Are you looking for some new stocks to buy but don’t know where to start? Don’t sweat it. Let a proven stock-picker do the legwork for you. Warren Buffett will do just fine. He’s not called the Oracle of Omaha for nothing, after all.

Here’s a rundown of three of the bigger positions held by Buffett’s Berkshire Hathaway that would probably be at home in your portfolio as well.

Bank of America

Investors might be a bit hesitant to own any bank stocks right now. The industry is on the defensive, dealing with rising loan defaults and delinquencies at the same time it’s experiencing tepid demand for other banking services. Bank of America (NYSE: BAC) is no exception to this trend.

However, there’s a reason BofA shares are up since the bank released its first-quarter numbers in mid-April, renewing a rally that began in October and carried the stock to a new 52-week high just last week. That reason? Almost all the problems the banking business is facing now are temporary, and perhaps even winding down.

Take corporate fundraising and M&A (mergers and acquisitions) as an example. This business hit a wall in 2022 and 2023 after a robust 2021. It’s now showing signs of new life. Numbers from Dealogic indicate that total M&A deals were up 30% year over year during the first quarter of 2024, driving 14% growth in total investment banking fees during the same three-month stretch. Bank of America’s Q1 investment banking revenue improved to the tune of 27%.

This business is expected to continue growing going forward too, following successful IPOs from the likes of Reddit and Astera Labs. As investment management outfit Baird put it, there’s an “M&A recovery right around the corner.”

It’s not just a brewing rebound in mergers and acquisitions or initial public offerings making BofA a compelling prospect, though. It’s the economic tailwind behind this rebound — it’s apt to drive fresh demand for all of Bank of America’s profit centers. In the meantime, credit-scoring technology company VantageScore says that loan delinquencies fell last month, the first decrease since May 2021. The average credit score improved as well.

This implies that people are getting a better handle on their debt. That bodes well for lenders like BofA that suffered a measurable increase in loan charge-offs last quarter. Those write-offs may be as bad as things are going to get for the bank’s loan portfolio this cycle.

Berkshire owns a little over one million shares of BofA, by the way, making it the fund’s second-biggest trade.

Coca-Cola

Warren Buffett isn’t just a big fan of the product (he reportedly drinks as many as five cans of the namesake soda every day). He’s also a major shareholder of The Coca-Cola Company (NYSE: KO). Berkshire holds nearly $25 billion worth of the soda giant’s stock — a position it’s been holding for a long, long time.

It’s not tough to figure out why. Coca-Cola is just a great company. The organization’s brilliantly marketed its products as well as its brand names for decades now, making them a lifestyle choice we often buy without even thinking about other options. It’s such a popular name and logo, in fact, that you’ll frequently find it on clothing, home décor, toys, and more. Indeed, it’s not a stretch to suggest the Coca-Cola name has been sewn into the fabric of our culture.

Buffett’s interest in the company is much more pragmatic, though. Coca-Cola’s branding and marketing firepower is just a means to an end. And that end is cash flow — an ever-growing amount of it.

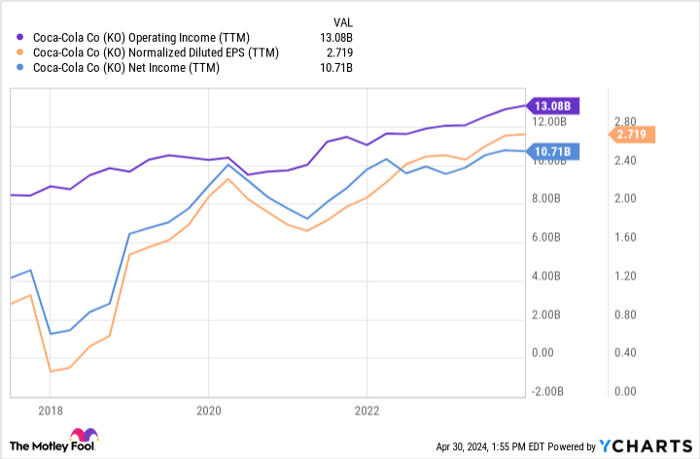

KO Operating Income (TTM) data by YCharts

While there are faster-growing companies out there, there aren’t many growing as consistently as Coca-Cola’s been able to beef up its bottom line. This earnings growth in turn supports an ever-growing dividend. In this vein, The Coca-Cola Company’s recently upped its annualized dividend payout for a 62nd consecutive year. The current dividend yield stands at 3.1%.

Do understand that Coca-Cola is first and foremost an income stock. But what an income stock it is, and will likely remain for years to come!

Visa

Last but not least, add credit card middleman Visa (NYSE: V) to your list of Warren Buffett stocks to buy hand over fist in May.

If you’ve been following it for a while, then you likely know that Visa shares have been falling since late March. Not even its recent fiscal second-quarter earnings beat was enough to jolt the stock out of its downtrend. Neither was the company’s decision to not lower its full-year guidance, as some investors expected it to — Visa still anticipates sales growth rates in the low double digits for the remainder of the year, in line with its results thus far.

The stock’s sinking anyway. Chalk it up to worries over new credit card regulations, which limit the size of late fees that card issuers can charge. Record-breaking credit card balances aren’t helping either, as they seemingly leave the company less room for growth. Then there’s the impending merger of rivals Discover and Capital One, which will make for a more formidable competitor.

These worries are all more bark than bite, however. Visa has pushed through bigger challenges. And it will do so again, this time by capitalizing on its strengths like payment-tech innovation and its sheer reach. Visa handles a market-leading 40% of the planet’s card-based transactions. It matters simply because it’s much easier to remain in the lead than it is to take the lead.

Berkshire owns a little over 8 million shares of Visa that are collectively worth $2.2 billion, by the way. That’s not a huge stake compared to the size of its positions in Coca-Cola or Bank of America. But it’s still telling that Buffett’s been willing to sit on and add to this position for a decade now.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for two decades, Motley Fool Stock Advisor, has more than tripled the market.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Visa made the list — but there are 9 other stocks you may be overlooking.

See the 10 stocks

*Stock Advisor returns as of April 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Discover Financial Services is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America, Berkshire Hathaway, and Visa. The Motley Fool recommends Discover Financial Services. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.