Market Correction Offers Buying Opportunity for Tech Stocks

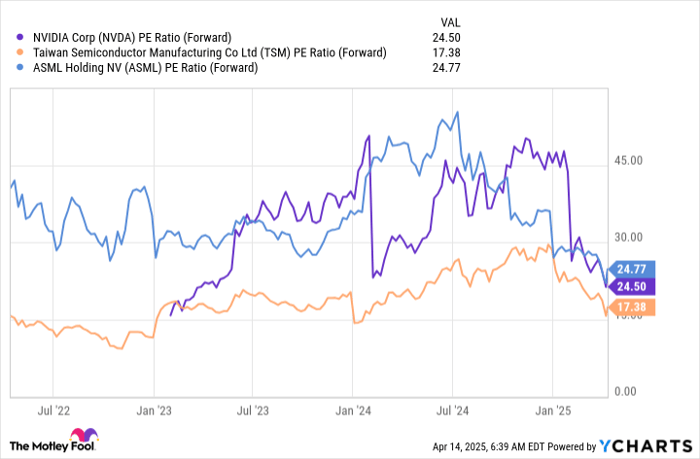

The recent marketwide sell-off has taken a heavy toll, especially on tech stocks. These equities, often trading at high valuations, are typically among the first to decline in such downturns. Major players like Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and ASML Holding (NASDAQ: ASML) have seen steep drops of approximately 25%, 30%, and 40%, respectively.

While some investors may panic, this period could represent a buying opportunity. The declines are driven more by fear than by fundamentals.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Tariff Relief: A Positive Outlook for Investors

Concerns have grown around President Donald Trump’s tariff policies, which many believe could negatively impact companies that source goods internationally. Higher prices on consumer goods could lead to reduced spending, ultimately hurting various sectors.

However, recent developments suggest a more favorable outcome. The administration has relaxed some of its tariff positions, particularly moving to a 10% rate on products, with exceptions for specific countries. Negotiations continue, and further reductions may occur, particularly for products that are vital for tech companies.

Notably, the White House has exempted critical items like copper, pharmaceuticals, semiconductors, smartphones, and computers from reciprocal tariffs aimed at China. As a result, the worst-case scenarios that investors anticipated are not materializing, yet stock prices remain below their all-time highs from earlier this year. In addition to favorable tariff adjustments, these companies stand to benefit significantly from the booming development of artificial intelligence (AI).

The Growing Impact of AI on Tech Companies

The focus on AI, though temporarily overshadowed by tariff anxieties, remains a substantial growth driver. Major tech firms are making significant investments in computing power to advance AI innovations and improvements.

Nvidia’s CEO, Jensen Huang, recently reported that 2024 marked approximately $400 billion in data center buildouts, which could escalate to $1 trillion by 2028. This growth trajectory bodes well for Nvidia, which posted $131 billion in revenue over the past year and stands to maintain impressive growth rates.

Although Nvidia’s growth potential is evident, Taiwan Semiconductor Manufacturing presents a broader industry perspective. As the premier chip fabricator, Taiwan Semi produces chips for nearly every leading tech company, including Nvidia and Apple (NASDAQ: AAPL). Their advanced planning processes allow them to foresee trends in chip demand well ahead of time.

Projected 45% growth in AI-related revenue over the next five years aligns with Taiwan Semi’s overall 20% growth forecast, reinforcing the expansion seen by Nvidia.

To meet rising chip demand, ASML is uniquely positioned. It is the sole producer of extreme ultra-violet (EUV) lithography machines necessary for advanced chip designs. This monopoly ensures that ASML’s growth prospects remain robust as the demand for technology accelerates.

Investors should keep an eye on ASML’s performance. The current market price presents an advantageous entry point for those looking to invest in a strong growth sector.

NVDA PE Ratio (Forward) data by YCharts

Despite recent sell-offs, these three tech stocks offer a compelling investment opportunity at lower valuations than seen just months ago. Investors looking to deploy cash may find few better options than these companies poised for significant growth.

Is Nvidia a Good Investment Right Now?

Before making a decision on buying stock in Nvidia, consider this:

The Motley Fool Stock Advisor has identified what they deem the 10 best stocks to invest in right now—Nvidia is not included in this list. The chosen stocks are anticipated to yield exceptional returns in the future.

For instance, Netflix was featured in this service on December 17, 2004. An investment of $1,000 at that time would now be worth $524,747!*Similarly, Nvidia was recommended on April 15, 2005, and a $1,000 investment is now valued at $622,041.

It’s also significant to note that Stock Advisor boasts a total average return of 791%, significantly outperforming the S&P 500’s 152% return. Don’t miss out on the latest top 10 list when you join Stock Advisor.

*Stock Advisor returns as of April 14, 2025

Keithen Drury has positions in ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein reflect those of the author and do not necessarily represent those of Nasdaq, Inc.