Market Volatility: A Look at Prominent Technology Investments

The stock market has experienced significant volatility following President Donald Trump’s tariff announcements and escalating trade tensions with China. Recently, stocks recorded some of the worst sessions since the onset of the COVID-19 pandemic five years ago. However, a recent rally—one of the market’s strongest days—demonstrated that these moments could present excellent opportunities to acquire high-quality stocks at reduced prices.

Despite the recent positive trend, investors should remain cautious. Although the market has rebounded from its lows, further fluctuations are likely.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Bargains in Technology: Key Stocks to Consider

Currently, several stocks in the technology sector present attractive bargains. Notable mentions include Nvidia (NASDAQ: NVDA), Taiwan Semiconductor (NYSE: TSM), and Advanced Micro Devices (NASDAQ: AMD). These companies have seen declines between 27% and 57% from their peaks. Their potential has been highlighted by three Fool.com contributors as top tech stock picks in today’s volatile market.

Here are the insights into why these companies are worth considering:

Short-term Volatility as a Long-term Investment Opportunity

Jake Lerch (Nvidia): My choice is Nvidia. As of this writing, Nvidia has fallen more than 27% from its all-time high, resulting in a loss of nearly $1 trillion in market capitalization over the past three months.

The downturn has been sharp, yet it’s essential for investors to focus on Nvidia’s long-term potential amidst the noise of current headlines.

While uncertainty from trade disputes and potential recession fears loom over the market, these factors make evaluating any company’s prospects challenging, including Nvidia’s. However, the company stands at the forefront of the artificial intelligence (AI) revolution, which raises concerns about its business capability should a global recession occur due to ongoing trade conflicts.

That said, successful buy-and-hold investing requires ignoring temporary market distractions and focusing on enduring trends. One such trend is the unstoppable growth of AI. Innovations evolve and replace outdated technologies, as evidenced by the decline of the typewriter and other obsolete tools.

If Nvidia’s core investment thesis—AI growth—remains intact, how should investors assess its value today? In my view, Nvidia’s stock appears undervalued at present prices.

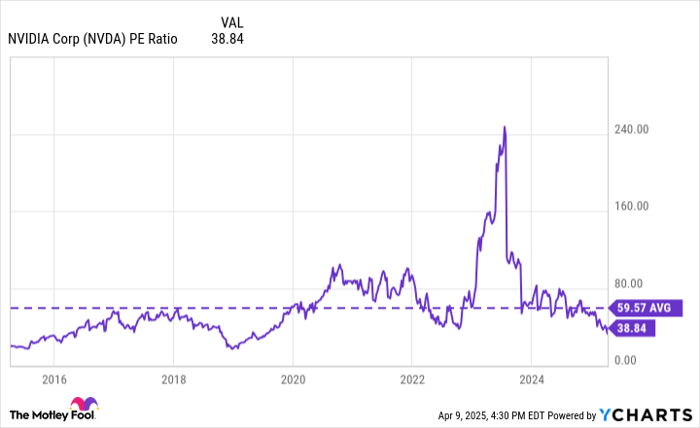

Currently, Nvidia’s price-to-earnings (P/E) ratio stands at 39x, which may seem high. However, it’s important to consider the company’s 10-year average P/E ratio.

NVDA PE Ratio data by YCharts. PE Ratio = price-to-earnings ratio.

Nvidia’s 10-year average P/E ratio hovers around 60x. It’s worth noting that over the past five years, the P/E ratio has dipped below this average only a handful of times, largely during the bear market of 2022.

For those optimistic about the long-term growth of AI and Nvidia’s pivotal role in future innovations, now seems like an opportune time to consider Nvidia’s stock.

Investing in Taiwan Semiconductor Amid Geopolitical Concerns

Justin Pope (Taiwan Semiconductor): Investors favor semiconductor stocks due to their vital role in technology development. Chips are fundamental components driving advancements in AI and other sectors. Taiwan Semiconductor is my top pick for capitalizing on the relentless demand for these components.

Interestingly, many chip manufacturers, like Nvidia, do not produce their chips internally but instead rely on foundries (firms that manufacture chips). Taiwan Semiconductor is the largest foundry worldwide, manufacturing a staggering 67% of the globe’s chips, according to Counterpoint Technology Market Research, a significant increase from 58% in mid-2023. This clearly highlights Taiwan Semiconductor’s growing lead over competitors.

Owning Taiwan Semiconductor presents competitive advantages due to its industry-leading production capacity and superior technology. This positions the company as the preferred partner for chip designers, particularly for high-end products like those provided by Nvidia for AI data centers. As AI continues to expand alongside new sectors like humanoid robotics and autonomous vehicles, Taiwan Semiconductor will remain busy amid strong chip demand.

However, investors must consider the geopolitical risks associated with Taiwan Semiconductor due to its geographic location. China’s claims over Taiwan complicate the situation, and escalating U.S.-China tensions may bring unwanted scrutiny to the company, a key player in strategic supply chains. Although Taiwan Semiconductor has established operations in America and Europe, the geopolitical landscape remains challenging.

Despite the inherent risks, Taiwan Semiconductor’s current valuation remains attractive. The stock’s P/E ratio has dropped below 22, which is a bargain for a market leader anticipated to achieve nearly 30% annual earnings growth over the long term. Assuming geopolitical tensions remain stable, Taiwan Semiconductor could be a wise investment choice.

Analyzing AMD’s Recent Stock Pullback: Is It Overdone?

Market Sentiment Affects Advanced Micro Devices’ Valuation

Will Healy discusses the current state of Advanced Micro Devices (AMD). As a dominant player in central processing units (CPUs) and graphics processing units (GPUs), AMD has found success in gaming and PC markets. However, its data center segment, although growing, still trails Nvidia in the artificial intelligence (AI) accelerator sector. Meanwhile, AMD’s embedded segment is emerging from a recent downcycle.

Currently, concerns have arisen due to the prolonged absence of updates for gaming consoles by Microsoft and Sony. Additionally, worries about tariffs and potential price competition with Intel have unsettled investors.

Reflecting this apprehension, AMD stock is trading at 57% below its all-time high from March 2024.

Positive Indicators for Recovery in AMD

Despite current challenges, several factors suggest a potential recovery for AMD. For instance, the data center and client (PC) segments saw impressive revenue growth of 94% and 52%, respectively, in 2024. This growth contributed to an overall revenue increase of 14% for AMD.

Furthermore, with less severe declines in the embedded sector and growing optimism surrounding gaming, these business segments appear to be exiting their downcycle. Analysts project a revenue growth rate of 23% for 2025, indicating a positive outlook for AMD despite existing concerns.

Interestingly, AMD’s forward valuation supports the notion that the stock’s recent downturn could be excessive. Although the current price-to-earnings (P/E) ratio of nearly 100 appears high, the forward P/E ratio hovers around 20, likely positioning AMD as a value stock if the current trends persist.

Although it seems challenging for AMD to catch up to Nvidia in the data center market, it cannot be denied that AMD has quickly escalated its data center revenue, overcoming numerous obstacles. With its previously lagging segments moving out of a downcycle, investors might find it worthwhile to capitalize on the current lower stock price and favorable valuation.

Should You Invest in Nvidia Right Now?

Before purchasing Nvidia stock, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they regard as the 10 best stocks to buy now, and surprisingly, Nvidia is absent from this list. The selected stocks promise significant return potential in the coming years.

Take note of historical context: when Netflix was recommended on December 17, 2004, a $1,000 investment would have grown to $495,226! Similarly, if you invested $1,000 in Nvidia when it made the list on April 15, 2005, it would now be worth $679,900!

With an average return of 796%, the Stock Advisor program significantly outperforms the S&P 500’s 155% return. Don’t miss out on the latest top 10 list by joining Stock Advisor.

*Stock Advisor returns as of April 10, 2025.

Jake Lerch has positions in Nvidia. Justin Pope has no positions in any mentioned stocks. Will Healy owns shares in both Advanced Micro Devices and Intel. The Motley Fool recommends Advanced Micro Devices, Intel, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool’s recommendations include options such as long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short May 2025 $30 calls on Intel. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.