Top Oversold Industrial Stocks That Could Be Worth a Second Look

In the industrial sector, some stocks are currently showing signs of being oversold, hinting at potential buying opportunities for investors.

The Relative Strength Index (RSI) is a tool used to assess the momentum of a stock by comparing its performance on days it rises versus days it falls. An RSI below 30 typically indicates that a stock is oversold, as noted by Benzinga Pro.

Let’s take a closer look at major companies in the industrial sector with RSIs near or below 30.

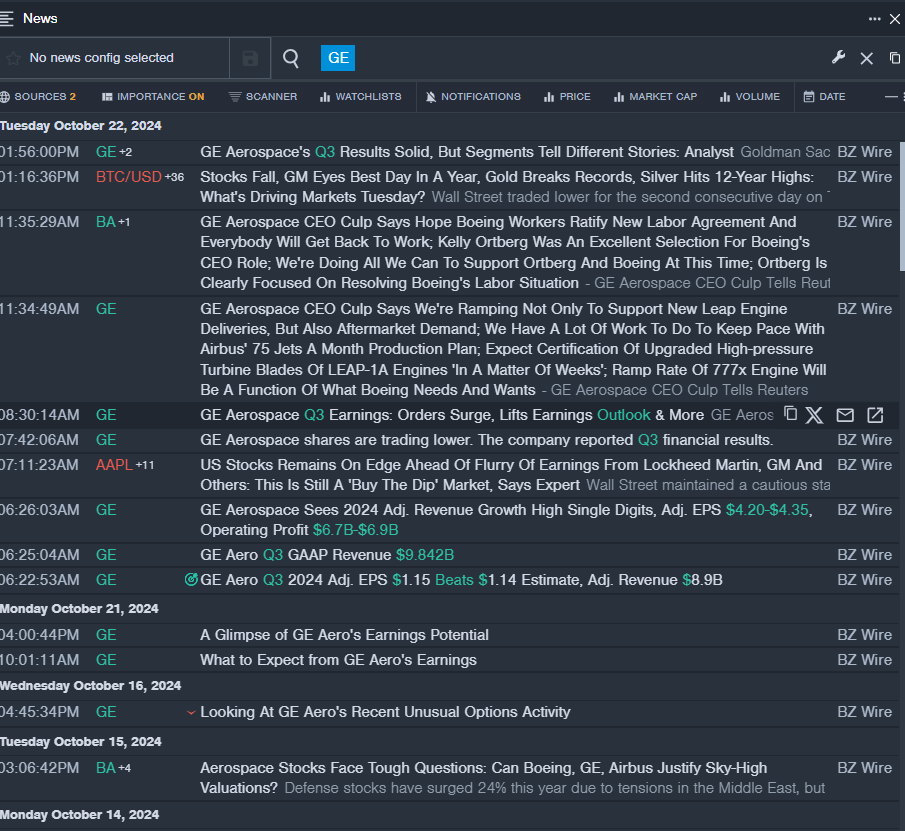

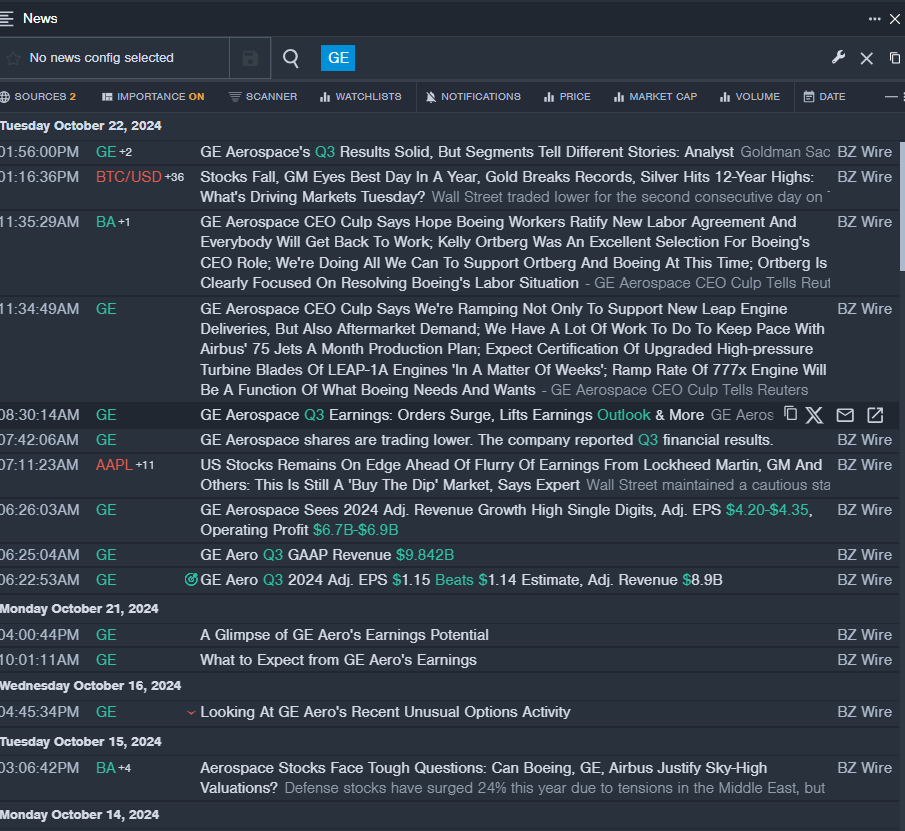

General Electric Co GE

- On October 22, General Electric announced a 6% increase in adjusted revenue year-over-year, amounting to $8.943 billion. GAAP revenue reached $9.84 billion, exceeding analyst expectations of $9.022 billion. H. Lawrence Culp, Jr., Chairman and CEO of GE Aerospace, mentioned, “We grew earnings by 25%, driven largely by services, and are raising our earnings and cash guidance for the year.” Despite these positive results, the stock experienced a 7% decline over the past week, reaching a 52-week low of $84.32.

- RSI Value: 26.67

- GE Price Action: Shares of General Electric dropped 9.1% to close at $176.66 on Tuesday.

- Benzinga Pro’s real-time newsfeed provided insight into the latest news regarding GE.

Lockheed Martin Corp LMT

- On October 22, Lockheed Martin released its third-quarter results, showing a 1.3% increase in net sales year-over-year to $17.104 billion, which fell short of expectations set at $17.351 billion. However, adjusted EPS improved to $6.84 from $6.77, surpassing the consensus of $6.50. CEO Jim Taiclet stated that the company is optimistic about its full-year 2024 sales and profit outlook. Over the past week, the stock declined by about 4%, marking a 52-week low of $413.92.

- RSI Value: 29.00

- LMT Price Action: Lockheed Martin shares fell 6.1% to close at $576.98 on Tuesday.

- Benzinga Pro’s charting tools identified the recent trends in LMT’s stock performance.

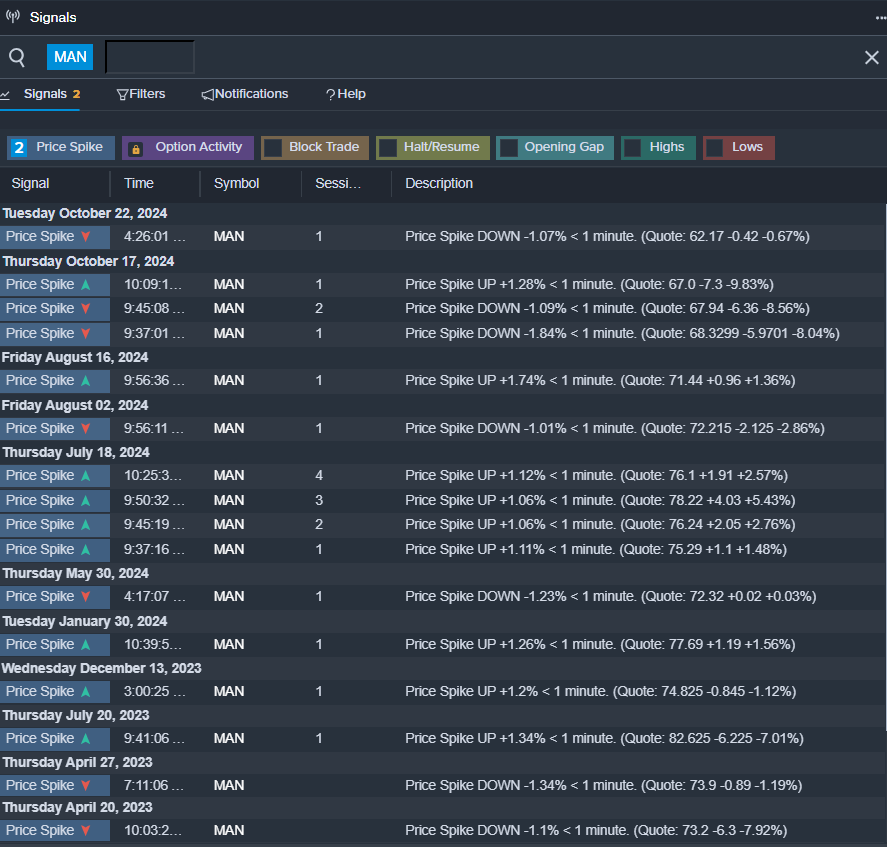

ManpowerGroup Inc MAN

- ManpowerGroup issued fourth-quarter EPS guidance on October 17 that fell short of analysts’ estimates. The company’s stock experienced a 13% drop over the past week and has hit a 52-week low of $61.53.

- RSI Value: 29.40

- MAN Price Action: Shares of ManpowerGroup gained 0.4% to settle at $62.84 on Tuesday.

- Signals from Benzinga Pro highlighted a potential breakout for MAN shares.

Read More:

Market News and Data brought to you by Benzinga APIs