Determined Companies Stand Strong

The volatile nature of upstream business in the integrated energy sector often means susceptibility to oil and gas price fluctuations. Additionally, rising input costs are adding pressure to the refining activities, clouding the outlook for the Zacks Oil & Gas US Integrated industry.

About the Industry

The Zacks Oil & Gas US Integrated industry encompasses companies primarily involved in upstream and midstream energy activities, including exploration, production, transportation, and storage. These businesses are intricately linked and heavily reliant on the fluctuating prices of oil and gas.

Trends Reshaping the Future of the Industry

Inflation Challenge: Persistent high inflation levels and increasing market volatility add complexity to energy demand, potentially affecting integrated energy firms.

Refining Struggles: The high cost of oil is squeezing refining profits for integrated companies in the United States.

Rise of Renewables: The global shift towards renewable energy sources is creating a decline in demand for traditional fossil fuels, impacting integrated energy players.

Volatility in Upstream Business: The fate of exploration and production activities is closely tied to oil and gas price fluctuations, making the upstream business extremely volatile.

Low Dividend Yields: Industry stocks have shown relatively lower dividend yields compared to the broader energy sector.

Unpromising Industry Rank

The Zacks Oil & Gas US Integrated industry is ranked at a dismal #237 among more than 250 Zacks industries, positioning it in the bottom 5%. The average of the Zacks Rank of all member stocks within this industry indicates dim near-term prospects.

Stock Performance and Valuations

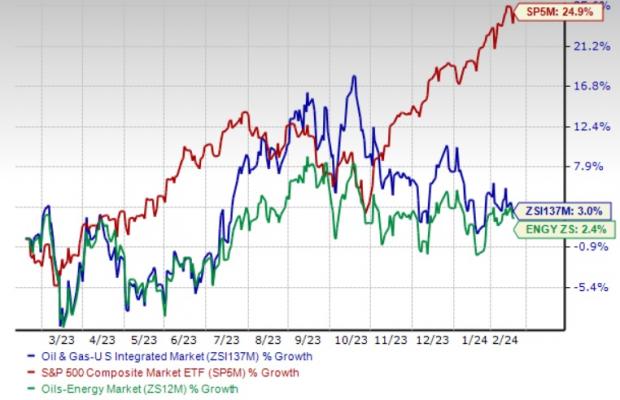

The industry has exhibited a 3% growth over the past year, outperforming the broader energy sector but trailing the S&P 500 composite, which surged by 24.9%.

Valuation Analysis

The industry’s current trailing 12-month EV/EBITDA ratio stands at 4.54X, lower than the S&P 500’s 13.64X but higher than the energy sector’s 3.63X. Over the past five years, the industry’s EV/EBITDA ratio has fluctuated between 3.29X and 13.38X, with a median of 4.80X.

Resilient US Integrated Energy Stocks

Equitrans Midstream With a focus on gas transmission, storage, and gathering systems, Equitrans Midstream generates stable cashflows. The company’s midstream assets support the production and development of natural gas across the region. Equitrans Midstream holds a Zacks Rank #1 (Strong Buy).

Atlas Energy Solutions Inc. A leader in the proppant and innovative logistics services space, providing services to oil and gas players in the prolific Permian Basin, Atlas Energy Solutions Inc. carries a Zacks Rank #3 (Hold) and is projected to see earnings growth of 58.3% this year.

DT Midstream Inc. As a leading operator of natural gas pipeline systems, DT Midstream Inc. influences the transportation of natural gas across various regions.

DT Midstream: A Key Player in the Energy Sector

DT Midstream operates gas interstate and intrastate pipelines, enabling the company to generate stable fee-based revenues. As a Zacks #3 Ranked midstream player, DT Midstream is strategically positioned to capitalize on the growing demand for clean energy due to its role in natural gas transportation.

Price and Consensus Analysis: DTM

When evaluating the performance of DT Midstream, it’s crucial to consider the pricing and consensus data. The information obtained can provide valuable insights into the company’s position within the market.

As of now, experts have identified 7 elite stocks from a list of 220 Zacks Rank #1 Strong Buys. These select stocks are deemed “Most Likely for Early Price Pops.” This initiative, which was first launched in 1988, has beaten the market by more than double, delivering an average gain of +24.0% annually. Investors are encouraged to give these hand-picked stocks their immediate attention based on historical data.

See the identified stocks now >>

If you wish to receive the latest recommendations from Zacks Investment Research, you can download the report titled “7 Best Stocks for the Next 30 Days” today. This report is available for free.

Click here to get this free report

You can also access the Free Stock Analysis Reports for the following companies:

Read the full article on Zacks.com here

Visit Zacks Investment Research for more information

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.