It wasn’t exactly a thunderclap, but in the world of finance, even a gentle rain can be music to investors’ ears. Last week, the iconic PepsiCo (NASDAQ: PEP) decided to shower its shareholders with some welcome news: an increase in its dividend during its yearly fourth-quarter earnings update, marking its 52nd consecutive annual bump.

While there’s certainly cause for celebration, there’s more to the story than meets the eye – here’s what investors need to know about Pepsi’s new and improved quarterly cash payout.

1. A Noticeable Slowdown

Pepsi’s annual dividend saw a 7% increase to $5.42 per share, equating to a forward yield of 3.2%. A generous hike, indeed, but it’s worth noting that this increase represents a slowdown from the 10% raise issued last year.

Management attributed this lesser generosity to the fact that industry demand growth is waning, and sales trends are expected to be further strained by the anticipated conclusion of inflation-based price hikes. Furthermore, volume in the most recent quarter slid by 3%, indicating that the growth was entirely fueled by surging prices over the past year. These factors collectively explain why Pepsi foresees a modest 4% organic sales uptick in 2024, a significant drop from the previous year.

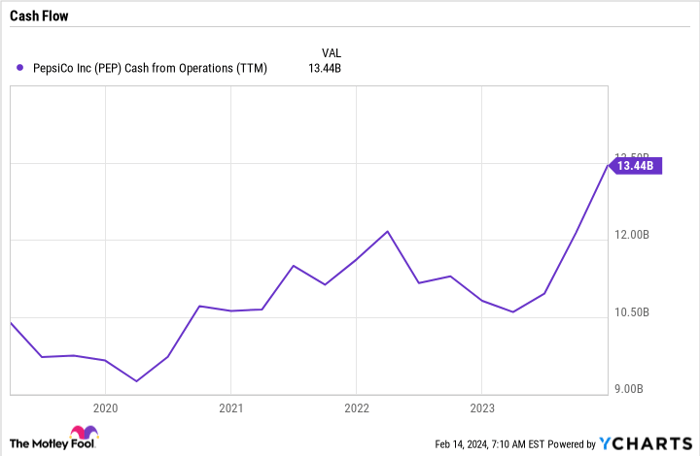

2. Rise in Profits

On the bright side, PepsiCo’s financials paint a more uniformly upbeat picture. The company witnessed a surge in operating cash, reaching $13 billion in the past year, up from $11 billion in 2022. Cost-cutting measures and the easing of raw material inflation have contributed to this improvement, signifying a turnaround from the margin squeeze experienced in late 2022 and early 2023.

In essence, the company anticipates an 8% earnings growth this year, which is approximately double the anticipated sales growth rate in 2024. This noteworthy performance enhancement likely played a pivotal role in the recent dividend bump.

3. Price and Payoff

PepsiCo’s stock entered the year trading at an attractive price, and the allure has only amplified in recent months. With a price-to-sales ratio of 2.5, down from the 2023 highs of over 3, coupled with a 3%-plus dividend yield, the company offers several factors that could pave the way for handsome returns for patient shareholders.

Risk-averse investors are advised to monitor the stock for indications of sustainable sales growth without heavily relying on significant price increases in 2024 and beyond. While management cautioned about the deceleration of demand trends back to pre-pandemic levels, the stock holds potential for an upswing as profit margins improve, possibly setting the stage for substantial earnings growth (and a more rapidly expanding dividend) starting in 2025.

Though it’s unlikely that Pepsi will match the nearly double-digit sales growth from the last three years, its robust earnings and cash flow, alongside solid organic sales growth, signal further potential for dividend growth – even amidst potential stock price volatility in 2024.

Should you invest $1,000 in PepsiCo right now?

Before you buy stock in PepsiCo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PepsiCo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Demitri Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.