Why Chewy Stock is Worth a Second Look

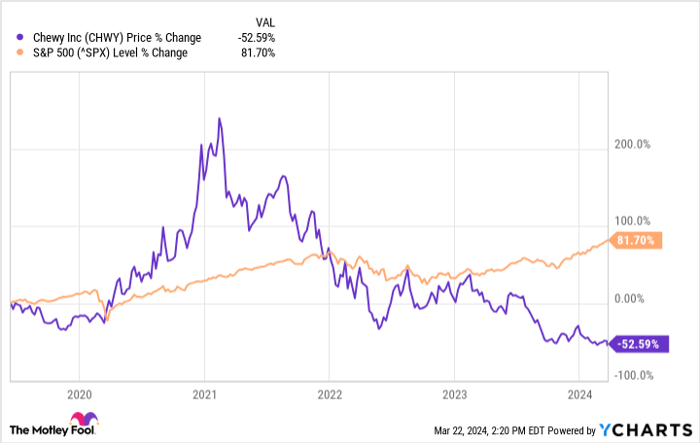

If you’re a prudent investor, you’re likely hunting for the silver lining in the midst of a gloomy outlook, and Chewy’s stock might just be your ray of hope. Despite its disappointing past performance in the market, here are three compelling reasons to ponder over investing in Chewy stock.

Firstly, the stock is trading at a bargain; a low price-to-sales ratio coupled with an attractive free cash flow valuation makes it an enticing prospect. Secondly, Chewy’s journey towards profitability is gaining momentum, with savvy moves like automation in its fulfillment centers and foray into advertising propelling its bottom line. Lastly, its eyeing of the veterinary services market showcases a promising avenue for growth beyond just retail products.

The second reason to buy Chewy stock is its growing profitability. The company has 16 fulfillment centers to support its $11 billion e-commerce business. But a few years ago, it started opening fulfillment centers with automation enhancements. Five fulfillment centers are now automated and are 30% more efficient than its other fulfillment centers, which helped unlock profitability for its retail business.

In summary, investors should consider buying Chewy stock hand over fist because it’s cheap, profitable, and has a long runway for growth. Nevertheless, one crucial issue might give you pause.

Why Caution May Be Warranted

While the allure of Chewy’s potential growth is evident, there’s a nagging concern that investors can’t ignore. Despite its robust efforts to enhance profitability and expand its offerings, Chewy has hit a snag in customer acquisition. The recent decline in active customers for the second consecutive year raises an eyebrow and hints at a potential stumbling block for its growth trajectory.

Chewy must reckon with the fact that its core business still hinges primarily on retail sales, making customer growth imperative for sustained success. The failure to attract and retain new customers poses a formidable challenge that investors need to monitor closely.

Despite this looming challenge, the intrinsic value of Chewy stock remains compelling for those seeking growth at a reasonable price, offering a dichotomy that warrants careful consideration before diving in.

Timing and rationale must harmonize before leaping into the stock market, and Chewy’s saga exemplifies this conundrum. Therefore, before taking the plunge into Chewy stock, weighing the pros and cons outlined here is paramount. As the market ebbs and flows, savvy investors navigate the seas of opportunity with a discerning eye, looking beyond the surface appeal to assess the underlying currents that might steer their investments to success.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chewy. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.