Semiconductor stocks have been at the forefront of investor interest, particularly as industry leader Nvidia has surpassed the market cap of tech giant Amazon. However, amid the soaring valuations of some artificial intelligence (AI)-fueled chip stocks, others have experienced a pullback at the start of 2024. This raises the question for investors – should they follow the momentum or buy the dip?

One way to sift through the myriad of semiconductor stocks is by looking at insider buying activity. The adage that company insiders typically purchase shares when they expect prices to rise holds true for identifying potential bullish indicators.

Semiconductor Stock #1: Super Micro Computer

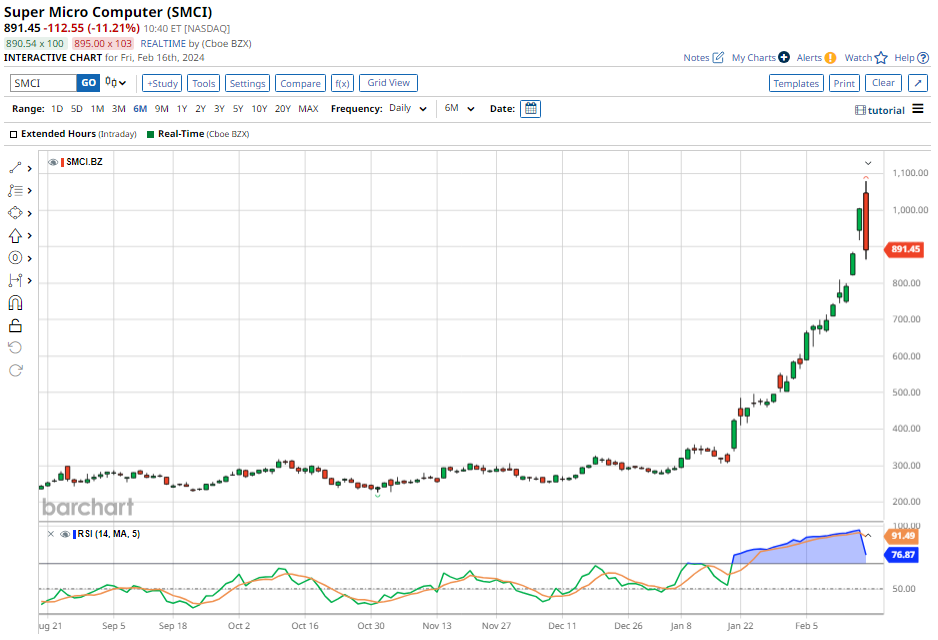

Super Micro Computer Inc. (SMCI) has been making strides in the high-performance server market, with a focus on cloud computing and big data. The company has witnessed an impressive 737% surge over the past 52 weeks, outperforming the broader market by a significant margin.

Notably, board member Fred Chan, who has been a company director since 2020, made a notable purchase of 2,000 shares of SMCI on Feb. 1 when the shares were trading at $568. The transaction amounted to $1.136 million, and the shares have already gained 41.4% in just about two weeks. In financial terms, SMCI has been robust, surpassing revenue and adjusted EPS expectations in its recent Q2 2024 earnings report. The company also raised its full-year revenue guidance.

Although SMCI is trading at relatively high valuation multiples, the PEG ratio suggests that the stock is still reasonably priced based on growth expectations. Analyst sentiment is predominantly positive, with a “Strong Buy” consensus rating and a notably bullish price target from Bank of America.

Semiconductor Stock #2: Wolfspeed

Wolfspeed Inc. (WOLF) is a leader in silicon carbide chip technology catering to the electric vehicle (EV), renewable energy, and aerospace and defense sectors. Despite a 38% year-to-date decline in its stock price, the company’s insiders stepped in to purchase shares following weak guidance for the third quarter, causing a sell-off in the stock.

WOLF shares have seen insider buying activity, with three board members acquiring shares, signaling confidence in the company’s long-term prospects. The stock is trading at a significant discount to its five-year average valuation premium. Analysts, while cautiously optimistic, hold a “Moderate Buy” consensus on WOLF, with a price target reflecting an expected upside of about 59.4% from current levels.

Semiconductor Stock #3: Intel

Intel Corporation (INTC) is a long-standing tech giant synonymous with semiconductors and has historically dominated the personal computing market. However, the company is facing increasing competition, particularly in AI innovations, leading to a lag in its stock performance compared to its peers.

These semiconductor stocks present contrasting scenarios, providing investors with a range of opportunities to consider. While the surge in SMCI’s stock and positive analyst sentiment are compelling, WOLF’s insider activity amid its stock decline and Intel’s challenges offer investors options to weigh.

The Intel and AMD Semiconductor Saga

Intel (INTC) and Advanced Micro Devices (AMD) have been locked in a market grudge match, with INTC trailing AMD by a whopping $100 billion by market cap. But what is Intel’s next move?

The Decline of INTC Stock

INTC stock has dropped approximately 13% since the beginning of 2024, a significant downturn catalyzed by the late January financial report. Despite Intel exceeding both EPS and revenue expectations in its Q4 results, investor confidence waned due to the company’s underwhelming guidance.

Specifically, Intel forecasted revenue for the first quarter to be in the range of $12.2 billion to $13.2 billion. However, Wall Street analysts had set their sights higher, with an average Q1 revenue expectation of $14.16 billion. The CEO, Patrick Gelsinger, attributed this discrepancy to several temporary headwinds impacting overall revenue, assuring investors that sequential and year-on-year growth in revenue and EPS is expected for each quarter of fiscal year ’24.

On Jan. 29, Gelsinger showed confidence in the company by purchasing 3,000 shares of Intel at $43.361 each, marking his first stock acquisition since the previous November. Days after AMD issued cautious guidance, Gelsinger made another purchase of 2,800 Intel shares at around $42.74 each. This move signified his belief in the company’s resilience, and INTC stock has seen a 1.8% increase since then. Analysts have remained nonchalant about INTC stock, with a consensus “Hold” rating from 33 analysts and a modest mean price target of $44.11, just 1.4% above the recent closing price.

Insider Stock Purchases in the Semiconductor Industry

Insider purchasing can have a significant impact on investor sentiment. Whether it signals executives’ confidence in the company’s strategic trajectory or serves to reassure nervous stakeholders, it is essential to evaluate such activities within the context of recent corporate developments, share price performance, industry outlook, and the company’s own guidance.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.