Investing Alert: Top Oversold Stocks in the Industrials Sector

In the industrials sector, certain stocks have become significantly undervalued, presenting potential buying opportunities for investors.

The Relative Strength Index (RSI) serves as a key momentum indicator by measuring a stock’s performance on days it rises against those it falls. Traders often use the RSI to predict short-term stock movements, with a value below 30 typically indicating an oversold position, as noted by Benzinga Pro.

Here’s a closer look at some of the most oversold stocks in this sector, featuring an RSI near or below 30.

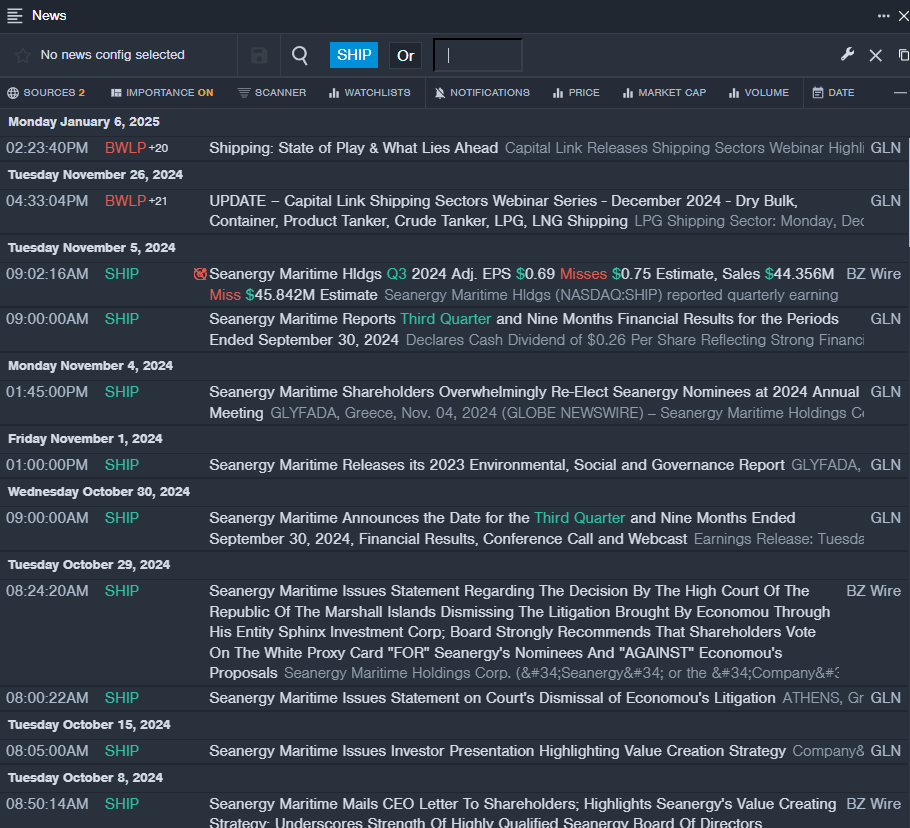

Seanergy Maritime Holdings Corp. SHIP

- On November 5, Seanergy Maritime reported quarterly results that did not meet expectations. The company has seen a 52-week low of $6.55.

- RSI Value: 22.4

- SHIP Price Action: On Monday, Seanergy Maritime shares fell 3.4%, closing at $6.62.

- Benzinga Pro’s real-time newsfeed highlighted the latest updates regarding SHIP.

Euroseas Ltd ESEA

- On November 20, Euroseas shared positive quarterly results. CEO Aristides Pittas noted that while the containership market had stalled, there was renewed interest from charterers in October and early November 2024. The stock has dropped 6% over the past month, reaching a 52-week low of $31.14.

- RSI Value: 29.3

- ESEA Price Action: Shares of Euroseas decreased by 2.2%, finishing at $35.19 on Monday.

- Benzinga Pro’s charting tool was instrumental in spotting the trends in ESEA stock.

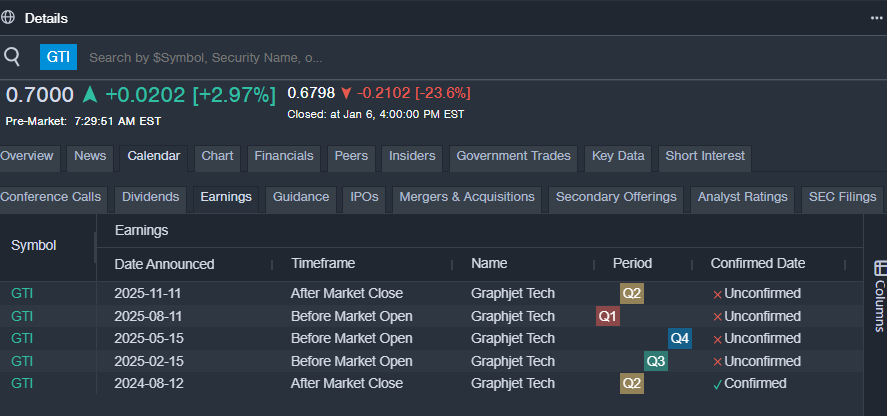

Graphjet Technology GTI

- On December 5, Graphjet Technology announced Liu Yu as its Chief Operating Officer and Chief Scientific Officer. The company has experienced a 67% decline in shares over the past month, with a 52-week low at $0.18.

- RSI Value: 21.7

- GTI Price Action: Shares of Graphjet Technology fell 23.6%, closing at $0.68 on Monday.

- Benzinga Pro’s earnings calendar was used to keep track of upcoming GTI earnings reports.

Read This Next:

Market News and Data brought to you by Benzinga APIs