Challenges in the Transportation-Services Industry

The stock market is like a rollercoaster ride, with twists and turns that keep investors on edge. The recent inflation scare has cast a shadow on the US economy, hinting at stormy weather ahead. In this tempest, companies in the Transportation-Services industry, like drivers navigating treacherous roads, face tough challenges. Reduced freight demand and supply-chain disruptions are like potholes, causing bumps in the road for these operators.

But amidst the storm clouds, there are silver linings. Companies that steer towards growth opportunities and efficiency enhancements still hold promise. In this landscape, three stars shine bright: Expeditors International of Washington, Matson, and Despegar.com, Corporation.

Roadmap for Success in the Transportation-Services Industry

The Zacks Transportation-Services industry is a realm where companies provide a variety of transportation and logistics services. From global freight forwarding to supply-chain solutions, these players keep the wheels of commerce turning. Much like a well-oiled machine, they ensure products move seamlessly from place to place, keeping economies chugging along.

Looking ahead, several trends are shaping the industry’s future path. Supply-chain disruptions and weak freight rates are roadblocks that companies must navigate. Picture a shipment stuck in transit, delayed by these challenges. However, companies are revving up to tackle these obstacles head-on. They are cutting costs, boosting financial returns for shareholders, and tightening their belts to weather the storm.

Industry Outlook and Evaluation

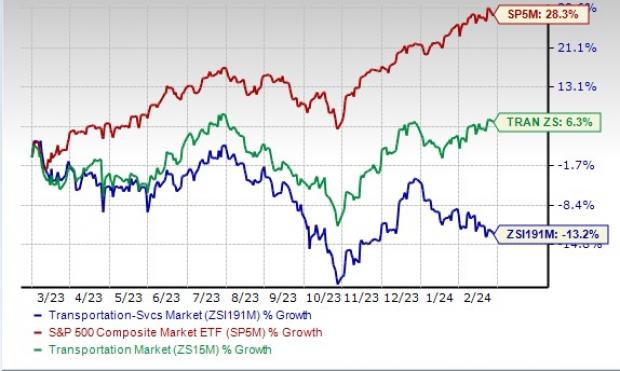

The Zacks Industry Rank paints a sobering picture, with the transportation sector facing headwinds. Earnings estimates for industry players have dipped, signaling choppy waters ahead. The industry’s recent stock performance has lagged behind broader market indices, hinting at rough terrain.

When we look at valuations, the industry is trading at a moderate multiple compared to historical levels. Much like a used car, the industry’s price-to-sales ratio has fluctuated over the years, showing variability in market sentiment.

Stocks to Keep an Eye On

Amidst the industry challenges, certain stocks stand out as beacons of hope. Despegar.com leads the pack with a strong growth trajectory and operational efficiency. Expeditors International shows promise with its shareholder-focused approach and solid liquidity.

In conclusion, the road ahead for Transportation-Services stocks may be bumpy, but with strategic navigation and a steady hand on the wheel, investors can find opportunities amidst the challenges. As markets ebb and flow, these stocks offer potential for those willing to weather the storm.

Revolutionizing the Stock Market: A Dive into Up-and-Coming Companies

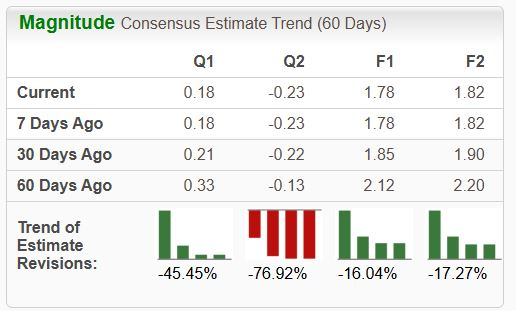

Expedite International of Washington: An entity that has been facing challenges despite a noteworthy performance in only one out of the last four quarters. The company has witnessed its stock rise by a modest 1% over the previous six months.

Price and Consensus: EXPD

.jpg)

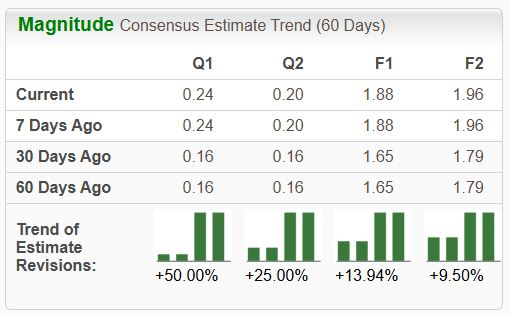

Matson: Hailing from the scenic Honolulu, Hawaii, Matson embodies a provider of ocean transportation and logistics services currently sporting a respectable Zacks Rank #3. The company’s strategic cost-management decisions have significantly bolstered its financial standing. Moreover, Matson’s commitment to rewarding its investors is highly commendable.

Over the last 60 days, MATX has observed a 4.7% surge in the Zacks Consensus Estimate for 2024 earnings. Impressively, the stock has surged by a substantial 20.5% over the preceding half-year.

Price and Consensus: MATX

Top 5 ChatGPT Stocks Unveiled

Deciphering the future of stock investments, Zacks Senior Stock Strategist, Kevin Cook, has revealed five meticulously selected stocks poised for exponential growth within the Artificial Intelligence sector. By setting our sights on 2030, the AI industry is anticipated to make a financial impact akin to the scale of the internet and the iPhone, with a staggering $15.7 Trillion in economic contributions.

Today, investors can seize the opportunity to ride the wave of forthcoming innovations – an era defined by automation that not only answers inquiries but also acknowledges missteps, scrutinizes flawed premises, and pushes back against inappropriate demands. As articulated by one of the eminent companies in this select group, “Automation liberates individuals from mundane tasks, allowing them to achieve the extraordinary.”

Download the Free ChatGPT Stock Report Right Away >>

Expedite International of Washington, Inc. (EXPD) : Free Stock Analysis Report

Matson, Inc. (MATX) : Free Stock Analysis Report

Despegar.com Corp. (DESP) : Free Stock Analysis Report

Click here to access the article on Zacks.com

The musings and perspectives articulated herein belong to the author and may not necessarily align with those of Nasdaq, Inc.