In the current market euphoria, symbolized by the soaring S&P 500 index, investors are scrambling to find undervalued opportunities amid the sea of inflated valuations. Yet, fear not, for hidden gems still exist in the financial landscape, particularly in the banking sector that has been slow to rebound due to the persistent high interest rate environment.

These three bank stocks stand out for their remarkably cheap valuations, potentially primed for a significant upward trajectory in the near future.

Image source: Getty Images.

Unearthing Value: The Story of Citigroup

Citigroup (NYSE: C) stands as a financial behemoth in the U.S. banking landscape, grappling with challenges stemming from its global operations that have stretched its resources thin. Despite its past struggles and regulatory fines, Citigroup’s current trading price at a remarkable 33% discount to tangible book value presents a compelling proposition.

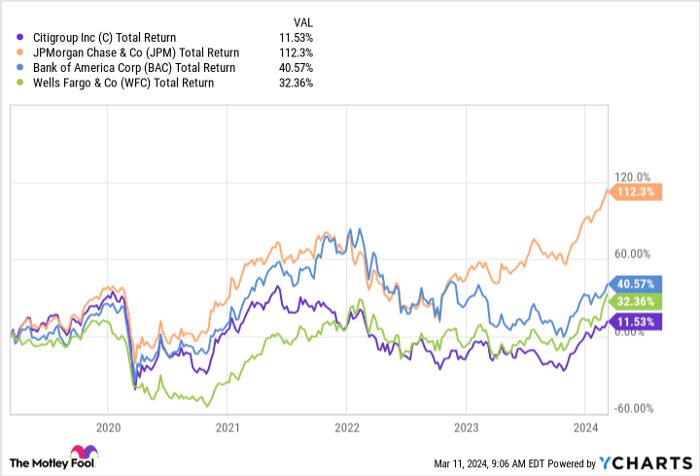

C Total Return Level data by YCharts

Under the strategic helm of CEO Jane Fraser, Citigroup is on the path to shedding unprofitable ventures and streamlining operations to enhance efficiency. Analysts like Mike Mayo foresee a potential uptick in Citigroup’s stock price to $100 within the next three years, indicating a bright future for this undervalued banking stalwart.

Riding the Wave: Goldman Sachs’ Path to Recovery

The legendary investment bank, Goldman Sachs (NYSE: GS), has weathered the storm of dwindling investment banking revenues due to rising interest rates, leading to a subdued market sentiment. However, with promising IPOs like Reddit, Stripe, and Klarna on the horizon, Goldman Sachs may be on the cusp of a resurgence, trading at attractive multiples of 16.8 times earnings and 9.9 times one-year forward earnings.

The resurgence of IPO activity could signal a turning tide for Goldman Sachs, making it an opportune time for investors to seize this bargain before the market catches on to its potential.

Lending Club: A Diamond in the Rough

Lending Club (NYSE: LC), a consumer-focused lending platform, has carved a niche in the debt consolidation market amidst soaring consumer debt levels. With an expansion into traditional banking following the acquisition of Radius Bancorp, Lending Club now offers a diversified revenue stream that sets it apart from traditional lenders.

CEO Scott Sanborn’s strategic vision to capitalize on the impending debt refinancing wave positions Lending Club as a lucrative investment option, boasting a discounted 18% to tangible book value and trading at just 11 times forward earnings.

As consumers look to consolidate their debts in a falling interest rate environment, Lending Club’s innovative products could drive substantial growth, making it a compelling buy for investors seeking undervalued opportunities.

These three underappreciated bank stocks offer a chance for investors to strike gold in a market crowded with overvalued equities. The road to riches may be bumpy, but these discounted gems promise a glittering payoff for those willing to take the plunge.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.