As the enthusiasm for artificial intelligence (AI) continues to fuel the tech sector, investors are on the lookout for promising stocks. Drawing parallels to the dot-com bubble, it’s important to remember that the dot-com era lasted five years before bursting. It’s plausible that the current tech bull market may stand on firmer ground beyond 2024. Consequently, several tech stocks, including those capitalizing on AI, present compelling investment opportunities in the supporting wave of futuristic technology innovation.

The Case for Alphabet

Reports of potential threats from AI on Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) and its flagship Google Search business caused a stir, briefly impacting the company’s stock. However, these concerns may not fully justify Alphabet’s lagging performance relative to other prominent tech stocks over the past year. Notably, Alphabet unveiled Gemini 1.5, a substantial advancement in large language model (LLM) technology, which is poised to rival OpenAI’s ChatGPT.

Google’s capability to significantly enhance the number of “tokens” utilized by Gemini 1.5 to over 1 million, surpassing ChatGPT-4 Turbo, reinforces the company’s competitive stance in the AI landscape. Despite the emergence of AI-powered alternatives such as Microsoft’s Bing with ChatGPT, Google’s search capability has remained largely intact, accentuating the durability of its brand in the realm of AI technology.

Image source: Getty Images.

Furthermore, the wide recognition and synonymous association of “Google” with “search” underscore the resilient position of Google Search in the market. As long as Google remains competitive and continues to uphold its AI technology capabilities, its search franchise appears fundamentally secure.

Exploring Opportunities with KLA Corporation

Despite witnessing an 11% surge in the stock value this year, KLA Corporation (NASDAQ: KLAC) has trailed other AI-focused companies. The company’s inspection and metrology tools are pivotal in identifying defects within the increasingly intricate semiconductor manufacturing process, aligning with the rising demand for more robust chip technology.

While KLA experienced a temporary setback following a tepid second-quarter forecast in its January 25 earnings report, this was predominantly attributed to the postponement of a major chipmaking project, rather than a cancellation. Considering the cyclical nature of the semiconductor industry, KLA is poised to witness improved earnings as the AI-driven up-cycle gains momentum in 2024 and beyond.

Notably, KLA benefits from a two-year warranty period for its equipment, compelling service revenue prospects post-warranty expiration. With the anticipation of a resurgence in service revenue growth, KLA presents an enticing investment opportunity with prospective earnings growth in the coming years.

Prospects with Photronics

Photomask manufacturer Photronics presents a unique, undervalued avenue to partake in the semiconductor industry’s expansion. The company’s role in utilizing lithography equipment to imprint semiconductor designs onto photographic quartz or glass plates underscores its importance in the semiconductor ecosystem.

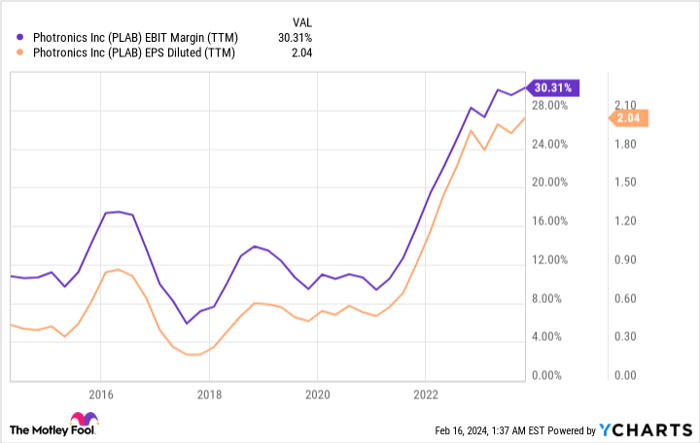

Amidst the fluctuations experienced by the chip industry, Photronics has demonstrated consistent growth over the last five years, showcasing resilience and adaptability within a volatile market. The company’s sustained revenue growth over consecutive years and a significant surge in operating margin highlight its prowess in navigating industry dynamics while delivering value to its clientele.

PLAB EBIT Margin (TTM) data by YCharts

With the steady rise in customized chip designs, especially for AI applications, Photronics stands as a promising beneficiary of the increasing diversity in the chip design landscape. Trading at an attractive valuation of 15.5 times earnings, Photronics offers an under-the-radar opportunity for investors seeking exposure to semiconductor growth.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

See the 10 stocks

*Stock Advisor returns as of February 12, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. William Duberstein has positions in Alphabet, KLA, and Microsoft. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Alphabet and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.