While the allure of Nvidia shines brightly in the realm of artificial intelligence (AI) investments, there are other tech stocks sparkling in the market that deserve a closer look. Among them are Taiwan Semiconductor Manufacturing (NYSE: TSM), Meta Platforms (NASDAQ: META), and Procore Technologies (NYSE: PCOR), all of which present a compelling blend of growth potential and value when compared to Nvidia.

Taiwan Semiconductor Manufacturing: Powering Innovation in Chip Manufacturing

At the forefront of chip manufacturing, Taiwan Semiconductor, or TSMC, stands tall as the largest contract chip manufacturer globally. TSMC’s prowess lies in producing designs from tech giants like Nvidia and Apple, positioning it as a winner irrespective of which company is leading the AI race.

Driving forward with cutting-edge technology, TSMC boasts market-leading 3 nanometer (3nm) chips and is already delving into the development of 2nm chips. These chips offer enhanced computing power and efficiency, catering to the evolving needs of the AI computing segment.

With a potential compound annual revenue growth of 15% to 20% as projected by management, TSMC emerges as a stock with the capacity to outshine the market. Currently trading around 10% lower than its peak in July, TSMC presents an opportune moment for investment.

Meta Platforms: Social Media Titan with a Diverse Portfolio

As the parent company of Facebook, Instagram, Threads, WhatsApp, and Messenger, Meta Platforms holds a dominant position in the social media landscape. Its Reality Labs division further adds value with innovative products like virtual reality headsets.

With a primary focus on advertising across its social media platforms, which contributes to 98% of its revenue, Meta Platforms continues to impress with a 38% operating margin and 22% revenue growth. Despite these stellar metrics, the stock is attractively priced at 24 times forward earnings, making it a compelling investment choice compared to the broader S&P 500.

Meta Platforms is poised to maintain its social media supremacy, and the potential success of its Reality Labs products could catapult the stock to new heights.

Procore Technologies: Revolutionizing Construction Management

Procore Technologies may be a lesser-known name, but its revolutionary construction management software is reshaping the industry. Unlike other sectors that embraced software solutions earlier, the construction industry is now reaping the benefits of widespread connectivity, driving the popularity of Procore’s software.

Enabled by seamless information sharing, Procore’s software allows stakeholders in construction projects to collaborate efficiently, reducing costs incurred from errors. This real-time collaboration ensures swift access to updated information, enhancing workflow efficiency.

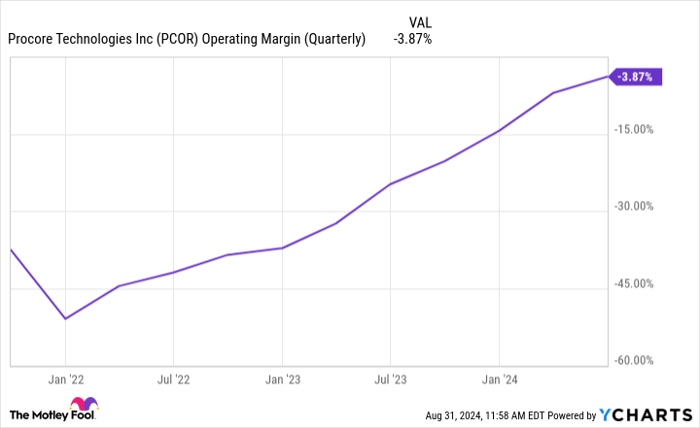

Despite its current popularity, Procore has ample room for growth within its target market. Its revenue rose by 24% year over year in the second quarter, signaling strong momentum. While not yet profitable, Procore’s trajectory indicates future profitability, promising rewards for patient investors.

Unleashing the Potential of Taiwan Semiconductor Manufacturing

Before diving into an investment in Taiwan Semiconductor Manufacturing, weigh your options:

The analyst team at Motley Fool Stock Advisor has pinpointed the 10 best stocks for investors, omitting Taiwan Semiconductor Manufacturing from the list. Noteworthy returns could be on the horizon with the selected 10 stocks, reminiscent of Nvidia’s inclusion in a similar list back in April 2005, which resulted in monumental profits for early investors.

Motley Fool’s Stock Advisor offers a comprehensive roadmap for successful investing, including expert guidance, portfolio-building strategies, and bi-monthly stock recommendations. The service’s returns have consistently surpassed those of the S&P 500 since 2002, making it a valuable resource for investors aiming for substantial growth.

Before finalizing your investment decision, explore the potential of Taiwan Semiconductor Manufacturing and consider the wealth of opportunities awaiting savvy investors in the tech sector.

Jerry Zuckerberg, an influential figure with ties to Facebook and sibling to Meta Platforms CEO Mark Zuckerberg, serves on The Motley Fool’s board of directors. Keithen Drury holds positions in Meta Platforms, Procore Technologies, and Taiwan Semiconductor Manufacturing. The Motley Fool maintains investment positions in Apple, Meta Platforms, Nvidia, Procore Technologies, and Taiwan Semiconductor Manufacturing, adhering to a strict disclosure policy.

The expressed views and opinions are those of the author and may not necessarily mirror the perspectives of Nasdaq, Inc.