Seize the day.

Now is the time to snag shares of quantum computing stocks while they hang at a modest valuation. These tech firms, still constructing their quantum computing systems, proffer the potential for staggering returns to early investors.

These three quantum computing stocks aim to commercialize their systems across diversified industries. Quantum technology bears the capacity to revolutionize facets of society; from finance to healthcare, as well as lead to breakthroughs and discoveries unattainable via classical computing.

Make a firm plan to make February unforgettable – grab hold of these three quantum computing stocks that wield the potential for a robust future.

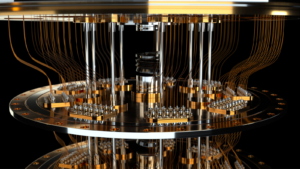

Rigetti Computing (RGTI)

Source: Bartlomiej K. Wroblewski / Shutterstock.com

Rigetti Computing (NASDAQ:RGTI) concentrates on evolving both quantum hardware and software solutions, distinguishing RGTI from its counterparts.

This year may turn out to be a crucial one for Rigetti Computing. The firm intends to advance its quantum computing prowess and enhance accessibility to its technologies for customers through its Quantum Cloud Services.

It is critical to contextualize this effort within its financial performance. The company recently disclosed revenues of $3.1 million, reflecting an increase from $2.8 million in the same period of 2022. Furthermore, the company reported a quarterly gross profit of $2.271 million, with a total gross profit for the nine months ending September 30, 2023, measuring at $6.692 million.

During the same quarter, Rigetti announced a five-year contract with the Air Force Research Lab to provide Quantum Foundry Services. Additionally, the company secured a DARPA IMPAQT contract aimed at developing quantum algorithms. Both endeavors underscore its burgeoning prominence in the defense industry.

Moving forward, analysts anticipate a 40.06% revenue increase next year to $17 million, with breakeven EPS potentially realized sometime in FY2027.

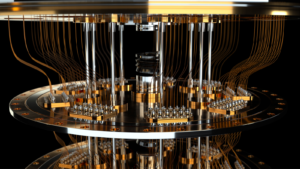

D-Wave Quantum (QBTS)

Source: T. Schneider / Shutterstock

D-Wave Quantum (NYSE:QBTS) is renowned for deploying quantum annealing technology, a specialized form of quantum computing. QBTS is distinct, as businesses and researchers are already leveraging its tech for specific quantum-enhanced computation tasks.

Encouraging signs for the stock include a remarkable upsurge in revenue for the third quarter of 2023 ($2.6 million), marking a 51% year-over-year (YOY) increase. This growth is further underscored by a significant spike in total bookings for the quarter, reaching $2.9 million, a 53% YOY increase.

Due to these developments, QBTS stock has surged 107.87% over the past year. However, it still lies beneath its all-time high, indicating further room for ascent.

Analysts project that QBTS revenues will reach an inflection point around FY2025, climbing to $34.65 million for a 103.80% increase from FY2024. Profitability on a GAAP EPS basis may be achieved around FY2027.

Acquiring shares of the stock today may cement a lower cost basis and substantial gains later on if these projections pan out as envisaged.

Quantum Computing (QUBT)

Source: Amin Van / Shutterstock.com

Finally, Quantum Computing (NASDAQ:QUBT) signifies one of the less-praised names in the industry. The brand is forging hardware-agnostic software solutions, capable of running on various types of quantum machines in the future.

QUBT’s balance sheet is impressive, exhibiting relative strength compared to some industry counterparts. In the last quarter, Quantum Computing managed to reduce its total liabilities to around $8.1 million. Its total assets amount to $89.3 million, with a substantial surge in cash and cash equivalents to $7.4 million.

This year and beyond, the firm plans to augment its product and service offerings, encompassing subscription access to its quantum computing solutions and deployment of quantum cybersecurity solutions.

One Wall Street analyst, Edward Woo from Ascendiant Capital, holds a particularly bullish stance on the stock, issuing a price target of $8.75 along with a “strong buy” rating. This represents an upside of 917.44%.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.