Investors Eye Oversold Stocks in the Industrials Sector

Stocks in the industrials sector are currently perceived as opportunities for savvy investors, given their undervalued status.

The relative strength index (RSI) serves as a key momentum indicator, assessing a stock’s performance by comparing gains on up days to losses on down days. Traders often find that a stock is oversold when its RSI dips below 30, according to Benzinga Pro.

Below is a current list of significant oversold stocks in the industrials sector, with RSI values near or below the threshold of 30.

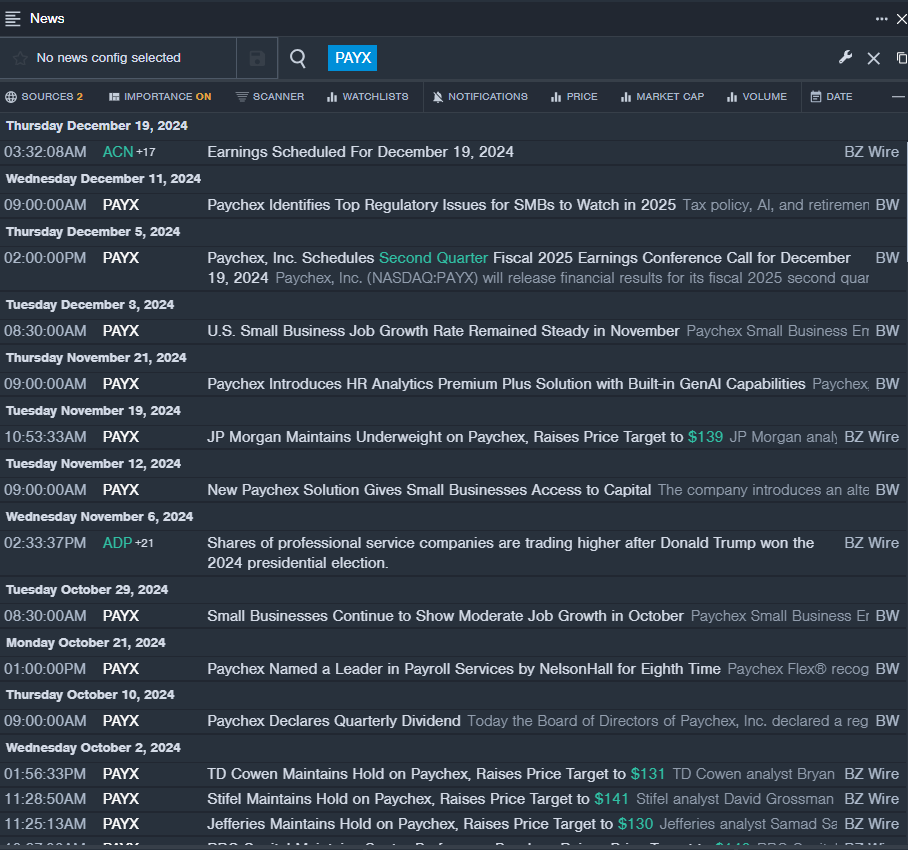

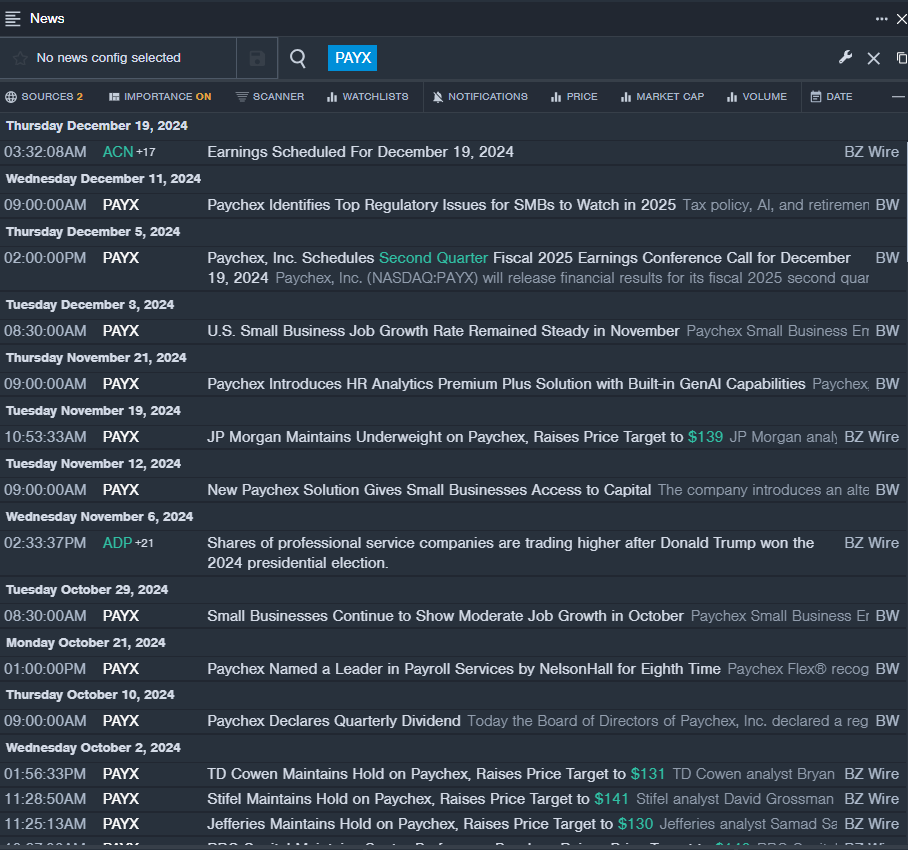

Paychex Inc PAYX

- On November 19, JP Morgan analyst Tien-Tsin Huang reaffirmed an Underweight rating on Paychex but increased the price target from $133 to $139. In the last five days, the stock has declined about 4%, with a recorded 52-week low of $114.72.

- RSI Value: 29.58

- PAYX Price Action: On Wednesday, Paychex shares dropped 3.2% to close at $135.86.

- Benzinga Pro’s newsfeed provided updates on the latest PAYX developments.

Sunrun Inc RUN

- On December 17, Goldman Sachs analyst Brian Lee maintained a Buy rating on Sunrun, while lowering the price target from $19 to $17. The company’s stock has seen a drop of about 12% over the past five days, with a 52-week low of $9.13.

- RSI Value: 28.40

- RUN Price Action: Sunrun shares fell 9.1% to close at $9.15 on Wednesday.

- Benzinga Pro’s tools have tracked the performance trends of RUN stock effectively.

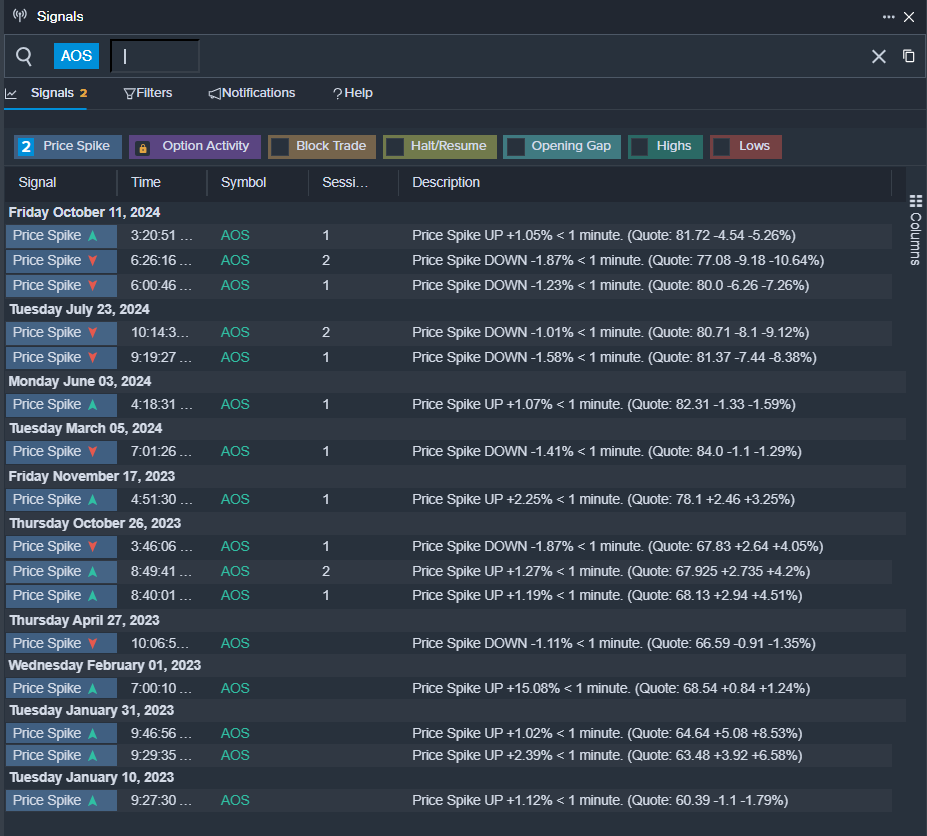

A O Smith Corp AOS

- On December 11, Stifel analyst Nathan Jones maintained a Buy rating for A.O. Smith but reduced the price target from $91 to $90. The stock has registered a 5% decline over the past five days, with a 52-week low of $68.89.

- RSI Value: 25.09

- AOS Price Action: A.O. Smith shares closed down 2.7% at $68.91 on Wednesday.

- Benzinga Pro’s alerts indicated possible movement in AOS shares.

Read This Next:

Overview Rating:

Speculative

Market News and Data brought to you by Benzinga APIs