As the 2023 Q4 earnings season unfolds, the recent burst of company reports have unfurled generously positive results, predominantly propelled by the resolute performance and expansion of the technology sector. And this vigorous financial fiesta is set to persist, with a fresh roster of companies ready to divulge their quarterly outcomes in the forthcoming week. Among the notable entities scheduled to unfurl their results are The Coca-Cola Co. (KO), Crocs (CROX), and Airbnb (ABNB), each with its own distinctive trajectory.

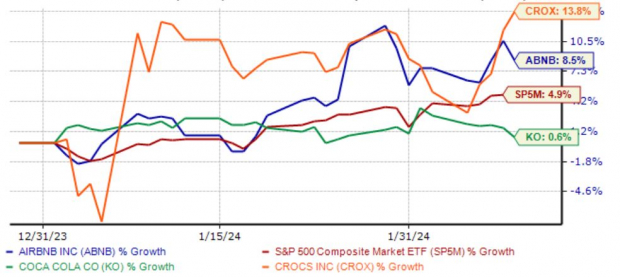

Both ABNB and CROX shares have demonstrated an outperformance compared to the S&P 500 in 2024, while KO shares have exhibited a tentative rise.

Image Source: Zacks Investment Research

How do the anticipations stack up as the release dates draw near? Let’s dive into each company’s prospects.

The Coca-Cola Co.

LNGLorem ipsum dolor sit amet, consectetuer adipiscing elit.

A peer of KO, PepsiCo (PEP), recently unveiled its quarterly results, with shares facing selling pressure post-release. Concerning headline numbers for PEP, the company posted a 3.5% beat relative to the Zacks Consensus EPS estimate and missed revenue expectations.

The unfavorable reaction PEP shares saw post-earnings is likely a reflection of slowing growth as consumer spending behavior reverts to pre-pandemic norms. Yet, PEP expects its categories to perform well throughout 2024, while also announcing a 7% boost to its quarterly payout.

Analysts have been reticent about headline expectations for Coca-Cola, with the $0.48 per share consensus estimate unchanged since last November and reflecting 7% growth. Revenue expectations have also primarily remained static, anticipated to soar by 5% from the year-ago period.

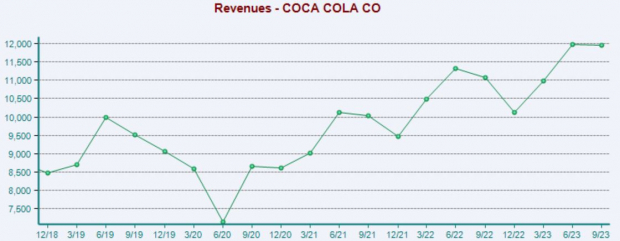

Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Coca-Cola’s earnings consistency should not be overlooked, as it has consistently surpassed both consensus EPS and revenue expectations. Its shares received a robust push post-earnings subsequent to its latest release, putting an end to a streak of consecutive adverse reactions in the past.

Image Source: Zacks Investment Research

Consumer spending habits will be hotly watched within KO’s report, with margins also remaining critical.

Airbnb

LNGLorem ipsum dolor sit amet, consectetuer adipiscing elit.

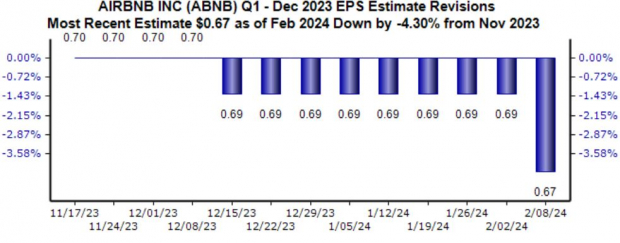

Airbnb’s premier platform provides a marketplace for connecting hosts and guests online or through mobile devices to book spaces and experiences. Analysts have tempered their expectations for the upcoming quarter, with the $0.67 per share consensus estimate down 4% since last November.

Earnings growth seems slated to remain robust, with the value implying a 40% surge year-over-year.

Image Source: Zacks Investment Research

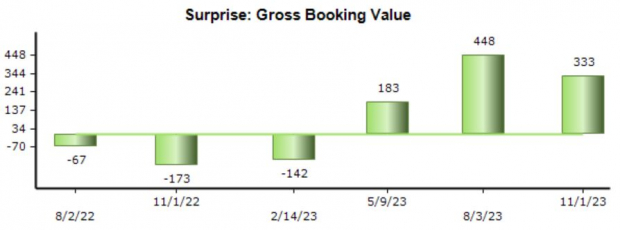

Concerning Airbnb, Gross Booking Value (GBV) and Nights and Experiences Booked stand as two pivotal metrics that investors focus on. With regards to GBV, the Zacks Consensus Estimate presently stands at $15.1 billion, signifying a 12% growth year-over-year.

As illustrated below, ABNB has consistently posted favorable GBV results lately, surpassing consensus expectations in three consecutive releases.

Image Source: Zacks Investment Research

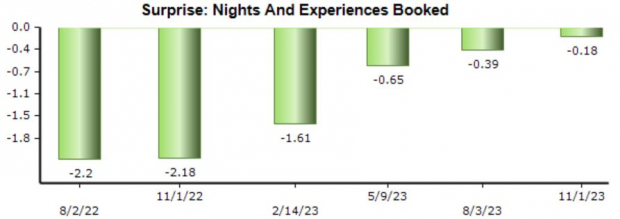

Additionally, we anticipate Nights and Experiences Booked to reach 98 million, an 11% enhancement year-over-year. ABNB has fallen short of expectations on this metric in the recent past.

Image Source: Zacks Investment Research

While the projected growth appears robust, it signifies a deceleration from previous quarters.

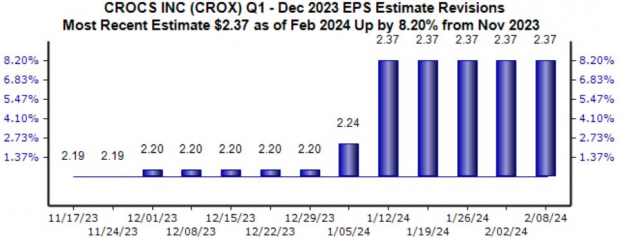

Crocs

Crocs serenades the market as one of the leading footwear brands, focusing indiscriminately on comfort and style. Analysts have been exceptionally bullish for the impending report, raising the $2.37 Zacks Consensus EPS estimate by 8% since last November. The figure implies a 10% downturn from the previous year.

Image Source: Zacks Investment Research

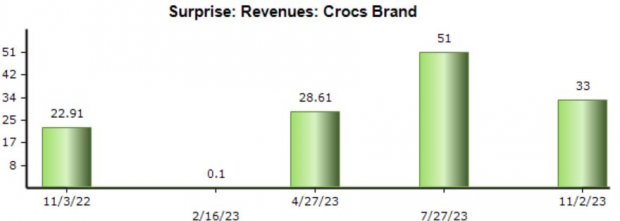

Investors will be eager to perceive the performance of the company’s brands, including HEYDUDE footwear. The Crocs brand has showcased substantial growth, with sales ascending by nearly 12% year-over-year throughout its latest period.

For the upcoming release, we anticipate the company to register $723 million in revenue from its Crocs brand, reflecting a growth of 9%. CROX has consistently surpassed this metric recently.

Image Source: Zacks Investment Research

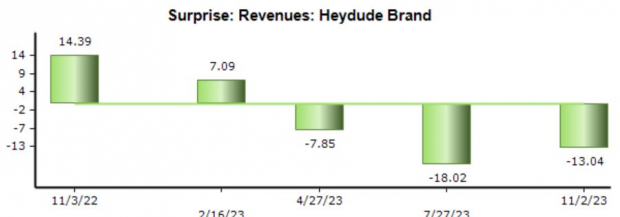

With regards to the HEYDUDE brand, the Zacks Consensus estimate of $226 million suggests a decline of nearly 19% from the year-ago period.

Image Source: Zacks Investment Research

Conclusion

Earnings season continues relentlessly, with a diverse array of companies divulging results daily. And in regards to the impending week’s schedule, the spotlight will glitter on The Coca-Cola Co. (KO), Crocs (CROX), and Airbnb (ABNB).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.