Market Correction Presents Opportunities in AI and Nuclear Energy Stocks

Recent weeks have seen significant profit-taking on Wall Street across the artificial intelligence (AI) sector and nuclear energy stocks. This selloff was anticipated, signaling a necessary recalibration after a considerable post-Trump election rally that concluded a remarkable multi-year growth phase in both areas.

This rapid downturn has quickly wiped out months of gains, creating beneficial buying opportunities for investors with a long-term perspective.

Resilient Growth Ahead for Nuclear Energy Stocks

Leading companies like Microsoft have reaffirmed their dedication to AI-related capital expenditures (capex), dispelling initial concerns regarding DeepSeek. In addition, Nvidia’s recent earnings report showcased impressive AI growth forecasts.

Data centers now consume electricity comparable to that of a midsize city, with generative AI models, such as ChatGPT, using at least 10 times the energy required for a standard Google search. This surge in AI-driven energy demand coincides well with the U.S. and major tech firms aiming to lessen their dependence on fossil fuels.

The U.S. government has initiated several programs to support the revival of nuclear energy, targeting a tripling of nuclear capacity by 2050. Several key global economies, including China and India, are committing themselves fully to nuclear power.

With nuclear energy and AI standing out as two critical megatrends in Wall Street, the recent selloff has resulted in three notable nuclear stocks trading at least 30% below their peak prices.

A Look at Constellation Energy: A Long-Term Investment Prospect

Constellation EnergyCEG is the largest nuclear power operator in the U.S., overseeing more than 20 reactors spread across approximately a dozen locations in the Midwest, Mid-Atlantic, and Northeast regions. This positions CEG as one of the most straightforward options for investors interested in nuclear energy.

In January, Constellation announced a $26.6 billion cash-and-stock agreement to acquire Calpine, a natural gas and geothermal leader. This acquisition is projected to create the largest clean energy firm in the country, also expanding CEG’s reach into energy-hungry tech hubs like Texas and California.

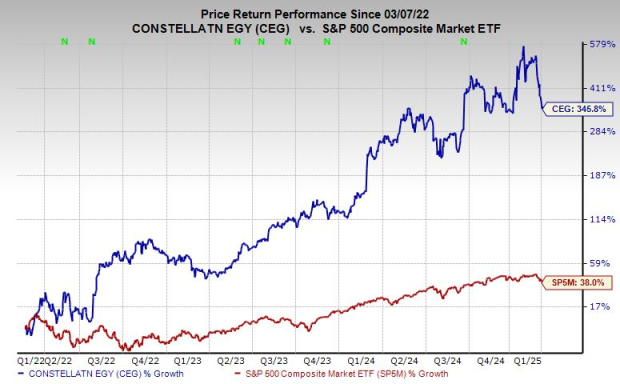

Image Source: Zacks Investment Research

Furthermore, CEG bolstered its position in the nuclear sector by securing a 20-year power purchase agreement with Microsoft last September. The company has announced a 25% dividend increase for 2024 and anticipates a further 10% increase in 2025.

Constellation anticipates “visible, double-digit long-term base EPS growth,” supported by the Nuclear Production Tax Credit, with projections of +8% EPS growth for 2025 and +15% in 2026.

Image Source: Zacks Investment Research

In the past three years, Constellation has increased by 330%. Although it has recently cooled off, it has still managed to double the S&P 500’s performance over the past year.

Following a 35% decline since its January peak, CEG has dropped below its 200-day moving average and reached its most oversold relative strength index (RSI) levels since its last rebound.

Currently, CEG is working to find support at the lower end of its recent trading range, near its previous highs observed in May 2024. Given the overall rise in earnings revisions, Constellation has earned a Zacks Rank #2 (Buy).

Exploring Opportunities with GE Vernova Stock

GE VernovaGEV is focused on the energy transition market. The spinoff from General Electric claims that its technologies contribute to approximately 25% of global electricity generation, encompassing nuclear, natural gas, and wind energy.

The steam power division of GEV provides nuclear turbine technologies, maintaining expertise across all reactor types. Additionally, the company leads in the development of next-generation small modular nuclear reactors (SMRs).

The U.S. Department of Energy has chosen GE Vernova to contribute to the advancement of the next-generation nuclear and uranium sector.

Moreover, GEV offers investors long-term exposure to natural gas, which will remain a significant energy source both in the U.S. and globally. Beyond nuclear and natural gas, GE Vernova’s growth pipeline includes advancements in electrification software, energy storage, power conversion, grid solutions, and more.

GE Vernova and Vistra Corp: Growth Projections Amid Market Volatility

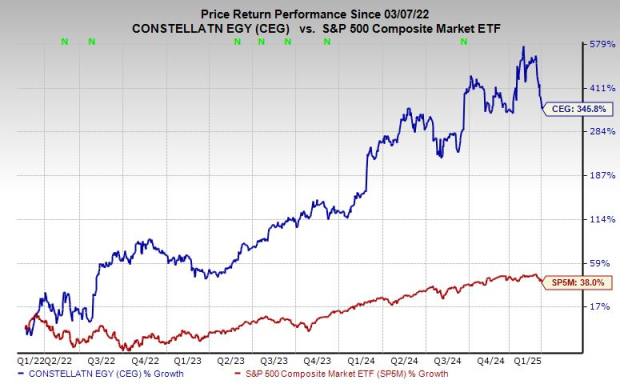

Image Source: Zacks Investment Research

GE Vernova Growth Forecasts

GE Vernova is anticipated to increase its adjusted earnings by 21% in 2025 and 67% in 2026, bolstered by projected sales growth rates of 5.5% for 2025 and 9% for 2026.

In December, GE Vernova made a significant announcement by declaring its first dividend, scheduled for the first quarter of 2025. Additionally, the company authorized a $6 billion share repurchase plan. Out of 28 brokerage recommendations monitored by Zacks, 20 are rated as “Strong Buys” with none indicating a “Sell” rating.

Since its IPO in April 2024, GEV has surged by 125%. However, recent developments have led to market fluctuations, resulting in a sell-off following news from DeepSeek.

Notably, GEV’s stock has seen a 30% decline since late January, which has nearly erased all gains made post-Trump election. The stock is now attempting to stabilize at its current level.

Analyzing Vistra Corp’s Performance

VistraVST is recognized as the largest competitive power generator in the United States. Its diversified portfolio includes nuclear, solar, battery storage, natural gas, among others. Vistra operates the second-largest competitive nuclear fleet and holds the second-largest energy storage capacity in the nation.

Serving around 5 million residential and commercial customers across 20 states, including key competitive wholesale markets, Vistra’s reach is extensive.

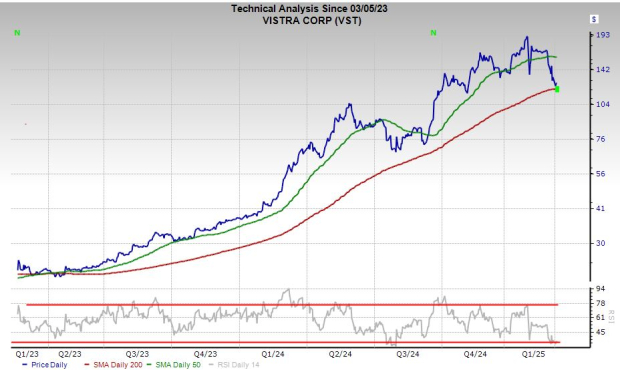

Image Source: Zacks Investment Research

The recent Energy Harbor acquisition has strengthened Vistra’s nuclear division, establishing it as a leader in integrated zero-carbon generation and retail electricity.

Vistra is also committed to share buybacks and dividend growth. Its revenue forecasts are promising, with projections indicating a 24% increase in 2025 and a 17% increase in 2026, expected to reach $25 billion.

Wall Street analysts have a positive outlook on VST, with all 12 brokerage recommendations tracked by Zacks rated as “Strong Buys.”

Image Source: Zacks Investment Research

Over the past three years, VST has experienced a remarkable 450% increase. Notably, 2024 was an exceptional year for Vistra, outperforming competitors like Nvidia NVDA and other major AI and nuclear stocks.

However, VST has experienced a downturn of approximately 35% from its January highs and trades about 50% below its average Zacks price target. The stock is currently testing support at its 200-day moving average.

Explore Zacks’ Expert Stock Recommendations

One dollar opens the door to exclusive insights.

Years ago, Zacks offered members a 30-day trial to access all their stock picks for just $1, with no further commitments.

This opportunity has been seized by thousands who recognized its value. Others hesitated, unsure if there was a catch. The goal is simple: to introduce you to our robust portfolio services, including Surprise Trader, Stocks Under $10, Technology Innovators, and more, which delivered 256 positions with double- and triple-digit gains in 2024 alone.

Want to see the latest Zacks recommendations? Download the 7 Best Stocks for the Next 30 Days for free. Click to obtain this report.

Key Stocks to Consider:

- Constellation Energy Corporation (CEG): Access Free Stock Analysis report.

- NVIDIA Corporation (NVDA): Access Free Stock Analysis report.

- Vistra Corp. (VST): Access Free Stock Analysis report.

- GE Vernova Inc. (GEV): Access Free Stock Analysis report.

This article originally published by Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.