What Lies Ahead for Nvidia: Examining Growth Amid Concerns

Nvidia (NASDAQ: NVDA) stock has surged to a record high. This increase can be attributed to the company’s impressive track record of triple-digit earnings growth. As a frontrunner in the booming artificial intelligence (AI) sector, Nvidia supplies customers with top-performing chips, software, and various services.

However, some investors worry about whether Nvidia can maintain its current momentum. The risk lies in competing chipmakers offering cheaper alternatives, potentially undermining Nvidia’s market share and prompting the company to lower prices, which could impact profit margins.

Nvidia’s stock is on track for a remarkable 176% gain this year, yet these concerns have occasionally influenced performance in recent months. Below are three vital factors about Nvidia that critics may overlook—elements that could bolster the company’s long-term growth prospects.

Image source: Getty Images.

Nvidia’s Journey in the AI Landscape

To understand Nvidia’s current position, it’s crucial to review its evolution. Initially focused on selling graphics processing units (GPUs) to gamers, Nvidia expanded into various sectors after recognizing the chips’ potential beyond gaming. The rise of the AI boom further fueled Nvidia’s growth, as GPUs excel at tasks such as training and executing complex AI models.

With an 80% share in the chip market, Nvidia has not only led in GPU sales but also developed a wide array of products aimed at supporting the entire AI lifecycle. Consequently, those looking to build AI projects find everything they need through Nvidia, enhancing its strong position in the market.

Yet, critics question whether Nvidia can maintain this leadership, sustaining growth and stock appreciation.

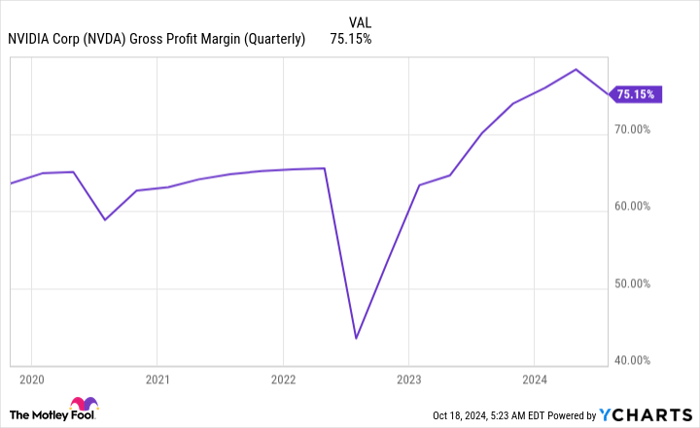

Impressive Gross Margins of Nvidia

One crucial component to consider is Nvidia’s gross margin, which has consistently remained above 60% for the last five years. In the latest quarters, it has even exceeded 70%. The company recently projected a gross margin of 75% for the third quarter and mid-70s for the full year—numbers that are remarkable, especially given the impending launch of the new Blackwell architecture, typically associated with higher early costs.

NVDA Gross Profit Margin (Quarterly) data by YCharts

With revenue growth soaring into triple digits recently, even a dip into double-digit growth would maintain a bright outlook for profitability.

The third key factor for Nvidia’s continued success is innovation. Customers are willing to invest in Nvidia’s new offerings, such as the much-anticipated Blackwell. Strong demand continues to outpace supply, indicating robust customer dedication.

Keeping Innovation at the Forefront

Nvidia plans to update its GPUs every year, creating challenges for competitors attempting to catch up. The company continues to enhance its existing infrastructure with innovative algorithms, ensuring that customers can easily integrate new Nvidia products into their systems.

Such a strategy not only retains customer loyalty but also supports sustained growth. As Nvidia scales operations, it becomes increasingly cost-efficient, which should help maintain wide profit margins.

These combined factors of solid margins and high growth prospects address critics’ concerns and bolster the argument that Nvidia stock has significant potential for future growth.

A Second Chance at a Smart Investment?

Have you ever felt like you missed the opportunity to buy shares in a successful company? If so, it might be time to consider this new chance.

In rare instances, our experienced analysts recommend a “Double Down” stock alert for companies they believe are poised for significant price jumps. For those worried about missing the boat, now may be the ideal time to invest before another opportunity slips away. The historical numbers are compelling:

- Amazon: investing $1,000 when we doubled down in 2010 would be worth $21,285 now!*

- Apple: a $1,000 investment when we doubled down in 2008 has grown to $44,456!*

- Netflix: turning $1,000 into $411,959 since our 2004 doubling down!*

Currently, we’re providing “Double Down” alerts for three exceptional companies, and a chance like this is not likely to come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.