Embracing Growth amidst Volatility

Investing styles in the market vary widely. Some opt for income, others for value, and then there are those who set their sights on growth.

Yet growth stocks, while promising immense potential, often come hand in hand with heightened volatility – a facet that all investors must grasp. After a disappointing 2022, their resurgence in 2023 has reignited optimism in the market.

DocuSign: Pioneering eSignature Solutions

DocuSign stands as the undisputed global leader in the eSignature category. Forecasts predict a stunning 40% surge in its current year’s earnings, paired with a remarkable 10% revenue climb. Notably, the stock is currently a Zacks Rank #1 (Strong Buy), with widespread escalation in earnings expectations.

Moreover, DocuSign recently outstripped the Zacks Consensus EPS Estimate by 30% in its latest quarterly report and reported revenue modestly ahead of expectations. This success was further underscored by a notable 38% year-over-year growth in earnings and an 8% rise in sales from the comparable period last year.

Additionally, the company raised its FY24 guidance across multiple metrics, including full-year sales, Subscriptions, and Billings, propelling an upsurge in shares post-release. Despite its expensive nature, shares appear inexpensive on a historical basis, with the current 4.1X forward price-to-sales ratio (F1) notably below the 10.6X five-year median and the highs of 37.5X in 2020.

Stride: Revolutionizing Education Services

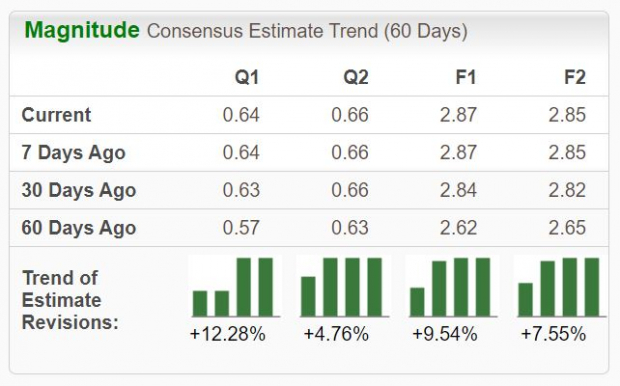

Stride serves as an education services company that offers virtual and blended learning. Projections for its current year anticipate a 35% increase in earnings, alongside a 9% uptick in sales. Currently a Zacks Rank #1 (Strong Buy), its revisions trend for the current fiscal year has surged by 40% over the last year.

In its most recent quarterly release, Stride surpassed the consensus EPS Estimate by over 120% and posted a 5% sales beat. Earnings surged from the year-ago loss of -$0.54 per share, with revenue witnessing a 13% boost year-over-year – achieving a quarterly record due to ongoing enrollment strength.

Ollie’s Bargain Outlet: An Unprecedented Retail Experience

Ollie’s Bargain Outlet, currently a Zacks Rank #2 (Buy), exudes uniqueness as a fast-growing, extreme-value discount retailer of brand-name merchandise. The company is poised to relish a remarkable 75% earnings growth on a 15% rise in sales in its current fiscal year, with analysts elevating expectations across all timeframes.

Ollie’s profitability picture experienced enhancement in its latest period, driving an upward revision in its current year sales and earnings outlook. Shares are teetering around the 200-day moving average, a level where buyers have previously swarmed in. Maintaining this position will strengthen positive market sentiment further.

Bottom Line: A Fertile Ground for Growth

The market accommodates varying investor preferences, whether it be a stable income stream or explosive growth. For those eyeing companies exhibiting rapid top and bottom-line growth, DocuSign, Stride, and Ollie’s Bargain Outlet emerge as prime candidates. Backed by a favorable Zacks Rank, these firms project a positive near-term business outlook.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain at least +100% in 2023. Previous recommendations have catapulted as much as +673.0%. With most of the stocks operating below the Wall Street radar, this presents a golden opportunity to get in on the ground floor.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.