Industry Overview

The internet service industry, with its diverse players, is subject to macroeconomic forces. Factors such as inflation, rate hikes, and supply chain issues influence the performance of companies within this capital-intensive sector. High fixed costs and the constant need to expand capacity mean that a high interest rate or a looming recession are not conducive to business growth. However, despite these challenges, the sector remains resilient, with companies focusing on innovation, cost control, and operational efficiency to weather the storm.

Stock Picks: Shopify, Upwork, and Uber

Amidst these market conditions, Shopify, Upwork, and Uber stand out as promising prospects in the internet services industry.

Industry Dynamics

The digital revolution and the pandemic have significantly altered the landscape of the internet services industry. The surge in online transactions has become the new norm, with the widespread adoption of connected devices driving increased usage of internet services. Furthermore, companies in this sector are grappling with the need to raise funds for infrastructure development and maintenance, even in the face of high interest rates and potential recessions.

Debt levels, a critical factor in this industry, have seen relative stability, albeit with fluctuations driven by fixed asset investment and acquisitions. Notably, traffic acquisition remains a pivotal driver of revenue, prompting companies to invest in strategies that attract and retain users within their online properties.

Additionally, the industry has witnessed a transformation in the perceived value of user data. Companies are leveraging this information to develop artificial intelligence tools, thereby creating new revenue streams and optimizing operational costs. With the advent of stringent data privacy regulations, the collection and use of user data have evolved, positioning AI as a key growth driver for companies of all sizes.

Industry Rank and Outlook

The Zacks Industry Rank for the Internet – Services industry stands at #55, placing it in the top 22% of Zacks-classified industries. Despite the complexity of selecting stocks within this diverse industry, aggregate earnings estimates have shown consistent upward revisions, indicating positive momentum.

Historically, industries ranked in the top 50% have outperformed those in the bottom 50%. With a solid positioning in the top 50% of Zacks-ranked industries, the internet services sector presents a compelling investment case, even in the face of potential economic headwinds.

Market Performance and Valuation

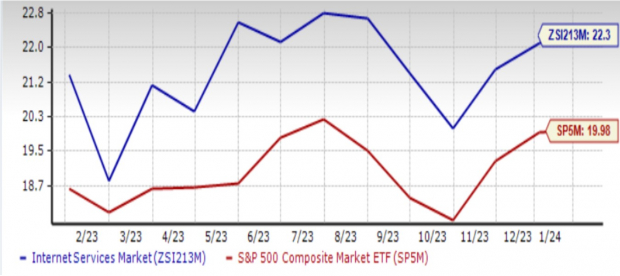

Despite fluctuations driven by market uncertainties, the internet services industry has outperformed both the broader technology sector and the S&P 500. Over the past year, the industry recorded a net gain of 55.8%, surpassing the 45.5% gain in the broader sector and the 20.9% gain in the S&P 500.

Embracing the Internet Services Industry’s Resilience and Potential

Price Performance

Image Source: Zacks Investment Research

Industry’s Current Valuation

As evidenced by the forward 12-month price-to-earnings (P/E) ratio, the internet services industry is presently trading at a 22.36X multiple. This valuation represents a slight premium above its median value of 21.48X over the past year. While it holds a premium to the S&P 500’s 20.02X, it remains a discount in comparison to the sector’s 24.92X.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Exploring the Best Bets

Within the compelling internet services industry, three stellar choices stand out. The first two carry the coveted Zacks #1 (Strong Buy) rank, while the third is rated Buy (Zacks Rank #2).

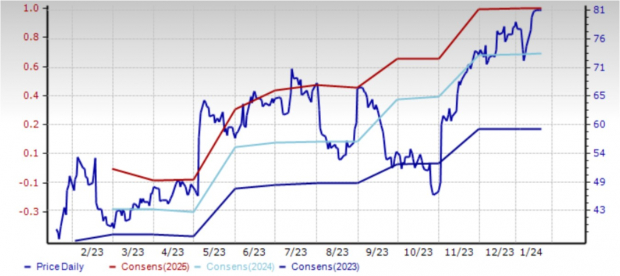

Shopify Inc. (SHOP)

Shopify, based in Ottawa, Canada, offers a comprehensive ecommerce platform spanning various regions. The company’s offerings cover a wide array of essential ecommerce functions, including product sourcing, inventory management, order processing, and fulfillment. Notably, Shopify has delivered an impressive earnings surprise of 183.3% in the September quarter, with revenue also exceeding expectations. The company’s ongoing growth trajectory is evident from the substantial increase in estimates for 2023 and 2024, reflecting a remarkable surge in confidence among analysts. The stock has soared by 103.4% over the past year.

Price and Consensus: SHOP

Image Source: Zacks Investment Research

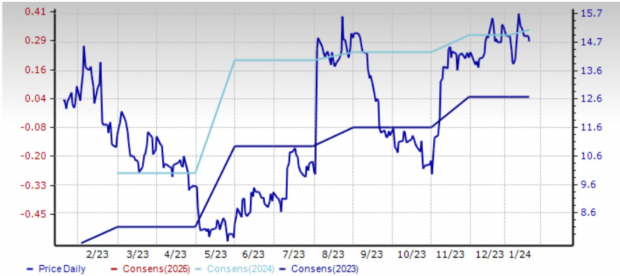

Upwork Inc. (UPWK)

Headquartered in San Francisco, Upwork operates a work marketplace connecting professionals and agencies with businesses and is rapidly capitalizing on the rising trend of remote work. Significantly, the company has achieved an exceptional earnings surprise of 500% in the September quarter, accompanied by robust revenue performance. Upwork’s relentless growth is further underscored by the substantial increase in estimates for 2023 and 2024. The stock has surged by 17.1% over the past year.

Price and Consensus: UPWK

Image Source: Zacks Investment Research

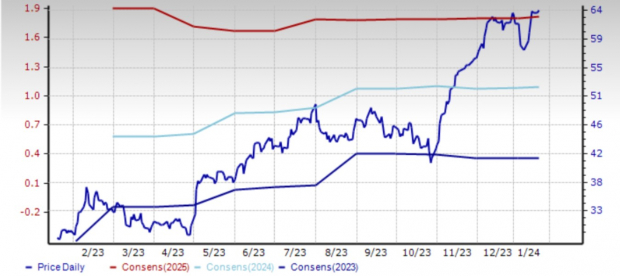

Uber Technologies, Inc. (UBER)

Uber, also based in San Francisco, develops and operates proprietary technology applications across numerous regions. Despite a recent miss in the September quarter, the growth estimates for 2023 and 2024 have seen an impressive surge, reflecting a high level of confidence among analysts. Uber’s stock has seen a remarkable appreciation of 118.0% over the past year.

Price and Consensus: UBER

Image Source: Zacks Investment Research

Only $1 to See All Zacks’ Buys and Sells

We’re not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent.

Thousands have taken advantage of this opportunity. Thousands did not – they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services likeSurprise Trader, Stocks Under $10, Technology Innovators,and more. They’ve already closed 162 positions with double- and triple-digit gains in 2023 alone.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.