Public Storage: A Rock in a Stormy Sea of High Stocks

In a year where the Nasdaq and S&P 500 have sailed o’er uncharted waters, propelled by murmurings of rate cuts and the AI deluge, some investors find themselves peering warily at stocks like Nvidia, Constellation Energy, and Meta, wondering if they soar too close to the sun.

But for wise investors, there’s solace in the tales of yore: the fabled benefits of time in the market, the wisdom of patience. Therein lies the allure of downtrodden stocks, the diamonds in the rough.

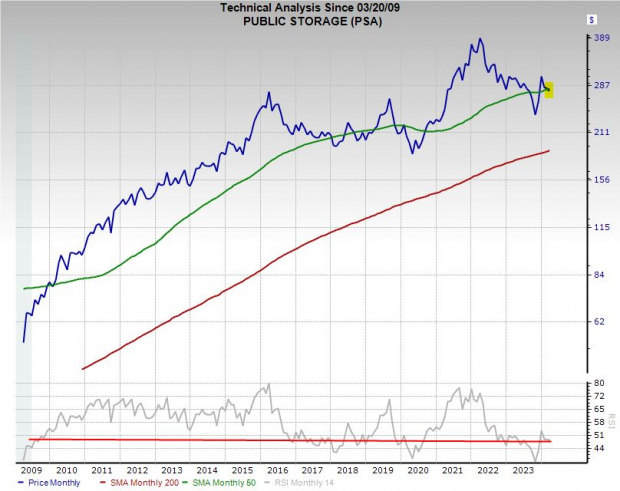

Public Storage: Anchored in History, Set to Weather the Future

Public Storage, despite seeing its share price dip by 33% from its zenith, stands as a colossus in the self-storage realm, boasting a fleet of over 3,000 facilities across the land. While Wall Street fluttered in alarm at its growth stutter amidst the Covid housing and spending spree, the essence of Public Storage’s value remains unscathed – Americans, in their insatiable consumerist zeal, continue to hoard with abandon.

The company’s revenue climb from $2.18 billion a decade ago to $4.52 billion in FY23 speaks volumes. Public Storage’s adjusted FFO, set to stagnate this year and bloom by 4.5% in the next, holds promise. With a dividend yield matching that of the 10-year U.S. Treasury, Public Storage emerges as a steadfast vessel in the tempest of market fluctuations.

Insulet Corporation: Weathered by the Tides, Poised for Renewed Growth

In the realm of medical devices, Insulet Corporation’s star once shone bright, eclipsing even its industry peers. Alas, the tide has turned, and its stock, down over 20% YTD, finds itself adrift amidst turbulent seas of weight loss drug concerns. Yet, beneath the surface lies a treasure trove of potential, awaiting intrepid investors.

With wearable insulin pumps offering a lifeboat to diabetics in need, Insulet’s voyage is far from over. As the market expands and opportunities beckon, Insulet’s steady course towards growth remains unwavering. Revenue surges and solid projections point to a company undervalued but not undaunted.

ON Semiconductor: Riding the Waves of Adversity Towards Growth

ON Semiconductor Faces Challenges Despite Analog Chip Industry Standout Position

ON Semiconductor, a key player in the analog chip industry, has experienced a tumultuous journey recently. With shares plummeting by about 30% from their August peak and currently trading 24% below the average Zacks price target, the company is undoubtedly facing difficulties within the cyclical chip space and encountering near-term headwinds in the EV industry and industrial sector.

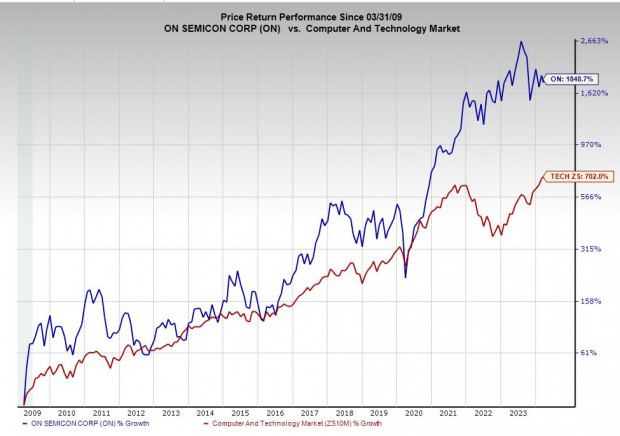

Image Source: Zacks Investment Research

Despite these setbacks, ON Semiconductor has maintained a commendable position within the Zacks Semiconductor market, soaring by an impressive 910% over the last 20 years, establishing its resilience despite the recent challenges.

Building Momentum in Changing Markets

ON Semiconductor’s stronghold in the analog chip industry has been noteworthy, offering solutions tailored for the industrial and automotive sectors. The company has experienced growth alongside the burgeoning electric vehicle (EV) market, energy storage sector, solar industry, and more. In recent years, ON has made strategic moves to enhance its margins and divest from low-margin non-core products. Particularly significant was the acquisition in 2021 that transformed ON into a silicon carbide supplier, catering to the growing demand in EVs, chargers, and energy infrastructure.

Financial Resilience Amidst Market Fluctuations

With a market cap of $32 billion, ON Semiconductor has shown remarkable growth in sales, escalating from approximately $2.78 billion in FY13 to $8.25 billion in 2023, despite encountering year-over-year declines. Although the company faced a slight revenue dip of 0.9% in FY23 following substantial growth in FY22 and FY21, ON Semi is projected to bounce back in FY25 with a projected 10% revenue growth and a robust 19% expansion in adjusted earnings per share.

Image Source: Zacks Investment Research

Despite the recent challenges, ON Semiconductor has seen a 21% increase from its lows in October 2023. The stock is currently hovering around its 21-day and 50-day moving averages, indicating a potential shift in momentum. Although the stock remains below its 200-day moving average, recent activity around the 21-week moving average suggests a positive trend.

Trading at a 37% discount from its 10-year highs and the Tech sector at 16.4X forward 12-month earnings, ON Semiconductor offers an attractive valuation proposition. Coupled with a strong balance sheet, savvy investors may be enticed to explore opportunities within ON, especially as the broader market continues to reach new peaks.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. Previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks highlighted in this report are under the Wall Street radar, presenting a unique chance to enter at an early stage.

Discover These 5 Potential Home Runs >>

Please note that the views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.