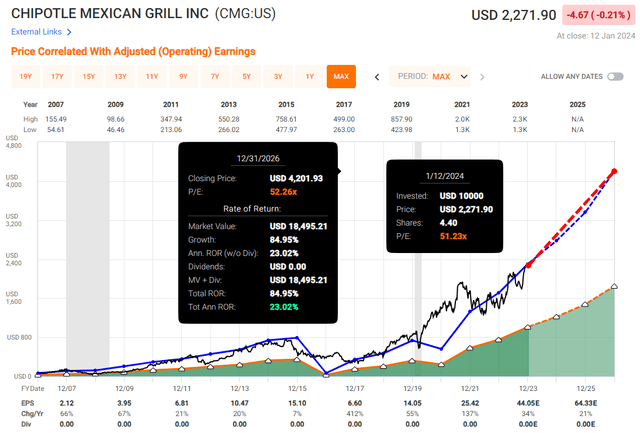

Investors will recognize Chipotle’s superiority in gastronomy, and the stock is by no means cheap. Since 2007, the stock has continuously traded at an average blended P/E of 52.3x, which seems very high for a restaurant chain.

The valuation has stretched even further in the last 10 years to an average blended P/E of 62.8x.

Since 2007, Chipotle has grown its EPS at a rate of 23% annually, and this trend is expected to continue well into the future.

Investment Outlook: Sizzling Potential in Chipotle, Meta Platforms, and MercadoLibre Stocks

1. Chipotle Mexican Grill, Inc. (CMG)

Chipotle Mexican Grill, known for its sizzling burrito bowls, has been displaying some sizzling numbers of its own in the stock market. The company is on track for a scorching rise, with projected earnings per share (EPS) of $53.19E in 2024, representing a 21% year-over-year growth, followed by $64.33E in 2025 and $80.40E in 2026. These numbers promise a mouthwatering investment opportunity for the future.

With the company’s historical growth trajectory combined with its current valuation of 51.2x its earnings, investors can savor the fact that the stock is trading at a fair value. If Chipotle continues its forward momentum and maintains its valuation, investors could be feasting on an annual return of approximately 23% over the next three years. It’s certainly optimistic enough to warrant a “strong buy” conviction.

2. Meta Platforms, Inc. (META)

As the largest provider of social media platforms, Meta Platforms, Inc. hooks a substantial 3.14 billion users on a daily basis—akin to nearly 38% of the world’s population being reeled in by its products. That’s a staggering statistic, portraying the company’s widespread influence and captivating reach in the digital realm.

Despite navigating through rough seas in 2022 when its stock price plummeted by a whopping 77%, Meta has since embarked on a remarkable turnaround, emerging as the second-best-performing stock in the S&P 500 (SPY) in 2023, delivering a remarkable 194% return. The company’s revival exemplifies a phoenix-like resurgence from the ashes of adversity.

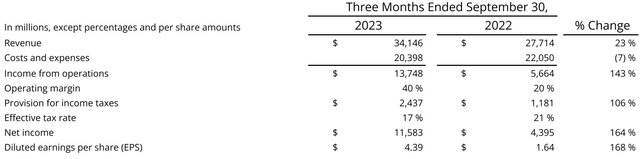

Meta’s recent Q3 performance reflects its prowess, with a 23% revenue surge to $34.15 billion and an impressive 2000 basis point growth in operating margin. This revitalization is underscored by a strategic refocusing on core ad business, a 24% reduction in headcount, and tactical belt-tightening in marketing expenses—a triumphant masterstroke in efficiency.

Looking ahead to 2024, Meta is primed to capitalize on a politically charged US presidential election, expected to fuel substantial campaign spending and bolster the profits of its advertising business. Simultaneously, the company is cultivating a robust focus on artificial intelligence (AI) initiatives, channeling resources into innovative AI projects while streamlining its workforce. This strategic balance is poised to yield a bountiful harvest of growth and productivity.

With tailored AI-driven advertisements set to ignite increased ad spending and drive business expansion, investing in Meta’s stock at a blended price-to-earnings (P/E) ratio of 25.8x appears to be a tantalizing prospect—as the company charts its course towards sustainable growth.

3. MercadoLibre, Inc. (MELI)

Dancing in the shadows of ecommerce giant Amazon, MercadoLibre, Inc. (MELI)—often dubbed as the “Amazon of Latin America”—exudes the same vibrancy and aspirational power. While Amazon explores the horizon of AWS for its next growth frontier, MELI stands as a fintech juggernaut in the Latin American domain, propelling its stock to striking heights.

In 2023, MELI’s Nasdaq-listed shares mirrored Amazon’s robust performance, with both companies notching up over 75% returns—a compelling testament to MELI’s unwavering potential in the market. Although MELI’s market cap of $80.4 billion is approximately 20 times smaller than Amazon, the company’s ambitions and influence loom large in the ever-evolving landscape of Latin American ecommerce and fintech.

With its Mercado Libre ecommerce platform rapidly expanding and its role as a fintech powerhouse gaining further prominence, MercadoLibre emerges as a captivating investment proposition, leveraging the buoyant tide of digital commerce and financial technology in the Latin American market.

MercadoLibre: A Unique Growth Opportunity in Latin America

MercadoLibre (MELI) offers a digital wallet, Mercado Pago, akin to PayPal’s popular Venmo, along with an array of financial services. JPMorgan analyst Marcelo Santos sees MELI as a leader in e-commerce, displaying robust growth in fintech, making it an attractive prospect for investors.

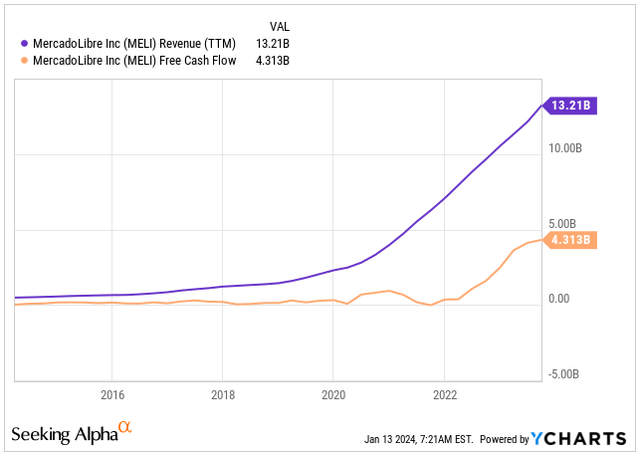

MELI experienced exponential growth during the tumultuous COVID-19 years of 2020 and 2021, a doubling of its business operations. Notably, the company sustained this healthy trajectory even as the world returned to normalcy.

Evolution of MercadoLibre

Initially dubbed the “eBay (EBAY) of Latin America” for its role in connecting individual buyers and sellers, MercadoLibre has evolved. The company has ventured into innovative payment services, credit, logistics, and advertising, broadening its offerings beyond just e-commerce.

Now, Mercado Pago, its payment services platform, is widely used in the region, powering transactions on the Mercado Libre marketplace. Surprisingly, its wallet services extend beyond the platform, and the company now witnesses a larger payment volume outside of its ecosystem.

Overall, over 167 million people across Latin America have availed themselves of either its e-commerce or fintech services, marking a 31% increase from the previous year.

Overcoming Regional Challenges

Despite regional challenges such as hyperinflation in Argentina, political unrest, potential economic slowdowns due to currency fluctuations, and social inequality, Latin America is poised for significant growth in the next decade. MELI has a distinctive opportunity to partake in this expansion.

Impressive Q3 Performance

The diversified nature of MercadoLibre’s business was evident in its recent Q3 earnings report. The company reported an adjusted $7.16 per share on sales of $3.8 billion for the quarter ending in September. Earnings surged 180% year-over-year, and revenue grew by 40%.

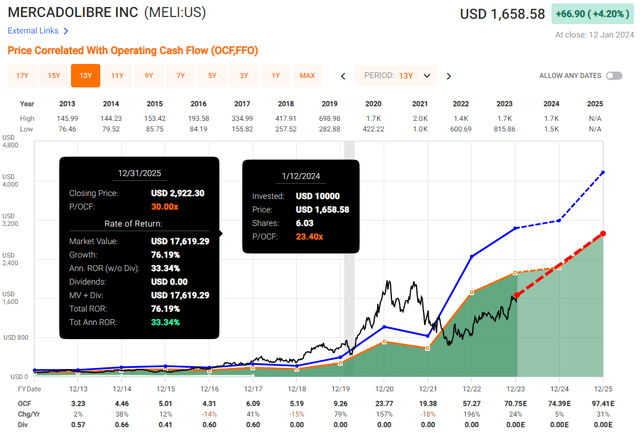

Comparing businesses such as MELI and Amazon based on the price-to-earnings (P/E) ratio often sparks debates about whether the stock is overpriced or if this metric misrepresents its true value. However, analyzing the operating cash flow (OCF) presents a more accurate picture. Since 2012, MELI has, on average, been trading at a P/OCF ratio of 42.8x, and the growth of the OCF has been high at 30.2%, akin to Amazon’s growth of 29.5% over the same duration. The growth is anticipated to continue, albeit at a slower rate of 14.5% annually.

- 2024: OCF $74.39E, 5% year-over-year growth

- 2025: OCF $97.41E, 31% year-over-year growth

Presently, the stock is trading at a P/OCF of 23.4x, significantly below its historical average. However, factoring in the decelerating growth, a reasonable P/OCF going forward would be 30x. This implies that if the growth materializes, the stock is poised to deliver a return of around 33% over the next 2 years, hence meriting a strong buy rating.

Takeaway: Tapping into Growth Stocks

Growth stocks, though often more volatile than dividend-paying stocks, should not be overlooked. The potential to supercharge a portfolio lies in their efficient allocation of profits, reinvesting back into the business for further growth. When aligned with astute leadership, the compounding effect takes on a whole new level of significance.

Considering this, adding growth stocks to one’s portfolio is a prudent move, given favorable market trends and potential for a strong performance.