Income investors can’t get enough of Rithm Capital (NYSE: RITM). The company’s stock offers a generous 9.8% dividend yield, and there are compelling reasons to believe this level of payout will continue in the coming years. On the other hand, value investors are taking note of the stock, which currently trades at a discounted valuation and has a clear potential for unlocking hidden value in the near future.

Regardless of your investment strategy, there are three solid reasons why Rithm stock could outperform and deliver impressive results in 2024.

1. A $300 Million Bet on a Turnaround

Purchasing Rithm stock is essentially making a bet on the U.S. mortgage market. As a mortgage real estate investment trust (mREIT), the company’s revenue is closely tied to the mortgage market’s performance, whether it’s through loan origination, servicing, or cash flow ownership. As long as Americans are obtaining and repaying mortgages, Rithm’s core business will thrive.

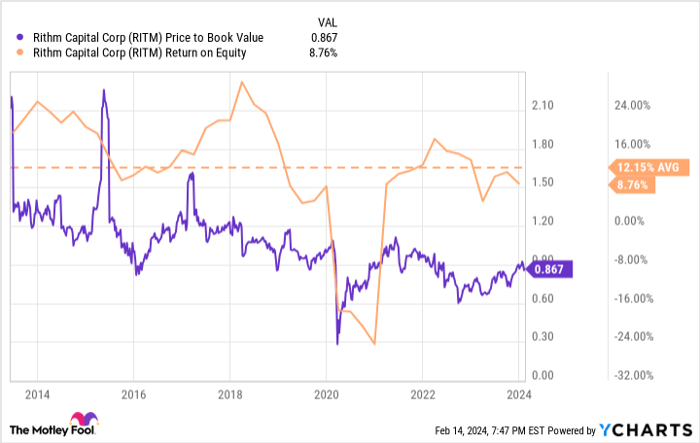

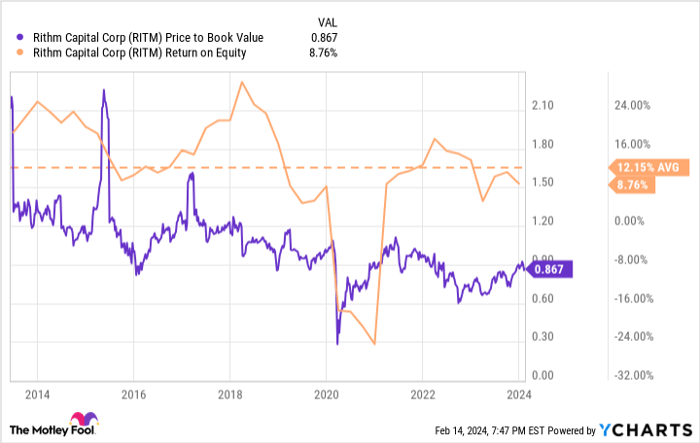

Over time, Rithm has consistently generated lasting shareholder wealth by concentrating on the U.S. mortgage market. Since 2013, its return on equity has averaged at 12.2%. Although the stock had a few setbacks in early 2020 due to the pandemic, resulting in a re-rating by the market, the return on equity has now moved back up toward historical levels, while the shares trade at a 13% discount to book value.

To leverage this opportunity, Rithm’s management has introduced a $300 million share repurchase plan, with $200 million allocated for buying back common stock. The rationale is clear: the management believes its assets are worth at least book value, and by repurchasing stock, it is achieving an immediate double-digit return on its investment.

RITM Price to Book Value data by YCharts

2. High Dividend Yield with Growth Potential

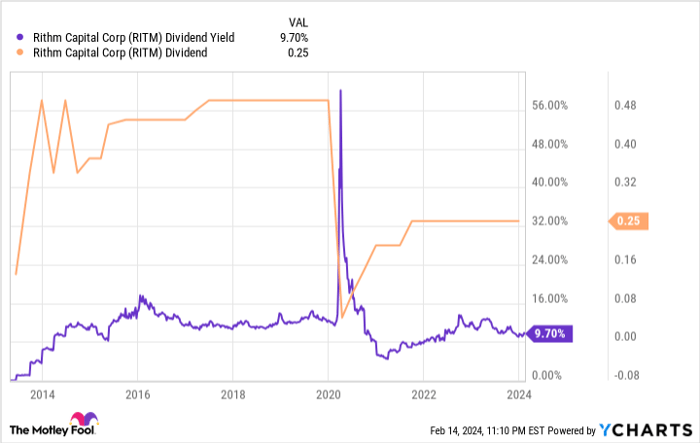

At first glance, Rithm Capital’s 9.8% dividend yield may seem unsustainable, seemingly destined to be cut in the near future. However, in reality, the dividend has remained high for years and has even been increased on several occasions.

The dividend was significantly reduced only at the start of the pandemic in early 2020, but it has steadily risen since, though still below its pre-pandemic highs.

If the economy slides into a recession, the dividend could be cut again, but this risk applies to many dividend stocks. The reality is that the payout is likely secure as long as significant economic headwinds don’t emerge. With around $1.9 billion in cash and liquidity, and the recent share repurchase program solidifying its ample cash flow for growth investments, dividends, and other value-generating initiatives, Rithm Capital appears to be in a good position.

RITM Dividend Yield data by YCharts

3. Potential for Double Returns

If Rithm Capital stock continues to trade at a discount to book value, patient shareholders can simply wait and collect an annual dividend of nearly 10%. However, if the valuation returns to historical levels, shareholders stand to profit in various ways besides collecting dividends. Just returning to book value would cause shares to appreciate by 15%, resulting in even higher total shareholder profits with the company investing hundreds of millions of dollars at the discounted valuation. If things go as planned, this stock could be a triple win for patient investors.

The most pressing challenge Rithm Capital might face in 2024 is an economic downturn that could disrupt the stability of the U.S. mortgage market. If mortgage originations decrease or current mortgage holders struggle to meet their loan obligations, Rithm Capital shares could decline, although the current discount to book value may cushion some of the downside risk.

The recent acquisition of Sculptor Capital, which manages $33 billion in assets, with a focus on U.S. credit markets, also poses a risk. A decrease in asset prices would directly impact Sculptor’s fee income, impacting Rithm’s overall revenues.

Rithm stock is not without risk, but with confidence in the economy’s stability in 2024, it offers multiple paths to significant gains.

Before investing $1,000 in Rithm Capital, ponder this:

The Motley Fool Stock Advisor analyst team has identified what they believe are the 10 best stocks for investors right now… and Rithm Capital wasn’t one of them. These 10 stocks have the potential to generate significant returns in the coming years.

Stock Advisor equips investors with a straightforward roadmap for success, offering guidance on portfolio construction, regular analyst updates, and two new stock picks each month. Since 2002, the Stock Advisor service has more than tripled the return of the S&P 500*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.