Leading Stocks Shine Amid Market Turmoil: A Closer Look at Meta, Amazon, and Interactive Brokers

With trade tensions and tariff discussions dominating the news cycle, uncertainty has crept into the stock market, causing concern among investors. Yet in this environment, some companies, particularly leading stocks, are defying the odds and showing strong performance. In today’s vigorous market, it’s crucial for investors to take notice when top stocks flourish, even in the face of negative news.

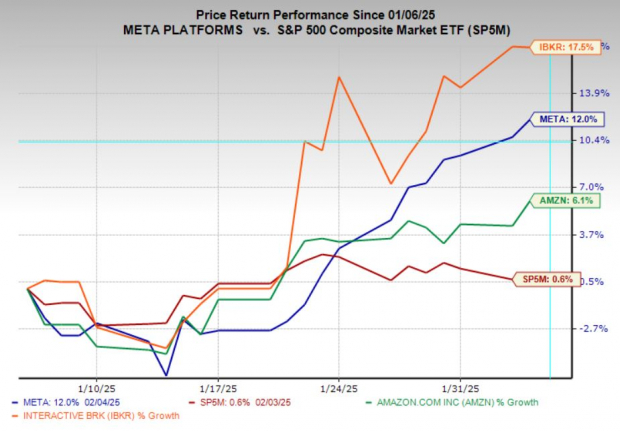

Meta Platforms (META), Amazon (AMZN), and Interactive Brokers (IBKR) have displayed remarkable strength in this volatile market. Each of these companies holds a significant position, with a consistent top Zacks Rank and promising growth forecasts, proving to be standout choices for investors navigating these unpredictable times.

Investors should not get too caught up in the short-term news cycles and market fluctuations. Historically, the performance of stocks over time is primarily driven by the underlying health of a business, rather than daily ups and downs. Focusing on stocks with solid earnings growth and reasonable valuations remains paramount for long-term investment success.

Image Source: Zacks Investment Research

Amazon Stock Reaches Record Heights

On Tuesday, Amazon marked an impressive milestone by hitting new all-time highs. This surge underscores the confidence investors have in its long-term growth, bolstered by its leading position in e-commerce, cloud computing (AWS), and the rapidly growing digital advertising sector.

Currently holding a Zacks Rank #2 (Buy), AMZN is projected to grow earnings by 28.2% annually over the next three to five years, positioning it among the highest growth companies in the Magnificent 7. With its ongoing momentum and leadership in multiple dynamic industries, Amazon stands out as a stock worthy of attention.

Image Source: TradingView

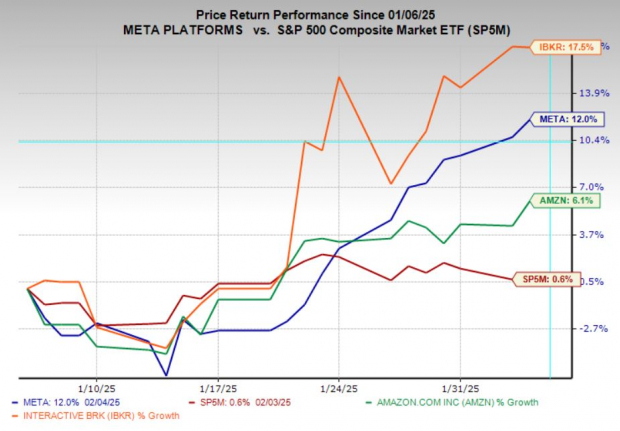

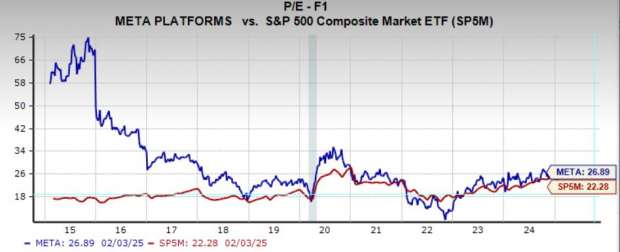

Meta Platforms: An Attractive Valuation

Since hitting rock bottom in 2022, Meta’s stock has soared over 500%, yet the company trades at a reasonable valuation of 26.9x forward earnings, considering its substantial growth potential.

Meta is projected to experience earnings growth of 18.3% annually over the next three to five years, driven by continual enhancements in its advertising platform thanks to AI advancements. This technology has improved ad targeting and engagement, leading to better monetization across the company’s platforms. With a Zacks Rank #2 (Buy) and potential for AI-driven growth, Meta remains a solid choice for investors.

Image Source: Zacks Investment Research

Interactive Brokers: A Leader in the Market

Interactive Brokers has had an impressive year, setting five new all-time highs so far. The company continues to draw both retail and institutional clients thanks to its cost-effective, high-tech trading platform coupled with superior execution.

IBKR holds a Zacks Rank #1 (Strong Buy) and is anticipated to enjoy earnings growth of 19.1% annually over the next three to five years. This growth is further supported by the current high-interest rate climate, which enhances the firm’s net interest income from client cash balances. With a strong trajectory and solid fundamentals, Interactive Brokers remains a top pick in the financial sector.

Image Source: TradingView

Is It Time to Invest in IBKR, AMZN, and META?

Even with ongoing tariff debates and general market trepidation, leading stocks have continued to excel. Amazon, Meta Platforms, and Interactive Brokers showcase strong market performance, solid Zacks Ranks, and robust growth forecasts. Their capacity to thrive amidst market volatility indicates solid leadership, making them attractive options for investors seeking profitable opportunities in this economic climate.

Research Chief Names “Single Best Pick to Double”

From thousands of stocks, five Zacks experts each identified their top pick poised for a potential +100% surge in the coming months. Among these, Director of Research Sheraz Mian selects one with the most explosive upside.

This company, focusing on millennial and Gen Z markets, reported nearly $1 billion in revenue last quarter. A recent decline in stock price presents a prime opportunity for investment. Not every pick triumphs, but this one could exceed previous Zacks’ high-fliers like Nano-X Imaging, which rose by +129.6% in just over nine months.

Want to access the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.