InvestorPlace – Stock Market News, Stock Advice & trading Tips

China has often been overlooked by investors, but swimming against the tide can lead to extraordinary gains. Noteworthy figures like Michael Burry and Ray Dalio are starting to pivot their gaze towards the East, and it’s not without reason. Amidst the underappreciated gems in the Chinese stock market are companies that serve as the backbone to the nation’s economic boom.

The Resilient Giant: Alibaba (BABA)

Source: BigTunaOnline / Shutterstock.com

At the forefront of this landscape stands Alibaba (NYSE:BABA). With its prestigious blue-chip status, Alibaba reigns supreme in the global e-commerce arena. Despite trading in a compressed range over the past year, just shy of its all-time high, the golden days of Alibaba may yet return. Remember the tech stock surge of yesteryears? With the Fed once again contemplating rate cuts, Alibaba’s meteoric comeback might just be around the corner.

Analysts at Susquehanna are seeing a bright future for Alibaba, setting a target price of $135 per share, signaling a potential 77.6% upside from current levels.

The Green Pioneer: Daqo New Energy (DQ)

Source: Shutterstock

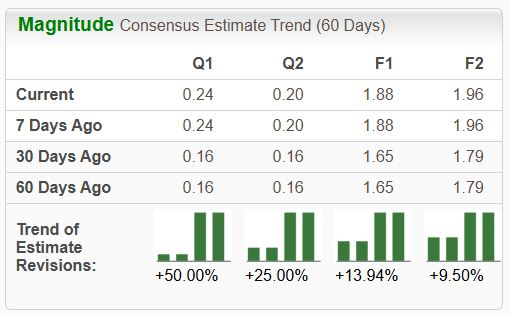

Daqo New Energy (NYSE:DQ) might not be a household name, but its contributions to the Chinese economy are undeniable. A pivotal player in the solar energy revolution, Daqo manufactures the essential raw materials for solar panels, driving the global shift towards renewable energy.

Despite a projected decline in earnings per share, analysts foresee a significant upside for the stock, with a price target of $38.60, representing a staggering 108.6% potential growth.

The Challenger: PDD Holdings (PDD)

Source: Freer / Shutterstock.com

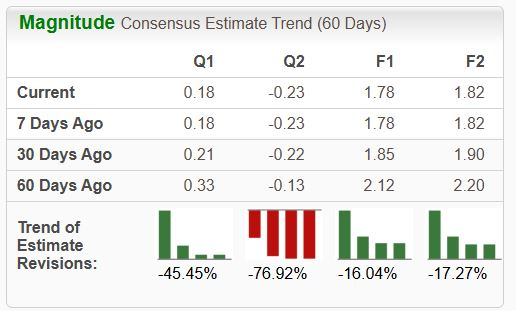

In the ring with Alibaba is PDD Holdings (NASDAQ:PDD), nimbly capturing the attention of American consumers through strategic advertising placements. Boasting impressive revenue growth rates, this contender has become a formidable player in China’s resurgence.

Despite a slightly conservative outlook on earnings growth, PDD’s previous performance hints at potential surprises ahead. With analysts predicting a 25.9% EPS increase in the coming year, this stock could be a dark horse in the Chinese market.

Notably, Gabriel Osorio-Mazzilli, a seasoned ex-Wall Street professional, remains neutral on these securities, adhering to a disciplined investment approach.

More From InvestorPlace

The post 3 High-Growth China Stocks American Investors Can Buy appeared first on InvestorPlace.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.