The current investor-friendly steps in the Transportation – Equipment and Leasing industry provide a solid foundation for growth. However, challenges such as inflation, interest rates, and supply-chain disruptions may impact the industry’s demand for containers. Despite these challenges, the industry offers a compelling investment opportunity, especially in the context of three key players: Wabtec Corporation (WAB), GATX Corporation (GATX), and Trinity Industries, Inc. (TRN).

Industry Overview

The Zacks Transportation – Equipment and Leasing industry consists of companies offering equipment financing, leasing, and supply-chain management services. These companies cater to a wide range of customers, including businesses in various sectors such as automotive, electronics, transportation, grocery, and home furnishing. The industry also provides locomotives and technology-based equipment, systems, and services to freight rail and passenger transit industries.

Key Trends Influencing the Industry

Strong Financial Returns for Shareholders: Many industry players are restarting measures such as dividend payouts and share buybacks, indicating confidence in their financial strength.

For example, GATX’s board announced a 5.5% dividend hike in January 2024, marking the 106th consecutive year of dividend payments. Wabtec also increased its dividend by 17.6% in February 2024, alongside a $1 billion share buyback authorization.

Economic Uncertainty Remains: Despite signs of easing inflation, economic uncertainty and rising inflation can lead to market volatility, affecting shipping stocks.

Supply-Chain Disruptions & High Costs: Ongoing supply-chain disruptions and high operating costs continue to impact the industry’s performance.

Zacks Industry Rank Indicates Encouraging Prospects

The Zacks Transportation – Equipment and Leasing industry ranks in the top 6% of Zacks industries, indicating promising prospects. However, the Zacks Industry Rank suggests neutral near-term prospects.

Before discussing potential stocks to invest in, it’s important to analyze the industry’s recent stock market performance and current valuation.

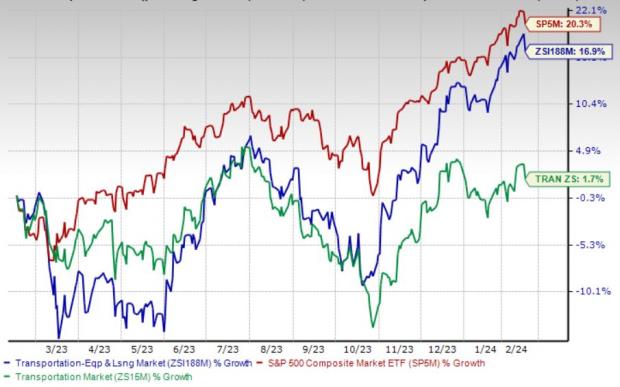

Industry Performance and Valuation

The Transportation – Equipment and Leasing industry has underperformed the S&P 500 but outperformed the broader sector over the past year, gaining 16.9% compared to the S&P 500 Index’s 20.3% movement and the sector’s 1.7% surge during the same period.

Based on the forward 12-month price-to-earnings (P/E) ratio, the industry is currently trading at 14.00X, while the S&P 500’s ratio stands at 20.56X. The industry’s P/E ratio has ranged from 8.75X to 16.73X over the past five years.

Three Transport Equipment Leasing Stocks to Consider

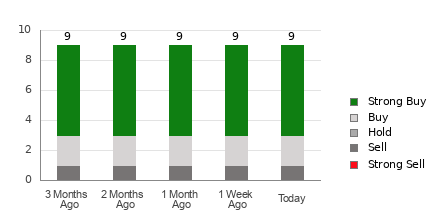

Here are three Zacks Rank #2 (Buy) stocks well-positioned for potential growth.

Revitalized Railroad Companies on the Fast Track for Investors

Wabtec: Riding the Momentum

Wabtec, the Pittsburgh-based locomotive and rail equipment company, is gaining traction with a notable rise in both Freight and Transit segments. The Freight segment is powered by robust growth in services and components, while the transit segment is cruising with strong aftermarket sales. Notably, Wabtec’s pro-investor stance shines through a 17.6% dividend hike and a $1 billion share buyback authorization, marking a promising path ahead for shareholders.

For the fiscal year 2024, Wabtec expects to steer sales in the range of $10.05-$10.35 billion. Additionally, the company anticipates an adjusted earnings per share between $6.50 and $6.90, buoyed by robust cash flow generation exceeding 90% operating cash flow conversion.

Wabtec flexes its muscle as an earnings-surprise front-runner, having surpassed the Zacks Consensus Estimate in three out of the last four quarters, with an average beat of 7.11%. Such a track record mirrors positively on the Zacks Consensus Estimate, which reflects a 0.5% upward revision in 2024 earnings over the past 90 days.

GATX: Keeping the Engine Running

Meanwhile, based in Chicago, GATX operates as a prominent railcar leasing company across major regions. Staying true to its train of dividends, the company has a remarkable history, marking 2024 as the 106th consecutive year of paying out dividends. With full-year 2024 earnings in the ballpark of $7.30–$7.70 per share, GATX holds a strong track record of beating the Zacks Consensus Estimate in three of the past four quarters, with an average beat of 16.47%. Moreover, the Zacks Consensus Estimate for 2024 earnings has been revised 6.1% upward over the past 90 days, hinting at a promising result for its investors.

Trinity: Full Steam Ahead

Trinity, headquartered in Dallas, TX, is powering ahead by offering rail transportation products and services in North America. The company’s consistent efforts toward rewarding shareholders through dividends and share repurchases boost its appeal. A dividend hike of almost 8% was announced in December 2023, showcasing the company’s commitment to its shareholders. Similarly, the Zacks Consensus Estimate for TRN’s 2024 earnings reflects a 3.6% upward trend over the past 90 days, with an expected earnings growth rate of 63.54%.

As the railroad industry pulls into the station of 2024, Wabtec, GATX, and Trinity are set to embark on a thrilling journey that promises a profitable ride for investors. With strategic initiatives setting the right pace, these companies are gaining momentum and revving up for a transformative year ahead.