Three Stocks Positioned to Thrive Amid Tariff Concerns

The potential implementation of tariffs poses a significant threat to many businesses by increasing the cost of imported goods. If companies rely solely on these imports, consumers and businesses may delay purchases, hoping that tariffs will ease and prices will drop. Moreover, rising prices across the board could dampen consumer confidence, leading to a reduction in overall spending.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Investor anxiety has been palpable, contributing to noticeable sell-offs on the stock market over the past week. Nevertheless, three companies are well-positioned to navigate the challenges created by President Trump’s tariff policies, making them strong buy candidates following the recent declines.

Nvidia and Broadcom: Key Hardware Suppliers

While various companies may weather the storm, AI hardware suppliers are in the spotlight due to their sensitivity to tariffs. Companies like Nvidia (NASDAQ: NVDA), Taiwan Semiconductor Manufacturing (NYSE: TSM), and Broadcom (NASDAQ: AVGO) serve as essential suppliers for artificial intelligence hyperscale businesses. I believe these companies will remain stable in the face of tariff challenges.

The core reason for this outlook lies in the reliance of AI firms on hardware suppliers’ products. Nvidia specializes in graphics processing units (GPUs) that are critical for training and running AI models. Their GPUs, and the supporting infrastructure, maintain a top-tier position with minimal competition. Competitors also import necessary parts, making them vulnerable to the same risks as Nvidia. Given the crucial role of GPUs in advancing AI technology, Nvidia is likely to sustain its market position.

In a similar vein, Broadcom manufactures connectivity switches and custom AI accelerators, referred to as XPUs. This product line is expected to experience significant growth in the coming years. Currently, only three companies utilize Broadcom’s XPUs, but projections show this division might capture a $60 billion to $90 billion market opportunity by 2027 as additional customers start using these accelerators. With revenue at $54 billion over the past 12 months, this growth potential is substantial.

Even with some tariff concerns, the drive for AI advancement is considerably stronger. Investors should look beyond immediate challenges and recognize the long-term potential for Nvidia and Broadcom.

Taiwan Semiconductor: Easing Tariff Worries

Taiwan Semiconductor (TSMC) plays a critical role as a supplier for both Nvidia and Broadcom. As neither can manufacture chips independently, they rely on TSMC for high-end production. Although President Trump previously threatened tariffs against Taiwan, TSMC’s recent announcement of a $100 billion investment in U.S. semiconductor facilities seems to have assuaged those fears.

Officials from Taiwan and TSMC assert that this expansion was not a result of pressure from President Trump; nonetheless, it ultimately aligns with his goals by increasing domestic production. With one of the key suppliers now avoiding tariff repercussions, Nvidia and Broadcom are likely to benefit moving forward.

Although the threat of tariffs persists, the current sell-off presents an opportunity for investors to buy shares of these three companies at attractive prices.

Valuation Insights: Stocks at Yearly Lows

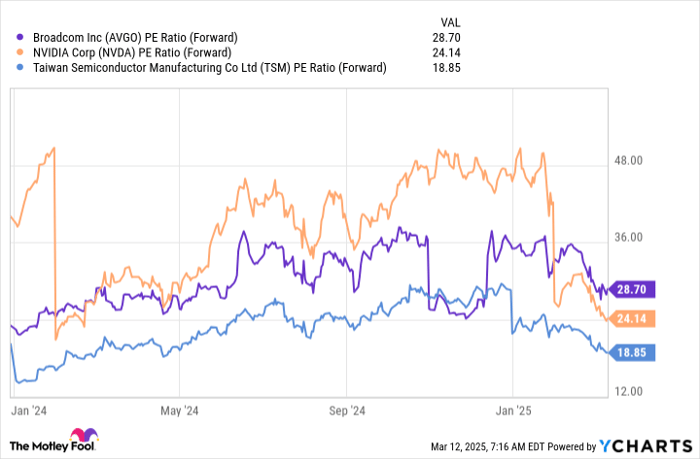

In light of the recent sell-off, the share prices of these three companies are among the lowest seen in over a year.

AVGO PE Ratio (forward) data by YCharts.

Firstly, Taiwan Semiconductor appears undervalued, trading at 18.8 times forward earnings. Despite its significance in the global market, this multiple is lower than the S&P 500’s 19.8 forward earnings ratio, indicating a pricing anomaly that presents a solid buying opportunity for investors.

Nvidia is similarly affordable, especially given the importance of its GPUs. The recent price decline from its 2024 levels presents a unique opportunity for investors to acquire shares at a discount.

While Broadcom is relatively more expensive, its potential in the expanding XPU market could justify its current valuation as a bargain.

These three firms represent promising investment opportunities, but a long-term perspective is essential. They are likely to yield positive results over the next three to five years. However, short-term volatility may persist, as pinpointing a market bottom during a sell-off is inherently challenging.

Seize This Second Chance for Investment

If you’ve ever felt you missed opportunities to invest in high-performing stocks, this might be your moment.

Occasionally, our team of analysts identifies a “Double Down” Stock recommendation for companies likely on the verge of significant value increases. If you think your window to invest has closed, now is indeed an opportune moment to consider purchasing before it’s too late. The results from past recommendations are compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $315,521!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $40,476!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,070!*

Currently, we are issuing “Double Down” alerts for three exceptional companies, and you may not encounter another opportunity like this for a while.

Continue »

*Stock Advisor returns as of March 14, 2025

Keithen Drury has positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.