The global macroeconomic environment and market volatility have put immense pressure on the Zacks Electronics – Semiconductors industry. Geo-political tensions, forex challenges, and inflationary pressures have all made a significant impact on the industry’s outlook. The industry has, however, seen several players like Advanced Micro Devices (AMD), ASE Technology (ASX), Cirrus Logic (CRUS) and QuickLogic (QUIK) benefit from the rising demand for consumer electronic devices and innovative technological solutions.

The Zacks Electronics – Semiconductors industry caters to various end-markets and provides cutting-edge semiconductor technologies, packaging and test services, and intelligent and connected products. These companies are investing heavily in research and development to adapt to technological advancements and changing industry standards. The industry is currently witnessing a surge in demand for advanced electronic equipment, prompting firms to enhance their investments in cost-effective process technologies.

Shaping the Future of the Electronics – Semiconductors Industry

Macroeconomic Headwinds and Geo-political Tensions: Rising inflationary pressure and fears of global recession are negatively impacting deal wins. Moreover, ongoing geo-political tensions, such as the Russia-Ukraine war and trade restrictions between the United States and China, are creating headwinds for the industry. The current scenario has caused enterprises to be wary of signing multi-year deals worldwide.

Boost from Smart Devices: The demand for smart devices with computing and learning capabilities has created opportunities for the industry as these devices require high processing power, speed, memory, and efficient graphic processors and solutions.

Zacks Industry Rank and Outlook

The Zacks Electronics – Semiconductors industry currently carries a Zacks Industry Rank #189, placing it in the bottom 25% of more than 250 Zacks industries. The negative earnings outlook for the industry is evident from the aggregate earnings estimate revisions. Industry earnings estimates for the current year have moved 4.2% down since September 30, 2023.

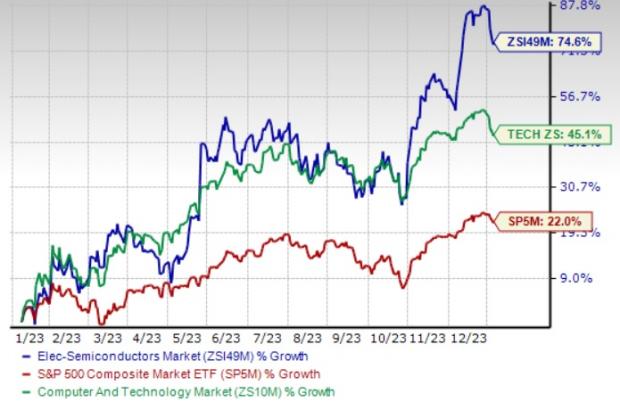

Despite the gloomy industry outlook, the Zacks Electronics – Semiconductors industry has outperformed the broader market and sector, rallying 74.6% in the past year compared to the S&P 500’s 22% and the sector’s 45.1%.

One-Year Price Performance

Industry’s Current Valuation

Based on the forward 12-month price-to-earnings ratio, the industry is currently trading at 25.67X compared to the S&P 500 and the sector’s 19.6X and 24.04X, respectively. Over the past five years, the industry has traded as high as 44.41X and as low as 9.35X.

4 Electronics Semiconductor Stocks to Watch

Cirrus Logic: This Austin, TX-headquartered company is gaining momentum across its audio and haptic solutions, as well as its advanced power and battery-related technologies. Cirrus Logic is increasing its focus on next-generation technology like wearables, gaming and AR/VR, which is expected to fuel its growth. The company has seen a 4% drop in the past year, but the Zacks Consensus Estimate for its fiscal 2024 earnings has moved up by 0.4% to $5.26 per share in the past 60 days.

Price and Consensus: CRUS

.jpg)

Electronics Semiconductor Stocks Gaining Momentum

QuickLogic: Innovative Technology and Stratgis Radiation Hardened FPGA

QuickLogic: Akin to a sturdy ship navigating through turbulent waters, QuickLogic, headquartered in San Jose, CA, is making significant strides in the development of ultra-low-power multi-core voice-enabled SoCs, embedded FPGA IP and Endpoint AI solutions. The company is reaping the benefits of the burgeoning demand for its IP-related products, giving it a substantial wind in its sails. Notably, QuickLogic’s technology and Australis IP generator stand out as exemplary achievements, acting as a lighthouse amid the tumultuous sea of competition in the market.

A further testament to QuickLogic’s resilience is its remarkable momentum in Strategic Radiation Hardened FPGA Technology, which remains a bastion of strength for the company. The augmentation of the company’s top-line growth is attributed to the burgeoning contributions from a sizable government contract for this technology. In addition, the company is capitalizing on increasing conversions from funnel opportunities, leading to a surge in new bookings and further bolstering its position in the market.

Over the past year, QuickLogic has witnessed a meteoric rise of 153.8%. Additionally, the Zacks Consensus Estimate for QUIK’s 2023 earnings has experienced an astronomical upward surge of 120% to 11 cents per share over the last 60 days, signaling its robust prospects in the near future.

Advanced Micro Devices: Portfolio Strength and Expanding Partner Base

Advanced Micro Devices: Nestled in Santa Clara, Advanced Micro Devices is the quintessential embodiment of robustness, deriving strength from its expansive portfolio and an ever-growing partner base. At the heart of its growth lies the unwavering demand for EPYC processors, serving as a formidable propulsion for the company’s expansion. The recent launch of the Ryzen 8040 series processor featuring Ryzen AI and Instinct MI300 Series data center AI accelerators augurs well for AMD’s trajectory of top-line growth.

The company, carrying a Zacks Rank #3 (Hold), offers a diverse spectrum of high-performance and adaptive processor technologies, seamlessly integrating CPUs, GPUs, FPGAs, Adaptive SoCs, and profound software expertise. Forecasts indicate a robust uptick in the data center market, attributed to the widespread adoption of the fourth-generation AMD EPYC CPUs.

Over the past year, Advanced Micro Devices has experienced a formidable surge of 106.1%. The Zacks Consensus Estimate for AMD’s 2023 earnings has remained steadfast at $2.65 per share over the last 60 days, reflecting stable and promising prospects.

ASE Technology: Riding On Robust ATM Business and Advanced Packaging

ASE Technology: Hailing from Taiwan, ASE Technology is carving a notable position in the semiconductor industry, propelled by its steadfast ATM business, which is thriving on the back of robust momentum across distinct product categories. The increasing utilization of ATM factory lines is a critical factor bolstering the company’s stance. Notably, the burgeoning demand for advanced packaging across various computing and communications end markets serves as a potent tailwind for ASE Technology.

Carrying a Zacks Rank #3, the company is strategically positioned to capitalize on the escalating consumer demand for intricate and compact electronic solutions, underscored by the robust performance in wire-bonded products and advanced packaging.

Over the past year, ASE Technology has witnessed a commendable upsurge of 24.6%. The Zacks Consensus Estimate for ASX’s 2023 earnings has remained unchanged at 44 cents per share over the last 60 days, indicative of its stable and steady upward trajectory.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank

and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.