Embracing Growth in the Concrete & Aggregates Sector

Despite looming uncertainties, the Zacks Building Products – Concrete & Aggregates industry is basking in a resurgence fueled by rising infrastructure spending, advantageous pricing dynamics, and an upswing in residential construction activities. Leading market players like Vulcan Materials Company, Eagle Materials Inc., and Summit Materials, Inc. are capitalizing on these favorable trends to chart a course for future success.

3 Key Trends Shaping the Industry’s Future

Focus on Reviving Infrastructure: Legislative acts like the Infrastructure Investment and Jobs Act signal a commitment to revitalize American infrastructure, driving significant investments across various sectors. This injection of funds is expected to provide a sturdy foundation for construction companies to thrive.

Acquisitions & Focus on Operating Efficiency: Strategic acquisitions and efforts to enhance operational efficiency are aiding companies in expanding their portfolios and boosting margins amidst a robust pricing environment.

Challenges of Input Prices, Weather, & Labor Scarcity: Escalating material costs, shortage of skilled labor, and weather-related disruptions pose obstacles for industry players. From fluctuating input prices to weather-related risks, businesses must navigate through a landscape fraught with challenges to maintain profitability.

Positive Industry Outlook and Performance

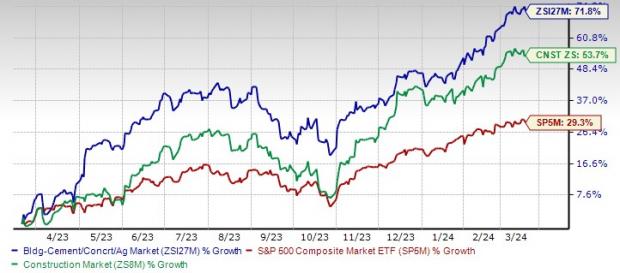

The Zacks Building Products – Concrete & Aggregates industry holds promise, with a Zacks Industry Rank #46, positioning it among the top 18% of Zacks industries. This ranking, along with a positive earnings outlook and solid stock market performance, underscores the industry’s growth potential.

Analysis of Industry Performance and Valuation

Over the past year, the industry has outperformed both the S&P 500 and the broader Construction sector, with a collective stock gain of 71.8%. Trading at 20.8X forward 12-month price to earnings, the industry’s valuation is favorable compared to the S&P 500’s 20.9X and the sector’s 17.8X.

Promising Concrete & Aggregates Stocks for Consideration

Within the Zacks Concrete & Aggregates universe, three stocks stand out with strong growth potential. Summit Materials, based in Denver, CO, is one such company that has been witnessing significant pricing growth and anticipates continued success in 2024. With an optimistic outlook fueled by robust state budgets and infrastructure funding, Summit Materials is positioned for sustained growth in the construction materials market.

The Concrete Aggregates Industry Potential Growth Opportunities

Summit Materials, Inc.: A company that currently sits atop the financial hill with a Zacks Rank #1. Summit Materials has seen its shares skyrocket by 52.2% over the past year. With earnings estimates for 2024 climbing from $2.09 to $2.42 per share in just 30 days, analysts’ zeal for the company’s future is unmistakable. Forecasts pointing to a 53.2% uptick in earnings for 2024 further showcase the overwhelming optimism. Additionally, boasting a commendable VGM Score of B, Summit Materials presents itself as a potentially thrilling investment prospect.

Price and Consensus: SUM

Eagle Materials: Hailing from Dallas, TX, Eagle Materials is climbing the ladder of success in the concrete aggregates industry. Focusing on heavy construction materials, light building materials, and materials vital for oil and gas extraction, the company’s growth trajectory is underpinned by surging demand for wallboard and cement. The robust homebuyer market, coupled with increased infrastructure awards and substantial investments in domestic manufacturing facilities, are propelling Eagle Materials forward. Despite challenges posed by rising rates, elevated pricing serves to strengthen the company’s position. Its advantageous geographic footprint, coupled with population growth trends and increased state-level infrastructure spending, positions Eagle Materials for sustained success.

Currently holding a Zacks Rank #2, Eagle Materials has seen its shares catapult by a staggering 84.4% in the past year. Earnings projections for fiscal 2024 have soared from $14.08 to $14.26 per share in the last 60 days, with an estimated 13.8% earnings growth rate for the same period. A respectable VGM Score of B further cements its allure as an investment opportunity.

Price and Consensus: EXP

Vulcan Materials Company: Deeply rooted in Birmingham, AL, Vulcan Materials is a major player in producing and distributing construction aggregates, asphalt mix, and ready-mix concrete. The company’s strategic focus on Commercial Excellence, Operational Excellence, Strategic Sourcing, and Logistics Innovation signals a commitment to enhancing pricing performance and operational efficiencies. By exercising prudent cost control measures and implementing augmented pricing strategies in aggregates, Vulcan Materials has been able to bolster earnings. A deliberate inorganic expansion strategy adds a further layer of strength to the company’s growth prospects. The company stands to benefit from an upsurge in residential and private non-residential construction, substantial demand for large industrial projects, significant infrastructure investments, and favorable pricing dynamics across the industry.

With a Zacks Rank #2, Vulcan Materials has witnessed its shares surge by an impressive 63.4% in the last year. Earnings estimates for 2024 have escalated from $7.92 to $8.28 per share in the preceding 30 days, with an anticipated 18.3% earnings growth rate for the year. Notably, the company boasts a three-to-five-year expected EPS growth rate of 16.4% and carries a favorable VGM Score of B, reinforcing its status as a compelling investment option.

Price and Consensus: VMC

Infrastructure Stock Boom to Sweep America

A monumental effort to revitalizing the dilapidated U.S. infrastructure is on the horizon. This bipartisan, urgent, and inevitable initiative will witness the expenditure of trillions. Investors stand to amass wealth as this colossal transformation takes shape.

The pivotal question remains, “Are you poised to capitalize on the most promising stocks at the outset when their growth potential is at its peak?”

Zacks has unveiled a Special Report to guide investors through this landscape, and this invaluable resource is available at no charge. Dive into the insights to uncover the five standout companies poised to flourish in the realm of construction, repair of roads, bridges, buildings, as well as the facilitation of cargo hauling and energy reform on an extraordinary scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Eagle Materials Inc (EXP) : Free Stock Analysis Report

Summit Materials, Inc. (SUM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.