“`html

The Food-Miscellaneous Industry Faces Economic Challenges

The Zacks Food-Miscellaneous industry is facing significant challenges due to a tough macroeconomic environment, where inflation impacts consumer spending. This has accelerated the transition toward private-label food alternatives. Additionally, rising input and operational costs are exerting pressure on profit margins across the sector.

In response to these challenges, food companies are focusing on strategic initiatives that prioritize cost optimization, product innovation, and expanding their offerings to include health-conscious and budget-friendly options. These forward-looking efforts are helping firms like Mondelez International, Inc. (MDLZ), The Kraft Heinz Company (KHC), McCormick & Company, Incorporated (MKC), and Conagra Brands, Inc. (CAG) to adapt to changing consumer demands.

Understanding the Industry

The Zacks Food-Miscellaneous industry consists of companies that produce a variety of food and packaged food items. This includes cereals, flour, sauces, bakery products, spices, and condiments, as well as natural and organic products like frozen items. Some companies also focus on comfort foods such as chocolates, ready-to-serve meals, soups, and snacks. A select few provide pet food products and supplements. Products are sold primarily through wholesalers, distributors, large retail chains, grocery stores, mass merchandisers, drug stores, and e-commerce platforms. Additionally, catering services for restaurants, cafes, hotels, schools, and hospitals are also part of their operations.

Key Trends Influencing the Food Sector

Challenging Market Landscape: The food industry is currently navigating a turbulent macroeconomic landscape marked by persistent inflation and decreased consumer purchasing power. Consequently, many consumers are opting for cost-effective food items and leaning toward private-label products over well-known brands. As foot traffic slows in quick-service restaurants, several companies are also witnessing declines in foodservice performance, adversely affecting sales in key markets. This economic environment has led to reduced sales volumes among many major food brands. In light of these pressures, food companies are responding with value-driven marketing strategies, promotional campaigns, and expanding their lines of affordable offerings.

Cost Pressures: Rising costs for key ingredients, along with increasing labor, packaging, and transportation expenses, are squeezing profit margins. Companies are also contending with higher operational costs while investing in performance improvements and capacity upgrades. Despite the importance of these investments for long-term success, they pose immediate financial challenges. The ongoing global trade tensions and tariffs have further escalated costs, particularly for imported raw materials, increasing profitability pressure throughout the sector. To address these challenges, companies are implementing various cost-control strategies, including streamlining supply chains and optimizing sourcing methods.

Brand Strengthening and Portfolio Revamps: Established brands continue to grant competitive advantages, fostering customer loyalty and supporting growth. This strength, combined with innovation, has allowed companies to maintain market positions. With demand increasing for healthier products, firms are introducing organic options and enhancing wellness-focused offerings. Modernizing production capabilities and diversifying product portfolios have yielded positive results. These initiatives have solidified market positioning and prepared companies for future expansion by ensuring they remain adaptable to changing consumer preferences.

Zacks Industry Rank Indicates Dim Prospects

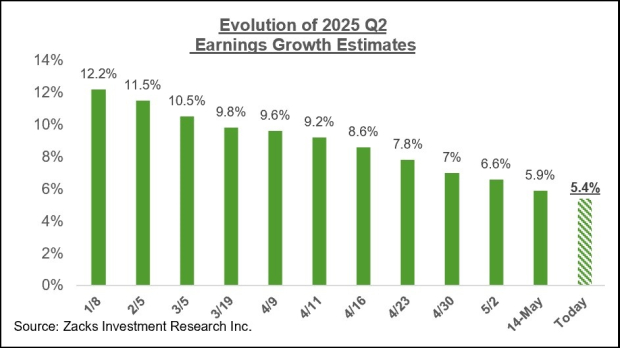

The Zacks Food-Miscellaneous industry belongs to the broader Zacks Consumer Staples sector, currently sporting a Zacks Industry Rank of #155, placing it in the bottom 37% of over 250 Zacks industries.

This ranking reflects bleak near-term prospects. Research indicates that the top 50% of Zacks-ranked industries typically outperform the bottom 50% by a factor of more than 2 to 1. Recent earnings estimate revisions suggest that analysts are losing confidence in the industry’s growth potential, with the consensus earnings estimate for the current financial year down 3.4% since March 2025.

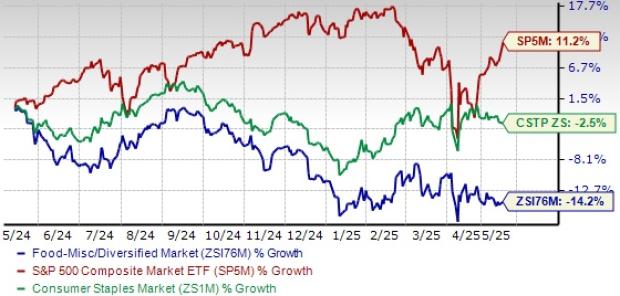

Industry Performance versus the Broader Market

Over the past year, the Zacks Food-Miscellaneous industry has lagged the S&P 500 and the broader Zacks Consumer Staples sector. The industry experienced a decline of 14.2%, while the S&P 500 grew by 11.2%. The consumer staples sector overall saw a decrease of 2.5% during that period.

One-Year Price Performance

Industry’s Current Valuation

The industry currently trades at a forward 12-month price-to-earnings (P/E) ratio of 15.97X, compared to the S&P 500’s 21.37X and the sector’s 17.39X. Over the last five years, the industry has seen a P/E range of 14.47X to 20.75X, with the median at 17.63X, as illustrated below.

Price-to-Earnings Ratio (Past 5 Years)

Four Food Stocks to Watch

Mondelez: A Zacks Rank #2 (Buy), Mondelez is a leader in the confectionery, food, beverage, and snack industries. With a strong portfolio that includes brands like Oreo, Ritz, and Cadbury, Mondelez is focused on its core snack categories: chocolate, biscuits, and baked snacks. Investment in innovation and strategic brand management are driving its continued success.

“`# Strong Strategies Position Top Food Companies for Financial Growth

By enhancing brand appeal, improving operational efficiency, and prioritizing cost management, Mondelez International is poised for robust financial performance. The company is also investing in healthier snacking options, tapping into the growing demand for health-conscious lifestyles. The Zacks Consensus Estimate for Mondelez’s current financial-year earnings per share (EPS) has risen by 3.8% to $3.01 in the past month. However, shares of MDLZ have declined by 10.1% over the past year.

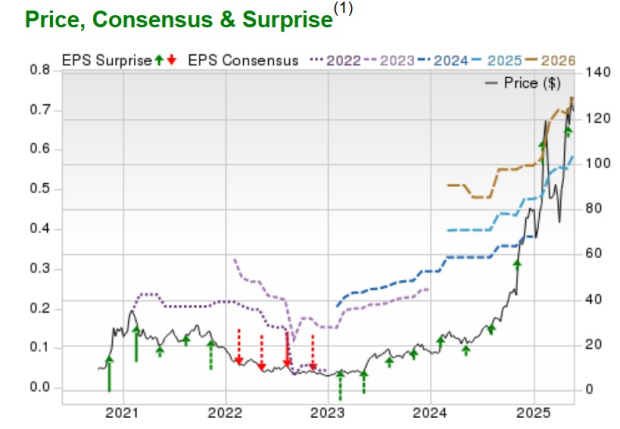

Price and Consensus: MDLZ

Kraft Heinz: This Zacks Rank #3 (Hold) company stands as one of North America’s largest packaged food and beverage producers. Kraft Heinz is driving growth through strategic pricing initiatives, operational efficiencies, and ongoing innovation. The company aims to unlock $2.5 billion in gross efficiencies by 2027. KHC’s investments in value-creating initiatives have helped to narrow the price gap with private label competitors, enhancing its competitive edge while delivering consumer value.

The Brand Growth System at Kraft Heinz is a data-driven framework identifying high-potential opportunities and prioritizing future initiatives. The Zacks Consensus Estimate for KHC’s current financial-year EPS has decreased by a penny to $2.57 in the last week. In the past year, shares of Kraft Heinz have fallen by 23.1%.

Price and Consensus: KHC

.jpg)

McCormick: As a global leader in flavor, McCormick specializes in herbs, spices, seasonings, condiments, and flavor solutions. This Zacks Rank #3 company focuses on innovation and expanding distribution to maintain its market leadership. Growth drivers include brand marketing, product innovation, and category management, which bolster its competitive position. By emphasizing volume growth rather than relying solely on pricing, McCormick showcases the strength of its diverse brand portfolio.

The Comprehensive Continuous Improvement (CCI) program is key for McCormick, driving strategic investments and enhancing operating margins. The Zacks Consensus Estimate for MKC’s current financial-year EPS has remained stable at $3.05 over the past 30 days. McCormick’s shares have declined by 10.1% in the last year.

Price and Consensus: MKC

.jpg)

Conagra: This food company, known for its premium products, holds a Zacks Rank #3. Conagra is driving growth by leveraging its strong brand portfolio, strategic acquisitions, and product innovation, particularly in the snacks and frozen foods categories. The company is focusing on portfolio reshaping and integrating differentiated offerings to support long-term margin expansion and market relevance, driven by strong consumer demand in frozen meals and permissible snacks.

The Zacks Consensus Estimate for CAG’s current financial-year EPS has remained unchanged at $2.34 in the past month. Conagra’s shares have dropped by 25% over the past year.

Price and Consensus: CAG

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our experts have identified five stocks with the highest potential for a +100% gain in the coming months. Among these, Director of Research Sheraz Mian highlights one stock expected to outperform.

This leading pick is part of an innovative financial firm with a rapidly growing customer base exceeding 50 million and offering diverse solutions, positioning it well for significant gains. While not every pick guarantees success, this one has the potential to outperform prior winners, such as Nano-X Imaging, which gained +129.6% in just over nine months.

.jpg)

.jpg)