Money in the stock market has been hotter than a July day in Phoenix. Both the S&P 500 and Dow Jones Industrial Average have skyrocketed to new all-time highs, and the Nasdaq Composite has surged almost 34% over the past year. Suffice it to say it’s a target-rich environment for stock pickers. Here, we’ll scope out three potential winners for investors seeking to fatten their wallets in 2024.

Image source: Getty Images.

Ferrari: The Need for Speed

At the top of the list is Ferrari (NYSE: RACE). This Italian company, renowned for its high-performance, luxury sports cars, has observed a steady climb in its stock over recent years. Shares have surged by a mind-boggling 217% since 2019.

Similar to fellow European luxury brand LVMH, Ferrari is raking in the riches from opulence. Sporting price tags ranging between $300,000 and $600,000, with some models fetching up to $3 million, these are not your average vehicles. Ferrari targets a select group of affluent consumers willing to fork over top dollar for statement-making sports cars.

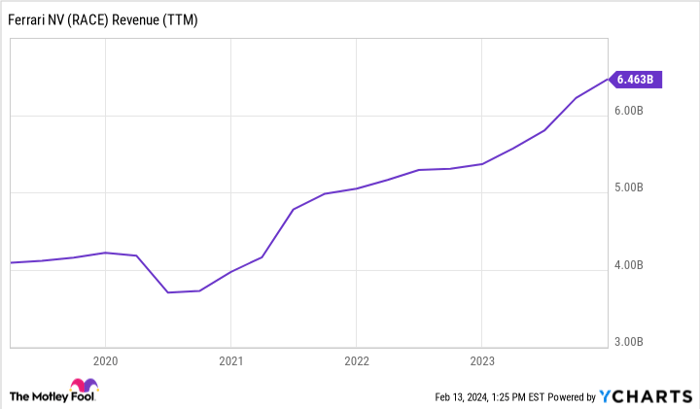

This business model has delivered extraordinary results. Revenue over the past 12 months has surged from $3.7 billion in 2019 to nearly $6.5 billion at the latest tally. What’s more, the operating margin — a pivotal measure of profitability — has vaulted from 24% to 26.8% over the past five years.

RACE Revenue (TTM) data by YCharts

With revenue scaling up by 17% in its most recent earnings report (ending Dec. 31, 2023), Ferrari is undoubtedly a name worth banking on for investors eyeing growth.

e.l.f. Beauty: Beauty & the Bucks

Next in line is e.l.f. Beauty (NYSE: ELF). e.l.f., short for “eyes, lips, and face,” is a cosmetics company that has been on a tear. Established in 2004, the company made its debut via an initial public offering (IPO) on the New York Stock Exchange in 2016.

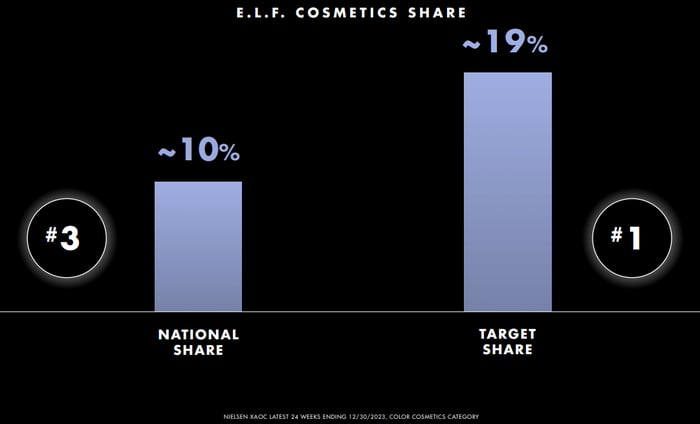

The company manufactures and retails value-priced makeup and skincare products online and at various outlets. Foremost among these outlets is Target, where it currently reigns as the top-selling color cosmetic brand, according to data from Nielsen.

Source: e.l.f. earnings presentation.

e.l.f.’s stock has surged as the brand’s popularity continues to soar. Shares have shot up an astonishing 1,730% since 2019, reflecting an incredible 78% compound annual growth rate (CAGR) over that period.

What’s more, analysts are bullish about the brand’s future as it expands its product offerings and gains more consumer recognition. Wall Street projects a whopping 71% surge in the company’s sales in 2024, amounting to nearly $1 billion. Anticipations for 2025 are even loftier, with sales estimated to reach $1.25 billion, marking a 25% year-on-year increase.

With a market cap of under $10 billion, the company could be an acquisition target for larger cosmetics or consumer-oriented firms. In any case, growth-oriented investors would do well to keep a close watch on e.l.f.

Palantir Technologies: The Data Dynamo

Last but not least is Palantir Technologies (NYSE: PLTR). Palantir is a behemoth in big data analytics, harnessing artificial intelligence (AI) to dissect colossal data sets, discern patterns, and furnish actionable insights.

In the current era, this is more critical than ever, with organizations of all sizes inundated in a data deluge. Palantir extends its services to both governmental and commercial entities, aiding them in enhancing productivity, precision, and efficacy.

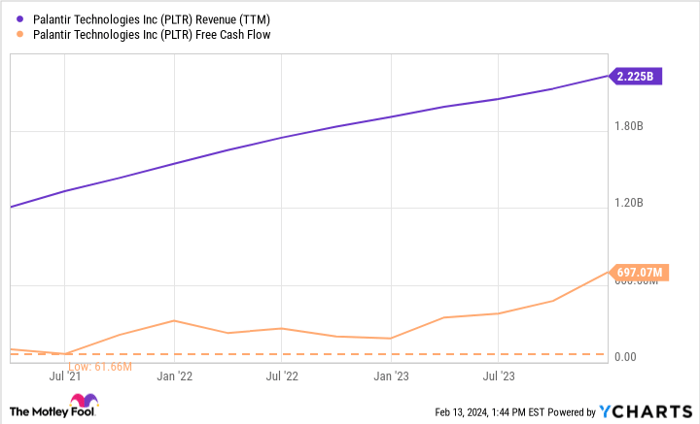

Financially, Palantir is clearly firing on all cylinders. Revenue over the trailing 12 months has surged from $1.2 billion in 2021 to $2.2 billion at present. Likewise, free cash flow — often viewed as the ultimate gauge of a company’s capacity to deliver shareholder returns — has swelled more than tenfold, ascending from $62 million in 2021 to $697 million today.

PLTR Revenue (TTM) data by YCharts

Thanks to its remarkable revenue and free cash flow expansion, coupled with a growing customer base, Palantir is undeniably a stock worth considering for investors with a penchant for long-term growth.

Is it worth putting $1,000 into Palantir Technologies right now?

Before diving into Palantir Technologies’ stock, consider this:

The Motley Fool Stock Advisor analyst team has just pinpointed what they deem are the 10 best stocks for investors to snap up at the moment… and Palantir Technologies didn’t make the cut. The 10 stocks that made the grade could yield mammoth returns in the years ahead.

Stock Advisor equips investors with a user-friendly guide to success, furnishing direction on building a portfolio, regular updates from analysts, and two fresh stock picks each month. Since 2002, the Stock Advisor service has outstripped the returns of the S&P 500 by more than threefold*.

Explore the 10 stocks

*Stock Advisor returns as of February 12, 2024

Jake Lerch holds positions in e.l.f. Beauty. The Motley Fool has positions in and recommends Palantir Technologies, Target, and e.l.f. Beauty. The Motley Fool has a disclosure policy.

The opinions and information expressed in this article are those of the author and do not necessarily reflect the official policy or position of Nasdaq, Inc.