Stocks Poised for Continued Growth Amid Market Optimism

The stock market has reached new heights this year, driven by falling interest rates, economic optimism, and greater clarity following the recent elections. This surge has energized a range of stocks, many of which still have significant growth potential.

Among them, Cameco (NYSE: CCJ), Brookfield Renewable (NYSE: BEPC), (NYSE: BEP), and Brookfield Infrastructure (NYSE: BIPC), (NYSE: BIP) stand out as top picks for those seeking compelling investment opportunities. Let’s explore what makes these stocks attractive right now.

Cameco: A Leading Force in Nuclear Energy

Reuben Gregg Brewer (Cameco): Concern among investors has arisen from a recent regulatory decision affecting the restart of some nuclear reactors. However, the nuclear power sector in the U.S. has shown a pattern of positive developments, gaining the support of major tech companies such as Microsoft, Alphabet, and Amazon.

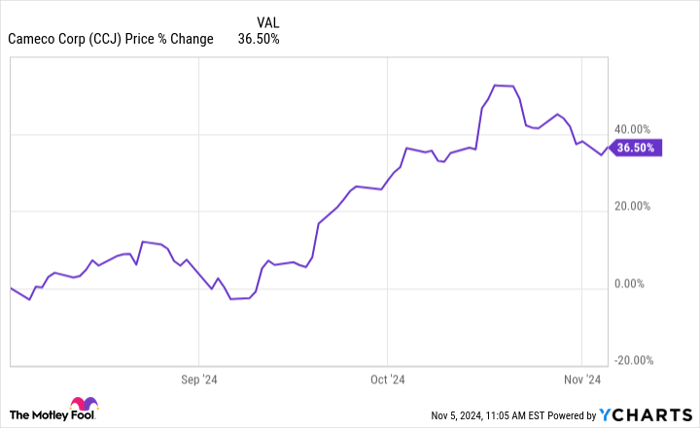

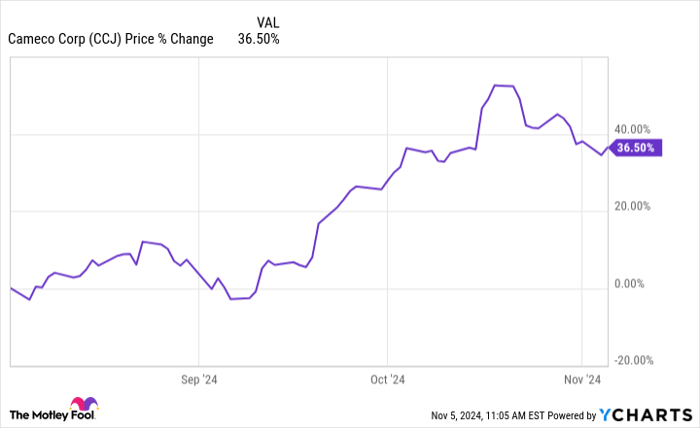

Nuclear energy stands out because it generates power without emitting carbon dioxide and is consistently available, unlike renewable sources such as solar and wind. For data centers, dependent on high energy consumption, this reliability is essential. Additionally, companies like NuScale Power are creating small-scale, safer modular reactors that are easy to transport. This positions Cameco, one of the world’s largest uranium miners, favorably in the market. Its stock has risen over 30% in the last three months, fueled by a renewed interest in nuclear power. Should this momentum continue, Cameco’s stock could rise even further.

CCJ data by YCharts

However, investing in uranium is not without risks. Its price is driven by supply and demand dynamics. If nuclear energy fails to deliver on its promise, then Cameco’s stock could struggle, making it essential for investors to believe in a bright future for nuclear power.

Brookfield Renewable: Energizing Future Growth

Matt DiLallo (Brookfield Renewable): Brookfield Renewable has experienced impressive growth, as evidenced by its funds from operations (FFO) per share increasing at a 12% compound annual rate since 2016. The company anticipates at least 10% FFO per share growth again this year, which has fueled a 20% increase in its share price over the past year.

Looking ahead, Brookfield projects sustaining over 10% FFO-per-share growth in the coming decade. Much of this growth is underpinned by a substantial development pipeline, featuring over 230 gigawatts (GW) of projects at various stages. The company plans to commission 10 GW of capacity each year for several years, including more than 10.5 GW for Microsoft during the 2026-2030 period. In addition, rising power prices could enhance its earnings as legacy contracts expire.

Furthermore, Brookfield has over $100 million worth of mergers and acquisitions (M&A) opportunities in the pipeline. Its recent agreement to acquire a 53% stake in Neoen, a developer of renewable energy in fast-growing markets like France and Australia, signals aggressive growth ambitions. With an expected annual earnings growth rate of over 10%, alongside a 4.5% dividend yield poised for 5%-9% annual increases, Brookfield could offer extraordinary returns over the next decade.

Brookfield Infrastructure: Recovering and Ready for More

Neha Chamaria (Brookfield Infrastructure): After a challenging last quarter in 2023, shares of Brookfield Infrastructure have rebounded significantly and recently hit their 52-week highs. Notably, Brookfield Infrastructure has climbed 42% over the past year, and the company’s rapid growth signals that it may have even more room to rise.

The recent third-quarter earnings report showcased a nearly 10% growth in funds from operations (FFO) to $1.8 billion. Brookfield Infrastructure benefits from consistent cash flows across its utility, transportation, midstream energy, and data infrastructure services. The company regularly recycles capital and invests in growth, producing steady FFO increases.

This year, Brookfield Infrastructure met its capital recycling goal of $2 billion ahead of schedule, partly by selling mature assets. Key investments have included acquiring data centers across North America and telecom tower sites in India, rounding off a solid year of strategic growth.

Brookfield Infrastructure: Promising Growth Ahead

Brookfield Infrastructure is focused on achieving a 10% increase in funds from operations (FFO) per unit and aims for annual dividend growth of 5% to 9%. This strategy implies that the stock is set to yield strong returns for its shareholders in the upcoming years.

This Might Be Your Chance to Invest

Have you ever felt regret over missing out on high-performing stocks? Here’s some news you might find interesting.

Our team of analysts occasionally identifies “Double Down” stocks—companies they believe are poised for significant growth. If you think you’ve missed your opportunity, now could be the best time to invest before it slips away. Consider these impressive numbers:

- Amazon: A $1,000 investment made when we doubled down in 2010 would be worth $23,446 now!*

- Apple: Investing $1,000 during our 2008 recommendation would have grown to $42,982!*

- Netflix: A $1,000 investment from our 2004 advice would now be worth $428,758!*

Currently, we are highlighting three exceptional companies as “Double Down” opportunities, and this may be a rare moment to consider.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of November 4, 2024

John Mackey, the former CEO of Whole Foods Market, which is owned by Amazon, is a board member of The Motley Fool. Suzanne Frey, an executive at Alphabet, is also on The Motley Fool’s board. Matt DiLallo has stakes in Alphabet, Amazon, Brookfield Infrastructure Corporation, Brookfield Infrastructure Partners, Brookfield Renewable, and Brookfield Renewable Partners. Neha Chamaria does not hold positions in any mentioned stocks. Reuben Gregg Brewer has no positions as well. The Motley Fool recommends and holds shares in Alphabet, Amazon, and Microsoft, along with Brookfield Infrastructure Partners, Brookfield Renewable, and Brookfield Renewable Partners. They also recommend specific options on Microsoft. The Motley Fool follows a strict disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.