Subscription Economy Grows as Corporations Adapt

As the allure of recurring revenue captivates many corporations, the subscription economy emerges as a beacon of sustainability and growth. Enabled by software and scalability, companies are seizing the opportunity to lock in customer loyalty through subscription services. However, in a marketplace flooded with options, the challenge lies in standing out to retain existing customers and attract new ones.

The strategic dilemma of balancing subscription pricing to ensure profitability without hindering scalability is a tightrope these corporations must tread. Setting prices too low for extended periods may erode profits, while sudden hikes could risk alienating the subscriber base. Thus, navigating this nuanced terrain is crucial for sustained success.

Unrivaled Dominance: Amazon (AMZN)

Since its groundbreaking launch of Amazon Prime in 2005, Amazon (NASDAQ:AMZN) has redefined the landscape of shipping and handling with its multitude of subscription offerings. Prime members revel in the perks of free expedited shipping, including same-day delivery for eligible orders, setting a gold standard in customer service.

Besides its shipping services, Amazon’s Prime membership unlocks access to a treasure trove of streaming content, enriching the subscription experience. Parallelly, Amazon Web Services beckons with its cloud computing offerings, delivering robust revenue growth year-over-year. With a legacy of unrivaled market penetration, Amazon remains a linchpin in the subscription economy.

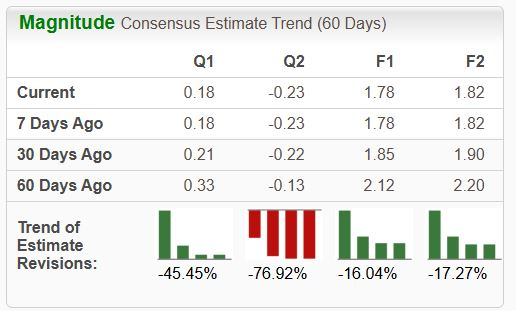

Cybersecurity Heights: Crowdstrike (CRWD)

As cyber threats loom large, Crowdstrike (NASDAQ:CRWD) emerges as a stalwart in fortifying corporations against malicious attacks. Reporting impressive revenue growth and soaring net income, Crowdstrike’s subscription revenue underpins its financial ascension. Notching up a formidable $3.44 billion in annual recurring revenue signals a trajectory poised for further ascent.

The spiraling profit margins underscore Crowdstrike’s financial vigor, paving the way for a more reasonable valuation down the line. While competitors grapple with sluggish growth, Crowdstrike’s upward march positions it as a standout player in the cybersecurity domain.

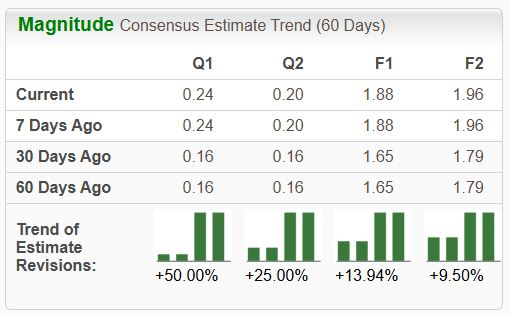

Pioneering Innovation: ServiceNow (NOW)

Empowering over 8,100 enterprises with its subscription-based software, ServiceNow (NYSE:NOW) orchestrates enhanced productivity through streamlined workflows. Boasting an impressive 99% renewal rate, ServiceNow’s suite of tools amplifies organizational efficiency, setting the stage for future price adjustments without compromising customer loyalty.

The steady influx of high-value customers underscores ServiceNow’s allure, exemplified by a robust 33% year-over-year growth in customers with million-dollar contract values. Amidst a landscape of evolving enterprise needs, ServiceNow’s consistent revenue growth and expanding net income augur well for sustained investor satisfaction.

Authored by Marc Guberti – a finance freelance writer at InvestorPlace.com and host of the Breakthrough Success Podcast – this insightful analysis underpins the essence of thriving in the evolving subscription economy.

For investors eyeing the subscription economy’s expansion, these stalwart companies exemplify robust resilience and growth potential amidst a teeming marketplace of subscription offerings.

As the subscription economy continues to burgeon, shareholders stand to benefit from the steady ascent of these industry leaders, poised for further ascension in the realm of recurring revenue models.

More From InvestorPlace

The post 3 Stocks to Buy as the Subscription Economy Continues to Grow appeared first on InvestorPlace.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.