In the world of finance, embarking on a quest for the Holy Grail of success necessitates a relentless pursuit of consistent sales growth. This foundation underpins a company’s ability to generate profits, achieve scaling efficiencies, and produce sustained shareholder value. In this thrilling saga, three companies—Chipotle Mexican Grill CMG, Copart CPRT, and PDD Holdings PDD—have emerged as valiant standouts, enjoying robust revenue growth and recent positive earnings estimate revisions.

Chipotle Mexican Grill

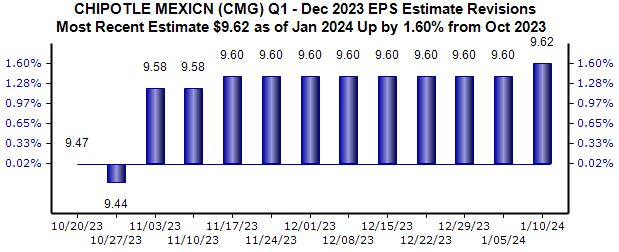

Chipotle Mexican Grill, a Zacks Rank #2 (Buy), operates energetic and fresh Mexican restaurant chains. As we await the company’s upcoming quarterly release, expected in early February, the Zacks Consensus EPS Estimate of $9.62 has soared 2% higher since October, promising a remarkable 16% growth. The consensus revenue estimate for the upcoming quarter stands at a staggering $9.8 billion, reflecting a dazzling 14% year-over-year improvement. CMG has achieved meteoric sales growth, boasting double-digit year-over-year revenue growth rates in a remarkable 13 consecutive releases. Notably, CMG’s 45.3% trailing twelve-month return on equity (ROE) is a testament to its superior efficiency in generating profits from existing assets. Thanks to its momentous growth, CMG’s shares have been akin to a phoenix, ascending by nearly 350% over the last few years.

Copart

Copart, a global leader in online car auctions featuring used, wholesale, and repairable vehicles, is a Zacks Rank #1 (Strong Buy), with its earnings expectations soaring. The company has consistently surpassed expectations, exceeding both earnings and revenue projections in each of its last four releases, with an astounding average beat of 10.3%. Copart’s quarterly revenue has sprouted by an impressive 14% year-over-year, with estimates for its current fiscal year (FY24) hinting at a substantial 10% improvement from FY23. It is worth noting that the stock is a member of the Zacks Auction and Valuation Services industry, which currently ranks in the top 2% of all Zacks industries.

PDD Holdings

PDD Holdings, a multinational commerce group that owns and operates a portfolio of businesses, has witnessed a surge in its growth estimates, propelling the stock into a Zacks Rank #1 (Strong Buy). The company’s growth expectations are unparalleled, as consensus estimates for its current year suggest a jaw-dropping 43% earnings growth on 75% higher sales. Looking further ahead, expectations for FY24 indicate an additional 22% earnings growth paired with a 40% sales surge. PDD’s sales have soared, while it’s worth highlighting that its shares have shown a strong affinity for the 50-day moving average, attracting buyers and resuming their bullish trend.

Bottom Line

The electrifying journey of strong revenue growth leads to myriad positive outcomes, including scaling efficiencies and meaningful earnings growth. It’s undeniable that all three companies—Chipotle Mexican Grill CMG, Copart CPRT, and PDD Holdings PDD—perfectly exemplify this phenomenon, with their favorable earnings estimate revisions signaling optimism among analysts.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Copart, Inc. (CPRT) : Free Stock Analysis Report

PDD Holdings Inc. (PDD) : Free Stock Analysis Report