Insiders purchasing shares in a public company often send a strong signal to investors.

When insiders buy, they are essentially putting their money where their mouth is, signaling a bullish stance on the company’s prospects.

Insiders, according to Section 16 of the Security Exchange Act, include officers, directors, 10% stockholders, and others who have access to company information due to their relationship with the business.

Insiders are bound by stringent regulations and must adhere to strict rules regarding the timing and disclosure of their trades.

Thus, it’s significant for investors to note that insiders have a longer holding period compared to regular traders.

Recent activity has been observed in three prominent companies: Walgreens Boots Alliance WBA, FedEx FDX, and Casey’s General Stores CASY – offering potential insights for investors interested in insider activity.

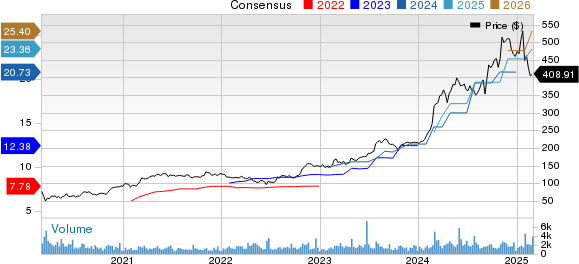

Casey’s General Stores

Casey’s General Stores operates convenience stores, primarily in the Midwest. A recent notable purchase was made by a director who acquired 725 CASY shares, amounting to nearly $200k.

The stock has been given a Zacks Rank #1 (Strong Buy), and earnings expectations have been trending upward.

Image Source: Zacks Investment Research

Investors eyeing CASY shares stand to benefit from a modest annual yield of 0.6%. Despite the modest yield, the company’s consistent 7% five-year annualized dividend growth rate underscores its commitment to enhancing shareholder returns.

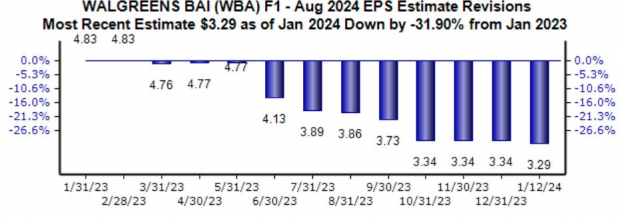

Walgreen Boots Alliance

Walgreens Boots Alliance is a prominent retail drugstore chain. Recently, the CEO made a significant investment, purchasing 10,000 shares worth just under $250k. However, analysts have revised down their current-year EPS expectation by 32% since October.

Image Source: Zacks Investment Research

FedEx

FedEx offers a broad array of transportation, e-commerce, and business services. A recent insider move involved a director purchasing 200 shares, with the total transaction value reaching $50k. However, the company’s earnings outlook has seen a downward trend similar to that of Walgreens Boots Alliance.

Image Source: Zacks Investment Research

Bottom Line

Insider purchases often broadcast a compelling vote of confidence in a company’s future. The recent insider activity in Walgreens Boots Alliance WBA, FedEx FDX, and Casey’s General Stores CASY can potentially offer valuable insights for investors considering these large-cap stocks.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA, which soared over +800% since being recommended. While NVIDIA continues to demonstrate strength, this new top chip stock seems poised for substantial growth.

With robust earnings growth and an expanding customer base, it is primed to cater to the burgeoning demand for Artificial Intelligence, Machine Learning, and Internet of Things. The global semiconductor manufacturing sector is expected to burgeon from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

FedEx Corporation (FDX) : Free Stock Analysis Report

Casey’s General Stores, Inc. (CASY) : Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.