In the fast-paced arena of semiconductors, akin to the agile race cars zipping around the track, the fortunes of companies can swiftly shift gears – from the high octane acceleration of growth to the agonizing skid of decline. While the semiconductor and microchip industry as a whole is riding a wave of prosperity, not all companies are poised to ride the crest. As investors navigate this landscape, three prominent semiconductor players are flashing warning signals on the dashboard, indicating a need for cautious evaluation and potentially, strategic divestment.

Challenges Beneath the Surface

Semiconductors, often dubbed the “oil of the 21st century,” have emerged as a critical commodity shaping the digital economy and technological landscape. With the U.S. government’s ambitious plans to bolster domestic semiconductor manufacturing, the sector presents a blend of promise and challenges. While the U.S. has made significant strides in technological innovation and artificial intelligence development, the manufacturing prowess in semiconductors still tilts heavily towards offshore territories like Taiwan and South Korea.

The domestic manufacturing push, spearheaded by initiatives such as the CHIPS Act and backed by substantial investments in the private sector, sets the stage for a transformative shift in the industry. However, amid this overarching narrative of progress, individual semiconductor stocks reveal fault lines that warrant keen scrutiny.

Texas Instruments: A Stumbling Block

Source: Katherine Welles / Shutterstock.com

Texas Instruments, symbolized by the ticker TXN, stands out as a laggard in the semiconductor cohort. Struggling to gain traction in a surging market, the company witnessed a stagnant performance over the past year, failing to capitalize on the bullish sentiment sweeping the sector. With lackluster sales figures and underwhelming guidance, Texas Instruments has left investors disillusioned, leading to a downgrade in analyst sentiment.

The latest setback came in the form of a 4% drop post an unimpressive forward guidance announcement that missed market expectations. Despite marginally surpassing Wall Street estimates in earnings per share, Texas Instruments fell short in revenue projections for Q1 of 2024. With management signaling weak demand and an anticipation of dwindling microchip inventories, the road ahead appears rocky for TXN stock, warranting a cautious stance from investors.

Intel: Navigating Turbulent Waters

Source: JHVEPhoto / Shutterstock.com

Intel, a venerable name in the semiconductor realm, finds itself at a crossroads as it grapples with substantial challenges in its foundry business. Bearing the brunt of a massive $7 billion operating loss in 2023 within this segment, Intel’s endeavor to transition from chip design to manufacturing seems to have hit a stumbling block. The escalating losses underscore the uphill battle Intel faces in aligning its operations with market demands.

While Intel remains optimistic about a turnaround, forecasting a break-even point in the foundry business by 2030, recent developments paint a stark picture. The decision to halt construction on a significant facility in Ohio further complicates the narrative, signaling a cautious approach to prevailing market conditions. As INTC stock reels from a 17% slump this year and a substantial decline over the past five years, investors are urged to approach with vigilance.

Qualcomm: Navigating Stormy Seas

Reassessing the Journey of Qualcomm: In Pursuit of Prosperity

Qualcomm in the Current Financial Landscape

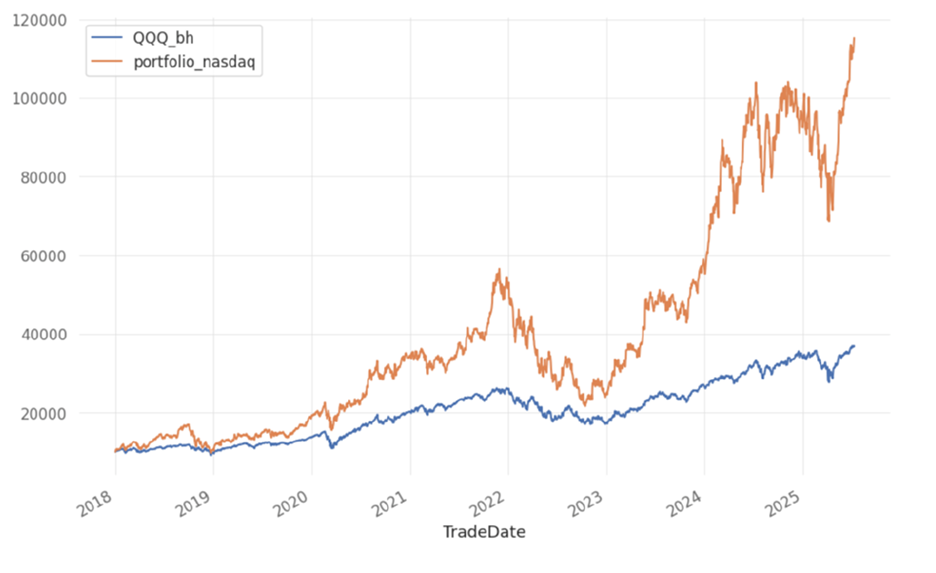

Wireless semiconductor firm Qualcomm’s (NASDAQ:QCOM) stock has not been abysmal by any means. Despite facing various challenges, the stock has managed to climb 38% over the past year, more or less keeping pace with the Nasdaq index composite. Nevertheless, when juxtaposed with its semiconductor counterparts, Qualcomm lags behind, lacking the standout performance investors ardently seek. Furthermore, Qualcomm is not presently viewed as a primary beneficiary of artificial intelligence (AI). In light of these circumstances, navigating around QCOM stock might be the prudent course of action.

Qualcomm’s Endeavors and Setbacks

Qualcomm specializes in microchips and semiconductors that facilitate smartphone connectivity to cellular networks. Although the company has made attempts to extend its reach beyond smartphones into sectors like personal computers, automotive technology, and virtual reality gear, these ventures have not yielded significant results thus far. Earlier this year, Qualcomm projected that sales of its smartphone microchips would remain stagnant in 2024 owing to the global slowdown in smartphone sales. This announcement left analysts underwhelmed, resulting in a mixed outlook for QCOM stock.

About the Author

In this insightful analysis, Joel Baglole, a seasoned business journalist with two decades of experience, sheds light on Qualcomm’s financial trajectory. Baglole’s impressive career includes stints at The Wall Street Journal, The Washington Post, and the Toronto Star, in addition to contributions to notable financial platforms like The Motley Fool and Investopedia.