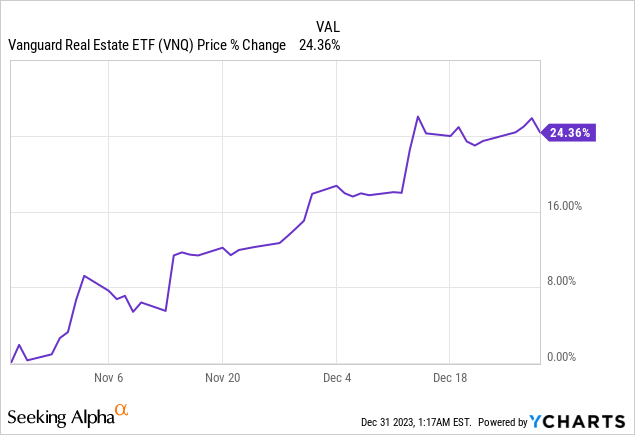

The roller-coaster ride of VNQ has certainly caught the attention of investors, but before we get too carried away, it might be an opportune moment to consider selling some of these REITs.

While I generally maintain an optimistic outlook on most REITs, some are simply not winners in the making.

The real estate investment trust domain is rich and diverse, but some are set to underwhelm investors over time. Let’s take a closer look at three REITs I believe are best offloaded in 2024:

Empire State Realty Trust (ESRT)

ESRT, known for being the proud owner of the iconic Empire State Building in New York City, has been a magnet for investors. The allure of this trophy asset has drawn many to buy shares of ESRT.

Consequently, its valuation multiple currently outstrips that of close peers such as SL Green (SLG) and Vornado Realty Trust (VNO).

| P/FFO | |

| ESRT | 11x |

| SLG | 8.8x |

| VNO | 10.5x |

But, in my view, it should be quite the opposite.

The Empire State Building is a remarkable asset, but ESRT’s portfolio extends beyond this iconic structure. It encompasses several older class B office buildings, on average older and less desirable than those of SLG and VNO, yet it commands a premium valuation.

While the Empire State Building’s observatory deck generates considerable revenue for ESRT, competition in this space is intensifying with the opening of new observatories at other buildings.

In summary, I believe ESRT should be priced at a discount relative to SLG, yet it is priced at a premium. Hence, I advocate selling ESRT. Its older properties will likely demand significant capital expenditures in the coming years, exerting downward pressure on its performance.

Orchid Island Capital (ORC)

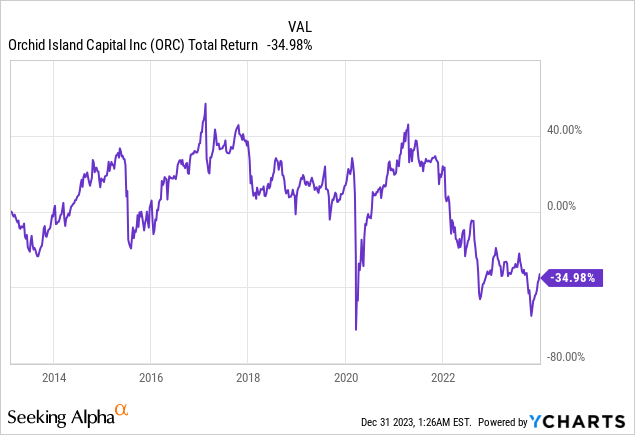

ORC, with its tantalizing 17% dividend yield, has captivated many individual investors.

However, I am not enticed by the prospect of holding it for the long haul.

I assert that its business model is impractical due to its heavy dependence on unpredictable macro factors such as interest rates and spreads, beyond its control. Furthermore, it is highly leveraged, and its management has one of the direst track records in the entire REIT sector:

Yes, you may enjoy a high yield, but is it worthwhile if it is coupled with substantial capital losses over time?

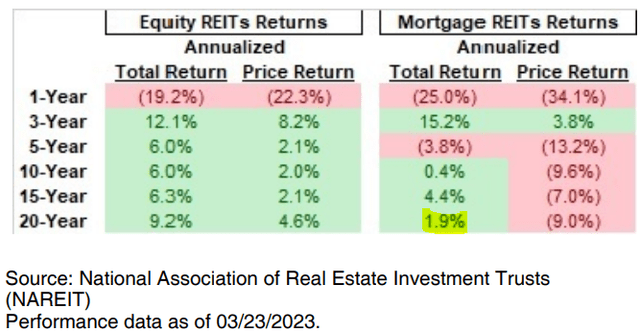

To be candid, it is not just ORC.

The entire mREIT sector has performed exceptionally poorly over an extended period due to their vulnerability to unpredictable macro factors. Over the past 20 years, they have garnered a meager 2% average yearly return:

Superior opportunities await in other segments of the REIT market.

A lofty yield does not necessarily translate to superior returns.

Welltower (WELL)

Welltower is undoubtedly a high-caliber REIT. Nonetheless, the predicament lies in the fact that this excellence is already factored into its valuation.

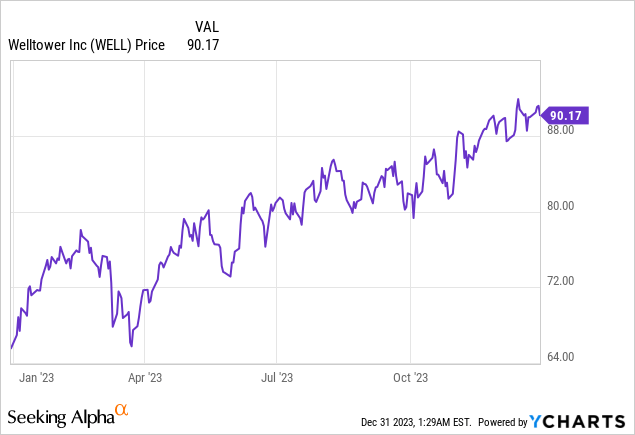

It stands as one of the few REITs currently hovering around its all-time highs:

It boasts numerous senior housing communities experiencing rapid growth prospects today.

However, this expected growth is already priced into the stock.

The stock is valued at 25x FFO, and its dividend yield is merely 2.7%, historically low for the company, especially odd given the current, higher interest rate environment.

On top of that, quite a few of its healthcare peers are priced at much lower valuations.

Here are a few examples:

- Healthcare Realty (HR), leader in medical office buildings, priced at just 11x FFO.

- National Health Investors (NHI), a pure-play senior housing REIT, priced at 13x FFO.

If I were to invest in this domain, I would much prefer owning a blend of these two REITs instead of Welltower.

Parting Thoughts

Not all REITs are cut from the same cloth.

In general, REITs continue to trade at a discount and are likely to perform well in 2024, as interest rates edge lower.

However, being discerning will be pivotal for minimizing risks and maximizing returns.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.