Strong Momentum Fuels Tesla, Palantir, and SoFi’s Market Surge

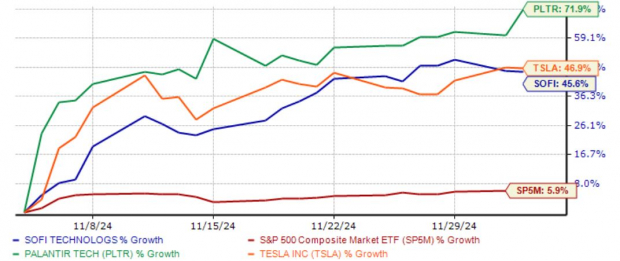

Momentum investors focus on stocks that are gaining traction, and lately, three stocks have stood out: Tesla TSLA, Palantir PLTR, and SoFi Technologies SOFI. Each has shown impressive performance, outpacing the broader market.

Here’s a visual snapshot of their performance over the past month, compared to the S&P 500.

Image Source: Zacks Investment Research

Let’s dive deeper into each company’s recent performance.

Tesla Delivers Impressive Earnings

Tesla has recently reported strong quarterly results that have boosted investor confidence. The company’s performance is particularly strong amid growing demand for electric vehicles (EVs). Its current Zacks Rank of #1 (Strong Buy) suggests further potential for growth.

Following the latest quarterly release, analysts notably revised their earnings expectations upward. The significant highlights include an increase in gross margin, which rose to 19.8% from 17.9% in the same quarter last year. Additionally, Tesla recorded its lowest-ever cost of goods sold (COGS) per vehicle during this period.

This profitability boost aligns with the company’s rising stock price following the recent U.S. election outcomes.

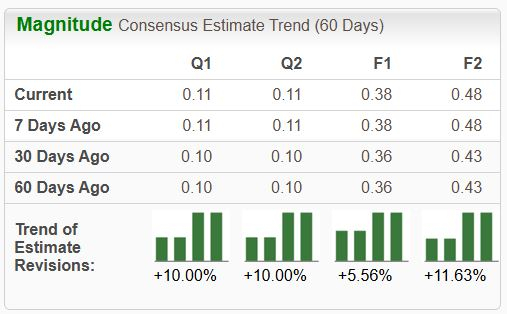

Palantir Thrives Amid AI Demand

Palantir’s strong performance can largely be attributed to the surging interest in artificial intelligence. The company’s recent quarterly results have captured investor interest, leading to positive adjustments in its earnings outlook.

During the latest reporting period, Palantir generated $726 million in sales, marking a remarkable 30% increase year-over-year and a 7% rise from the previous quarter. The company has consistently shown sequential sales growth over the years, benefiting significantly from the growing demand for AI solutions.

Image Source: Zacks Investment Research

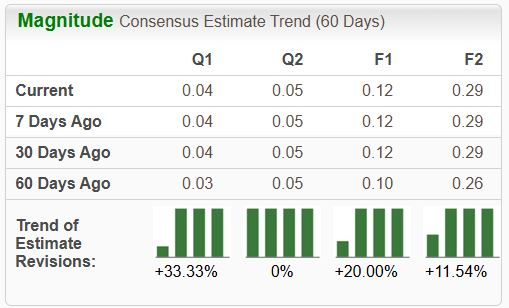

SoFi Increases Financial Projections

SoFi’s stock has also surged following its strong quarterly results, enhanced by the Federal Reserve’s current easing policies. Analysts expect substantial growth for the fiscal year, projecting a 130% increase in earnings per share (EPS) alongside a 21% rise in sales.

The company continues to attract more users, experiencing a 35% year-over-year growth in membership from the prior year. Furthermore, net interest income increased by 25%, and personal loan originations hit a record $4.9 billion in Q3, prompting SoFi to uplift its FY24 outlook.

Image Source: Zacks Investment Research

The Bottom Line

Momentum investing aims to capitalize on trends where buyers take the lead, and it’s clear that enthusiasm for Tesla TSLA, Palantir PLTR, and SoFi Technologies SOFI has driven their recent stock price upswings.

Get Exclusive Insights for Just $1

Yes, you read that right.

A few years ago, we surprised our members by offering a 30-day access to all our investment picks for only $1, with no obligation to continue afterwards.

While thousands have seized this opportunity, others hesitated, unsure if there was a catch. Our goal is simple: to let you experience our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which collectively closed 228 positions with double- and triple-digit gains in 2023.

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report

SoFi Technologies, Inc. (SOFI) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.