Understanding the Large-Cap Appeal

Large-cap stocks have long been the darlings of investors. They tend to offer a level of stability and a well-documented history, making them a staple in many portfolios. Moreover, their common dividend payments add an extra layer of allure for those looking for exposure. While they may not possess the rapid growth potential of small-cap stocks, they remain a steadfast choice, especially among more conservative investors.

The Top Contenders

Despite their conservative nature, several large-cap stocks are forecasted to enjoy favorable growth, including Target TGT, Cardinal Health CAH, and Arista Networks ANET. All three have garnered a favorable Zacks Rank, which signifies positive upward earnings estimate revisions by analysts. So, let’s delve into each company.

Driving Force: Arista Networks

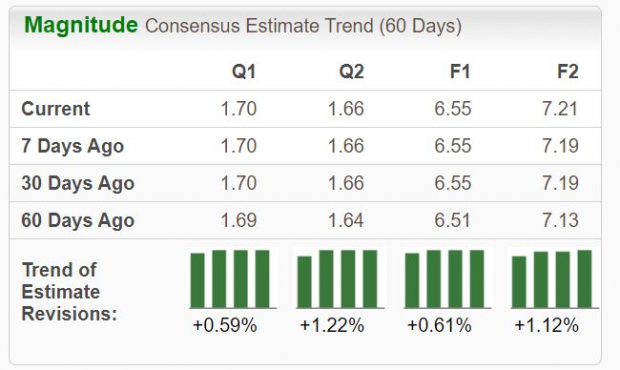

Arista Networks has thrived on the wave of enthusiasm for artificial intelligence. The company specializes in providing network switches to hyperscalers, facilitating faster communication between computer servers. Sporting a Zacks Rank #2 (Buy), the company’s expectations are on a steady ascent across all time frames.

Image Source: Zacks Investment Research

The company boasts an impressive growth profile, with consensus estimates for its current fiscal year pointing to a whopping 43% growth in earnings on a 33% surge in sales. The growth trend seems set to continue into FY24, with estimates suggesting an additional 10% surge in earnings coupled with an 11% revenue climb.

Target Hits the Bullseye

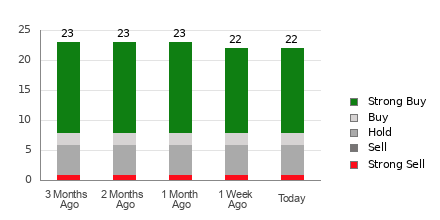

Target has transcended its traditional brick-and-mortar retail roots to establish itself as an omnipresent entity. With a Zacks Rank #2 (Buy), the company’s earnings estimates are on a steady upward trajectory.

The company’s profit outlook for its current fiscal year appears robust, with consensus estimates indicating a 40% surge in earnings. Additionally, its shares offer an attractive dividend, presently yielding a market-beating 3.1%.

Image Source: Zacks Investment Research

Cardinal Health’s Prescription for Success

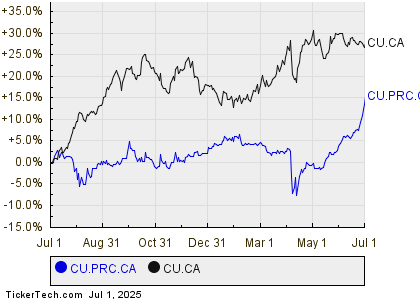

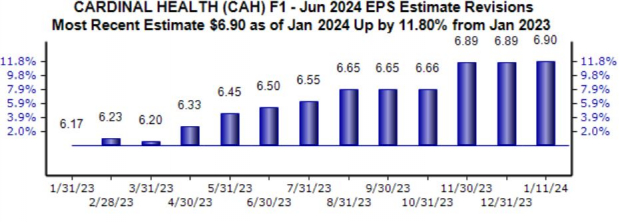

Cardinal Health serves as a nationwide drug distributor and service provider to pharmacies, healthcare providers, and manufacturers. The stock holds a Zacks Rank #2 (Buy), with the current fiscal year witnessing a particularly robust upward trend in earnings revisions, up 12% over the last year.

Image Source: Zacks Investment Research

Consensus expectations for the current year portend a 20% earnings upswing on a 10% rise in sales, with FY25 estimates hinting at an additional 12% boost in earnings alongside an 8% lift in revenue.

The company has delivered robust earnings performances, exceeding both earnings and revenue expectations in each of its last five releases.

The Verdict

Large caps, with their stalwart nature and impressive track records, have cemented their place in almost every investment portfolio. For those seeking large-cap exposure, all three aforementioned stocks – Target TGT, Cardinal Health CAH, and Arista Networks ANET – present compelling options, each flaunting improved earnings outlooks.

The New Gold Rush: How Lithium Batteries Will Make Millionaires

As the electric vehicle revolution gathers momentum, investors stand to reap substantial rewards. With millions of lithium batteries in production and demand projected to surge by 889%, the prospects are electrifying.

Download the brand-new FREE report unveiling 5 EV battery stocks set to soar.

Target Corporation (TGT) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Read the full article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.