The academic landscape is transforming with the surge of e-books and online learning, presenting new opportunities for growth in the U.S. education industry. However, challenges such as higher advertising expenses and the emergence of generative artificial intelligence systems demand thoughtful strategies to ensure prosperity. Leading companies like Stride, Inc., Strategic Education, Inc. (SEI), and American Public Education, Inc. (APEI) are anticipated to thrive through prudent management and strategic initiatives in the burgeoning Schools industry.

Industry Description

The for-profit education sector caters to diverse academic needs, offering a wide array of undergraduate, graduate, and specialized programs in finance, accounting, healthcare, technology, and more. These companies provide career-oriented courses, childcare services, and even specialize in offerings like yoga classes and related retail merchandise as well as fitness classes.

3 Trends Shaping the Future of the Schools Industry

Rising Demand for Online Education & Healthcare Professionals: the ascendancy of online education and the shortage of healthcare professionals mark crucial trends driving the industry’s growth. Companies are leveraging online platforms to meet the surging demand for virtual education, while also addressing the acute shortage of skilled healthcare professionals.

Cost-Saving Efforts, Increasing Use of Technology & Introduction of More Programs: Resilient company strategies involve cost-cutting measures, leveraging technology, and diversifying program offerings to enhance student outcomes and address the needs of working adults.

Higher Rates & Generative AI systems: As the Federal Reserve adopts a hawkish stance, companies are bracing for increased costs of debt offerings. Meanwhile, the rise of generative AI systems presents a notable threat to industry growth. The proliferation of AI technology may disrupt traditional business models and student employment post-graduation.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Schools industry holds a strong position within the broader Consumer Discretionary sector, ranking in the top 10% of Zacks industries. Notably, the industry’s earnings growth potential is gaining confidence, with analyst estimates for 2024 showing a 4.8% increase since October 2023.

Industry Outperforms Sector & S&P 500

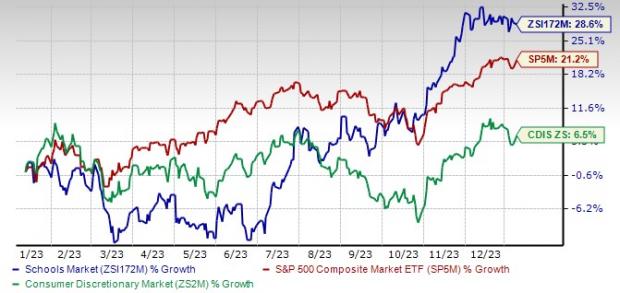

Over the past year, the Zacks Schools industry has significantly outperformed the broader Consumer Discretionary sector and the S&P 500 composite. With a collective gain of 28.6%, compared to the sector’s 6.5% rise, the industry demonstrates robust potential for investment.

One-Year Price Performance

Industry’s Current Valuation

When evaluating the industry’s forward 12-month price-to-earnings ratio, it presents a compelling multiple for gauging the valuation of for-profit education companies.